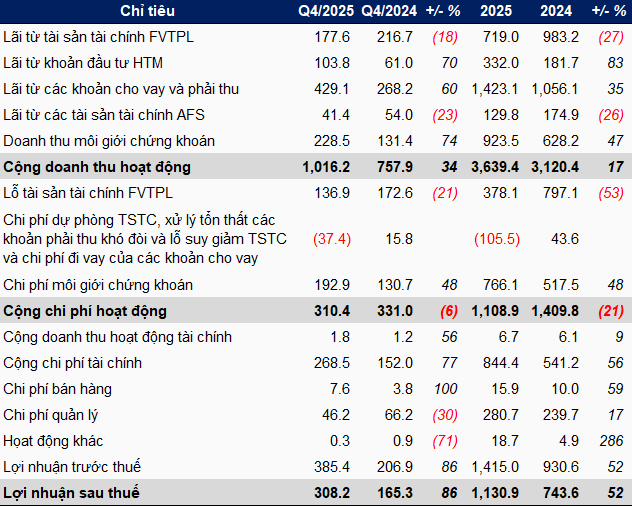

In Q4/2025, MBS generated over VND 1,016 billion in operating revenue, a 34% increase compared to the same period last year. Lending (margin) remained the top revenue contributor at 42%, followed by brokerage services at 22%.

The company reported a net profit of more than VND 308 billion, surging 86%, driven by strong performance in lending, held-to-maturity investments (HTM), and brokerage.

Specifically, revenue from lending and receivables rose 60% to over VND 429 billion; HTM investments yielded nearly VND 104 billion, up 70%; while brokerage activities earned nearly VND 36 billion after operating expenses, a 55-fold increase year-over-year.

In contrast, proprietary trading underperformed, with a 21% profit decline to nearly VND 34 billion. Financial activity losses also widened to nearly VND 267 billion, up significantly from VND 151 billion in the same period, due to higher interest and bond expenses.

For the full year 2025, MBS achieved over VND 3,639 billion in operating revenue, a 17% increase from 2024; pre-tax and post-tax profits reached VND 1,415 billion and nearly VND 1,131 billion, respectively, both up 52%. These results exceeded the company’s pre-tax profit target of VND 1,300 billion by nearly 9%.

|

Q4 and full-year 2025 business results of MBS

Unit: Billion VND

Source: VietstockFinance

|

By the end of 2025, MBS’s total assets reached over VND 30,776 billion, a 39% increase from the beginning of the year. Asset growth was primarily driven by loans, rising from nearly VND 10,294 billion to nearly VND 15,041 billion; HTM investments from nearly VND 4,995 billion to over VND 6,461 billion; financial assets measured at fair value through profit or loss (FVTPL) from nearly VND 1,974 billion to over VND 3,104 billion; and cash and cash equivalents from nearly VND 1,774 billion to over VND 2,684 billion.

MBS’s HTM investments primarily consist of time deposits, while its FVTPL portfolio is largely allocated to securities and bonds. Despite a significant year-over-year increase, loan balances cooled from their peak in Q3.

In terms of funding structure, short-term borrowings accounted for 58%, totaling over VND 17,730 billion, up 36%. MBS also raised long-term capital through bond issuance, reaching nearly VND 1,562 billion, 1.5 times higher than the beginning of the year.

Shareholders’ equity stood at over VND 6,587 billion, up from VND 5,728 billion at the start of the year. Equity is expected to surpass VND 10,000 billion soon, as the Extraordinary Shareholders’ Meeting on December 19, 2025, approved a public offering of up to 333.7 million shares (2:1 ratio).

This capital increase is slated for completion by mid-2026 and is deemed essential by MBS leadership given the company’s modest capital base.

At an offering price of VND 10,000 per share, the company expects to raise nearly VND 3,337 billion, with VND 1,000 billion allocated to proprietary trading and VND 2,337 billion to margin lending.

– 18:50 09/01/2026

MBS to Utilize Nearly VND 86 Billion from ESOP Issuance for Margin Trading Capital

On December 19th, the Board of Directors of MB Securities Corporation (HNX: MBS) passed a resolution to implement an employee stock ownership plan (ESOP). This plan involves issuing nearly 8.6 million shares to employees, scheduled for execution in 2025. The proceeds from this issuance will be allocated to margin lending activities.

MBS Capital Surge: Breaking the 10,000 Billion Mark – A Year-End Trading Boost!

Recently, at an extraordinary shareholders’ meeting, MBS approved a plan to increase its chartered capital beyond the 10,000 billion VND milestone. This strategic move aims to strengthen the company’s financial foundation, expand its operational scale, and enhance its capacity to serve investors in an increasingly competitive securities market.