Source: Author’s compilation

|

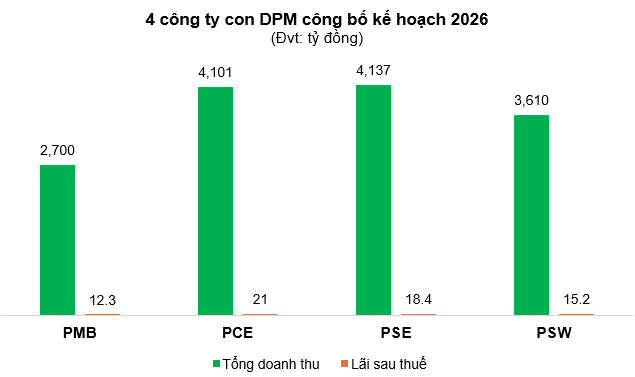

PetroVietnam Fertilizer and Chemicals Corporation – Northern Branch (PVFCCo-PMB, HNX: PMB) has set its 2026 targets with a total revenue of VND 2,700 billion. Pre-tax profit is expected to reach nearly VND 15.4 billion, with post-tax profit at approximately VND 12.3 billion. The company plans to distribute a 7% dividend.

In terms of volume, PMB aims to sell 233,000 tons, with Phu My Urea accounting for around 150,000 tons.

PetroVietnam Fertilizer and Chemicals Corporation – Central Branch (PVFCCo-PCE, HNX: PCE) has outlined its 2026 plan with a total revenue of nearly VND 4,101 billion. Pre-tax profit is projected at VND 26.2 billion, with post-tax profit nearing VND 21 billion. The expected dividend rate is 14%.

The total planned volume is 359,000 tons, with Phu My Urea making up approximately 190,000 tons. The company plans to invest around VND 70 billion in projects during 2026.

PetroVietnam Fertilizer and Chemicals Corporation – Southeastern Branch (PVFCCo-PSE, HNX: PSE) targets a total revenue of over VND 4,137 billion for 2026. Pre-tax profit is expected to exceed VND 23 billion, with post-tax profit surpassing VND 18.4 billion. The planned dividend rate is 10%.

The planned sales volume is 362,000 tons, with Phu My Urea contributing around 210,000 tons. PSE‘s total investment capital requirement for 2026 is estimated at nearly VND 8 billion.

PetroVietnam Fertilizer and Chemicals Corporation – Southwestern Branch (PVFCCo-PSW, HNX: PSW) anticipates a 2026 revenue of VND 3,610 billion. Pre-tax profit is expected to be VND 19 billion, with post-tax profit at approximately VND 15.2 billion. The dividend rate is projected at 5%.

In terms of volume, PSW plans to sell around 170,000 tons of Phu My Urea in 2026.

Previously, PVFCCo – Phu My announced its 2026 business plan with an expected revenue of VND 17,600 billion, a 10% increase from the previous year. Pre-tax profit is planned at VND 850 billion, with post-tax profit at VND 680 billion. The expected dividend rate is 12%.

In terms of production volume, Phu My Urea (converted) is projected at 902,700 tons, Phu My NPK at 180,000 tons, and UFC 85 at 10,000 tons. The total investment capital requirement for 2026 is over VND 1,160 billion, including VND 580 billion for basic construction, VND 370 billion for equipment procurement, and VND 210 billion for financial investments. All investments will be funded by equity, without borrowing.

On the stock market, over the past year, DPM and its three subsidiaries PCE, PSE, and PMB have seen price increases of approximately 28%, 23%, 14%, and 13%, respectively. PSW is the only stock with a decline of over 2% during the same period. However, all five stocks have underperformed compared to the VN-Index, which has risen nearly 52% in the past year.

Source: VietstockFinance

|

– 10:55 09/01/2026

Tech Giant Unveils 2026 Business Plan, Aiming to Pocket Over $2 Million Daily

In 2026, the parent company aims to achieve a remarkable milestone with a targeted revenue of 15,295 billion VND and a net profit of 647 billion VND.

Lê Ngọc Sơn Appointed as Chairman of Petrovietnam’s Board of Members

On the afternoon of December 26th, in Hanoi, Prime Minister Pham Minh Chinh attended the 2024 business performance review conference and the 2025 task deployment meeting of the Vietnam Oil and Gas Group (Petrovietnam). During the event, he also presented the appointment decision for the new Chairman of the Group’s Members’ Council.