KBSV experts highlight four key factors that could influence the residential real estate market in 2026:

First, efforts to streamline and enhance the legal framework will ensure medium to long-term growth. In the first nine months of 2025, the real estate sector saw numerous legal resolutions. Draft documents aimed at addressing short-term bottlenecks while ensuring long-term stability were introduced, including Resolution 171/2024/QH15, Decree 75/2025/NĐ-CP, Resolution 206/2025/QH15, and the “Draft Regulation on Mechanisms and Policies to Overcome Difficulties in Implementing the Land Law.”

“We view these as positive policy relaxations by regulators following a period of tightening. This trend is likely to continue into 2026, as policies have more time to take effect. Consequently, KBSV anticipates a significant increase in new project approvals, with streamlined procedures and improved mechanisms. Notably, projects facing delays are expected to resume and relaunch in the coming year,” KBSV Research notes.

Second, increased infrastructure investment will create opportunities for real estate projects. In 2026, alongside ongoing road infrastructure projects, major initiatives such as the North-South high-speed railway and ring roads in Hanoi and Ho Chi Minh City will be implemented. These projects will establish a synchronized and convenient transportation network, significantly enhancing the value of adjacent areas and supporting local property prices.

The expansion and upgrade of transportation infrastructure will greatly improve convenience and the practical utilization of real estate, thereby raising price levels. This will encourage developers to launch new projects. Market trends indicate that many investors are proactively targeting properties in areas with emerging infrastructure, establishing asset value even before these projects are fully operational.

Third, a noticeable shift toward suburban areas is occurring due to: high urban property prices driven by luxury developments, which are unsuitable for middle-income buyers (a group with significant potential demand); the scarcity of urban land, prompting developers to explore suburban projects; and improved transportation infrastructure, which increases convenience and demand for spacious, high-quality living environments in peripheral areas.

This trend is not unique to Vietnam but is observed in major cities globally. KBSV predicts that companies will increasingly develop land in suburban areas, and opportunities for Transit-Oriented Development (TOD) will expand. Absorption rates for suburban projects are expected to remain positive. Companies with land holdings in suburban areas and near key transportation projects will benefit in 2026.

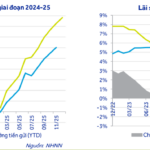

Fourth, interest rates may rise slightly but remain stable at supportive levels for the real estate market. According to KBSV, lending rates for home purchases have increased by 100–150 basis points across banks, though they remain lower than in 2020–2021.

KBSV forecasts a modest 50–100 basis point increase in deposit rates in 2026, but stability is expected throughout the year as the government prioritizes growth. Thus, favorable interest rates will continue to positively support the real estate market in the coming year.

Vietnamese Stocks Surge Nearly 200 Points Since Nguyen Duy Hung’s “Bottom Call”

Since SSI Securities Chairman last suggested that the market was presenting numerous opportunities with attractively priced stocks, the VN-Index has surged impressively.

Why More Banks Are Raising Interest Rates on Social Housing Loans

Unlock exclusive savings with Agribank’s unbeatable 5.6%/year interest rate for the first 5 years of your loan. Meanwhile, top banks like Vietcombank, BIDV, and Vietinbank have halted their special 5.2-5.5% fixed-rate offers for borrowers under 35, making Agribank’s deal even more irresistible. Act now to secure your financial future!