Fed’s Near-Certain Rate Cuts: A Positive Outlook for Vietnam

The Federal Reserve implemented three rate cuts in September, November, and December 2025. For 2026, international organizations forecast up to two additional cuts, each by 0.25%. However, the number of cuts may decrease if inflation concerns persist in the U.S. next year.

The Fed’s rate cuts are expected to significantly benefit Vietnam’s stock market. “As U.S. rates decline while Vietnam’s rates trend upward, the differential will become more pronounced. This gap is projected to reach around 3% in 2026,” noted an expert. This not only reduces pressure on Vietnam’s monetary policy but also helps retain foreign capital and even encourages net buying by foreign investors.

Additionally, the Fed’s halt of its Quantitative Tightening (QT) policy, which involves selling bonds to reduce liquidity, starting January 1, supports U.S. market liquidity and cools interest rates. This positively impacts Vietnam’s stock market, providing a foundation for the State Bank of Vietnam to manage monetary policy more effectively.

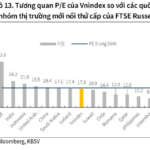

These factors will facilitate the return of affordable capital to emerging and frontier markets like Vietnam. Coupled with Vietnam’s market upgrade progress, including passing FTSE’s March 2026 review, and strong GDP and corporate profit growth forecasts, these elements are expected to drive foreign investors toward net buying in 2026, according to Mr. Hung.

GDP Growth as a Market Catalyst

In 2026, Vietnam aims to achieve a 10% GDP growth rate. Commenting on this target, Mr. Hung acknowledged the significant challenge but emphasized its potential positive impact on the stock market if realized.

“Stock markets typically lead economic trends. Therefore, if the economy grows by 8-10%, Vietnam’s stock market will undoubtedly rank among the world’s top performers,” stated the VDSC expert.

However, a rising tide doesn’t lift all boats; GDP growth doesn’t guarantee universal stock gains. Mr. Hung advised investors to carefully identify sectors benefiting from this growth and understand where capital is flowing. “Direct beneficiaries, in my view, include public investment, industrial zones, services, tourism, and technology. Investors should avoid broad purchases and focus on leading companies capable of leveraging economic recovery,” he added.

One key growth driver is the policy to boost public investment and infrastructure. Vietnam’s infrastructure has seen remarkable transformation over the past decade, with upcoming projects like Long Thanh Airport, the North-South high-speed railway, and metro lines. Improved infrastructure reduces travel times, lowers logistics costs, and enhances nationwide trade and tourism connectivity.

Nevertheless, increased public investment raises inflation concerns. The expert reassured that current investments are focused on essential, high-priority projects rather than being scattered. “This ensures effective capital utilization without waste. Vietnam’s inflation target is set at around 4.5% for 2026 and beyond,” he explained. “Current inflation remains low due to falling oil prices and weak consumer demand. While there’s a risk of inflation in 2026 as the economy grows, it will be manageable and an acceptable trade-off.”

Exchange Rates to Stabilize in 2026

Exchange rate pressures significantly impacted Vietnam’s economy in 2025. However, Mr. Hung noted that exchange rates haven’t substantially affected the stock market, as evidenced by the rising VN-Index. Still, continued rate increases in subsequent years could have adverse effects.

For 2026, the expert predicts greater exchange rate stability, driven by the Fed’s rate cuts and Japan’s rate hikes. This dynamic will help prevent significant VND depreciation.

“A slight exchange rate increase of 3-4% remains acceptable and could even benefit Vietnam’s export-oriented economy. Exchange rate pressures will no longer constrain monetary policy as they did previously,” he concluded.

– 09:00 10/01/2026

Vietnam’s GDP Surges 8.02%, Hailed by Global Media as Asia’s Shining Star

Leading international media outlets project Vietnam’s GDP to grow by 8.02% in 2025, highlighting the nation’s remarkable economic resilience even amidst global trade tensions and tariff fluctuations.

When Even Investment Funds Fall Prey to FOMO

Despite numerous equity funds posting significant gains in 2025, their overall performance has yet to match the VN-Index. This disparity, coupled with the outsized influence of select stocks, is prompting critical questions about portfolio allocation strategies.

Stock Market Week 05-09/01/2026: Kicking Off the Year with a Bang

The VN-Index kicked off 2026 with a remarkable start, surging 4.67% in the first trading week. This upward momentum was primarily driven by large-cap stocks, while liquidity expanded significantly, indicating a more optimistic investor sentiment after a prolonged period of caution. Additionally, the broader market saw improved capital flow across various sectors, further bolstering the positive outlook.