The VN-Index experienced a volatile trading session, with significant fluctuations throughout the day. For much of the session, inflows into banking stocks provided crucial support, driving the index to occasional positive breakouts. However, late-session adjustments across Vingroup stocks pressured the market, ultimately leading to a decline.

By the close of trading on January 8th, the VN-Index fell by 6 points, settling at 1,855 points. Liquidity surged, with trading value on HOSE soaring past 38 trillion VND.

Foreign investors’ trading activity was a bright spot, with net buying of approximately 568 billion VND.

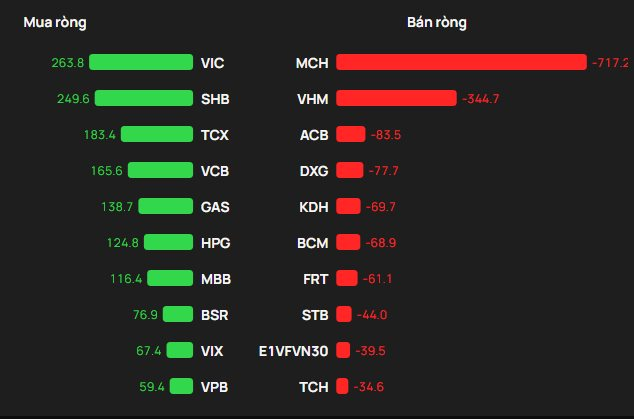

On HOSE, foreign investors net bought 521 billion VND

On the buying side, VIC saw the strongest foreign inflows on HOSE, with purchases exceeding 264 billion VND. SHB followed closely, with 250 billion VND in net buying. Additionally, TCX and VCB were bought for 183 billion VND and 166 billion VND, respectively.

Conversely, MCH saw the heaviest foreign selling, with outflows of 717 billion VND. VHM and ACB also faced significant selling pressure, with 344 billion VND and 84 billion VND sold, respectively.

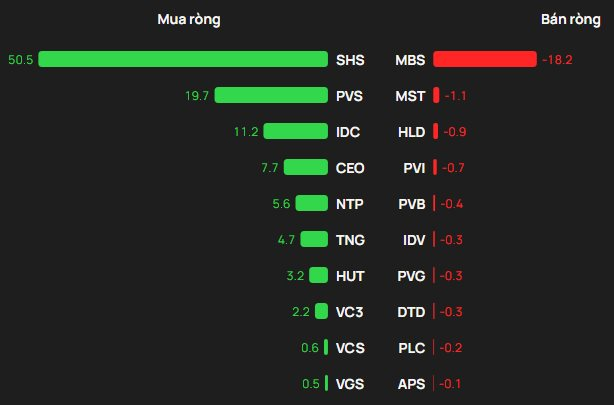

On HNX, foreign investors net bought 85 billion VND

SHS led HNX in net buying, with 51 billion VND in purchases. PVS followed, with net buying of 19.7 billion VND. Foreign investors also allocated smaller amounts to IDC, CEO, and NTP.

On the selling side, MBS faced the strongest foreign outflows, with nearly 18 billion VND sold. MST, HLD, PVI, and PVB also saw minor selling pressure.

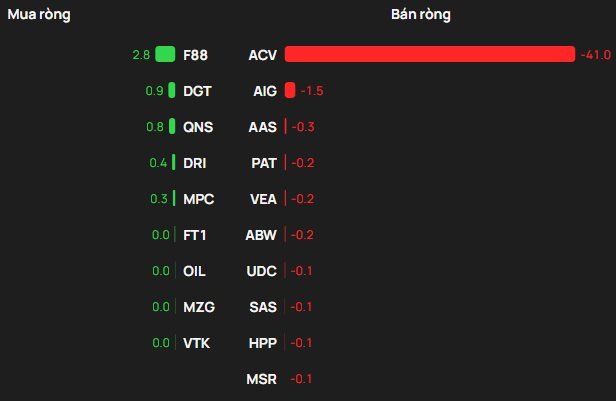

On UPCOM, foreign investors net sold 38 billion VND

F88 led UPCOM in foreign buying, with 2.8 billion VND in purchases. DGT and QNS also saw modest net buying, each in the hundreds of millions of VND.

Conversely, ACV faced the heaviest foreign selling, with outflows of 41 billion VND. AIG and AAS also saw net selling.

How Businesses Pocket Trillions: Unlocking the Secrets to Massive Profits

Leading Vietnamese corporations including Truong Hai Group, THISO International Trading and Services JSC, Phat Dat Real Estate, and VCP Construction and Energy JSC have successfully raised hundreds of billions to trillions of Vietnamese dong through bond issuances.

Stock Market Week 05-09/01/2026: Kicking Off the Year with a Bang

The VN-Index kicked off 2026 with a remarkable start, surging 4.67% in the first trading week. This upward momentum was primarily driven by large-cap stocks, while liquidity expanded significantly, indicating a more optimistic investor sentiment after a prolonged period of caution. Additionally, the broader market saw improved capital flow across various sectors, further bolstering the positive outlook.

VPBankS Surges Ahead, Securing Top 10 Market Share on HOSE Amidst Fierce Competition

VPBank Securities (VPBankS) has achieved a remarkable milestone by entering the top 10 market share of HoSE brokers for the first time, securing the 9th position in Q4/2025. This breakthrough highlights the company’s exceptional growth trajectory and its ability to execute ambitious post-IPO and listing strategies, all within just four years of operation.