The trading session on January 9th witnessed significant divergence in the stock market. While the VN-Index surged by over 12 points, driven primarily by state-owned bank stocks and enterprises, most real estate shares plummeted, with many falling below critical support levels.

At the close, the VN-Index rose by 12.34 points, or 0.67%, to 1,867.90 points. Liquidity remained exceptionally high, with total trading value on the HoSE exceeding 38.006 trillion VND and order-matched volume surpassing 1.2 billion shares.

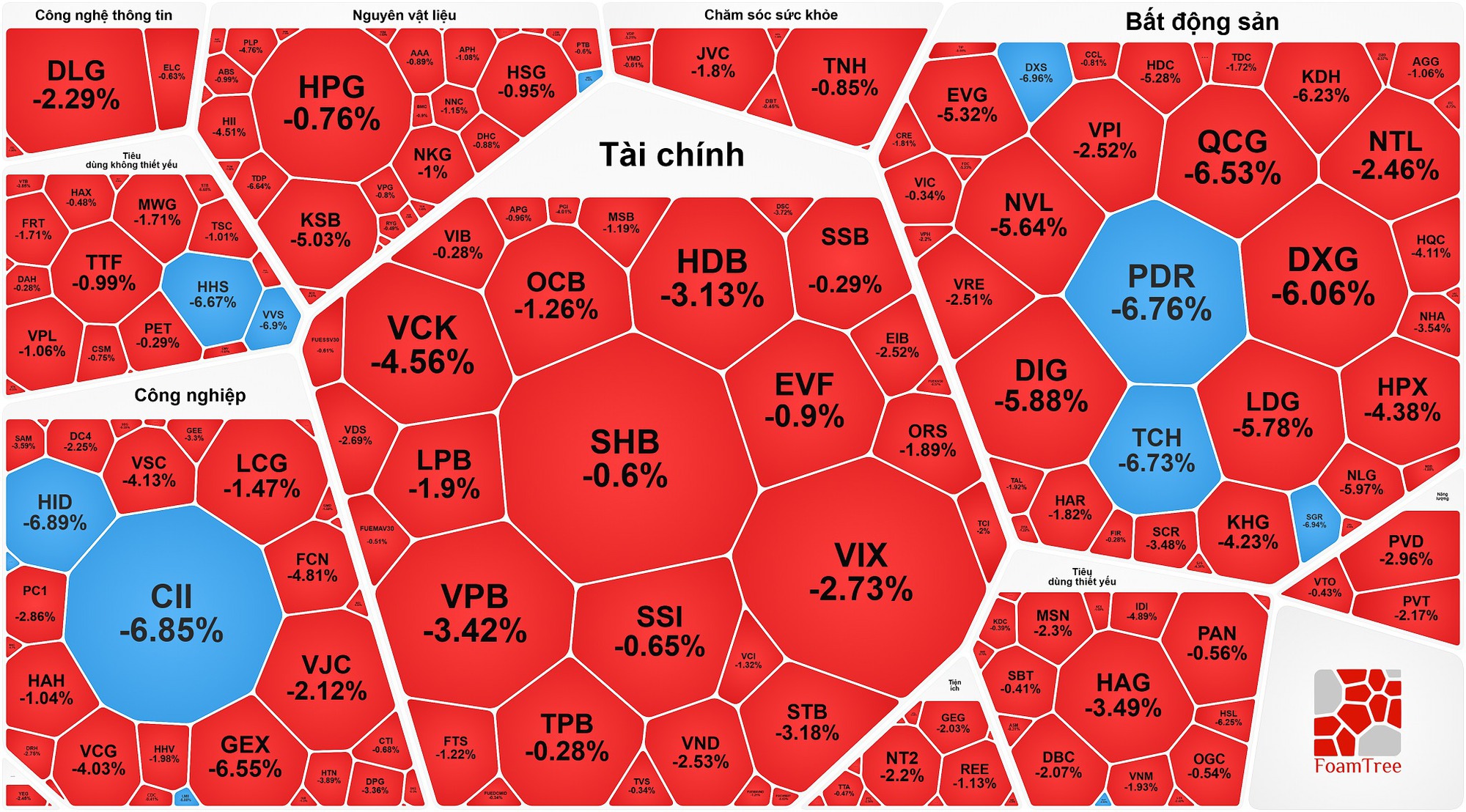

Stocks plunge into the red

The VN-Index’s rally today was almost entirely reliant on state-backed pillar stocks, particularly the Big 4 banks. BID soared 7%, VCB climbed 6.8%, and CTG rose 6.7%. These three stocks alone contributed over 16 points to the index, providing crucial support for the market.

Alongside banks, Viettel and energy stocks also traded positively. VGI on the UpCoM surged nearly 15%, while CTR on HoSE hit its ceiling at 6.9%. Major energy stocks like GAS gained 6%, GVR over 5%, and BSR nearly 6%, further bolstering the index’s green hue.

In stark contrast, real estate stocks faced intense selling pressure. Numerous shares dropped sharply with high volumes, breaking short-term price floors. PDR fell 6.76%, TCH 6.73%, DXG 6.06%, DIG 5.88%, and NVL 5.64%. The selling pressure indicates speculative capital is rapidly exiting this sector.

Negativity also spread to brokerage stocks and other mid-caps, with VIX down 2.73% and VND down 2.53%.

Market breadth revealed a “green shell, red core” scenario. Despite the VN-Index’s strong rise, declining stocks outnumbered advancing ones by 219 to 107, with 53 unchanged. Most investors holding non-pillar stocks recorded significant losses.

A bright spot was foreign investors’ continued net buying, totaling over 805 billion VND in the session. However, foreign capital concentrated on pillar stocks like VCB, BID, and CTG, exacerbating market polarization.

Analysts noted that the January 9th session highlighted a “pillar pull, mid-cap dump” trend. With the VN-Index nearing 1,870 points amid weakening breadth, investors should exercise caution. Short-term risks persist, particularly for real estate stocks breaking trends.

Market Pulse 09/01: Capital Flees Real Estate Sector, VN-Index Holds Steady

At the close of trading, the VN-Index climbed 12.34 points (+0.67%) to reach 1,867.9 points, while the HNX-Index dipped 2 points (-0.8%), settling at 247.1 points. Market breadth favored decliners, with 423 stocks falling and 290 advancing. Similarly, the VN30 basket saw red dominate, as 17 stocks declined, 12 rose, and 1 remained unchanged.

Foreign Block’s Strategic Move: Nearly VND 600 Billion Net Buy as Market Reverses – Which Stocks Were Most Heavily Accumulated?

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately 568 billion VND. This influx of investment highlights their confidence in the market’s potential and serves as a positive indicator for future growth.