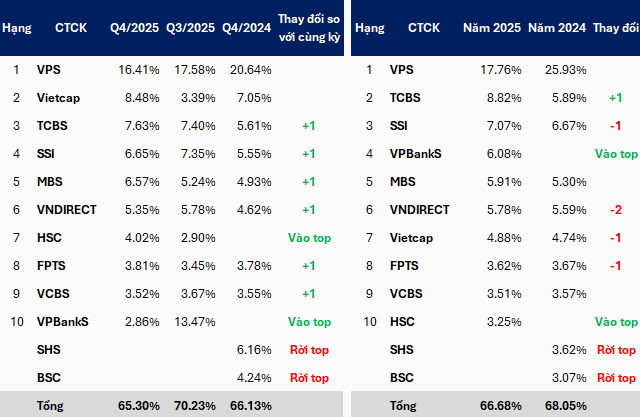

By the end of 2025, according to the top 10 list of leading stock brokerage market share companies on the UPCoM market, as announced by the Hanoi Stock Exchange (HNX), VPS Securities maintained its top position with a 17.76% market share. However, this figure marked an 8.17 percentage point decline compared to 2024, contributing to the overall market share decrease for VPS across all platforms, including stocks on HOSE, HNX, and derivatives.

VPS’s slowdown also indicates a shifting landscape, with other securities firms gaining ground. Notably, TCBS improved its market share from 5.89% to 8.82%, securing the second position.

Despite some firms increasing their market share, slower growth prevented them from climbing the ranks, as seen with MB Securities (MBS). Others, like SSI Securities, VNDIRECT Securities, and Vietcap Securities, experienced declines.

Compared to 2024, two new entrants joined the top 10: VPBank Securities (VPBankS) and HSC Securities (HSC). VPBankS made a remarkable ascent to fourth place with a 6.08% market share, despite only entering the top tier in Q3/2025.

Beyond UPCoM, VPBankS also climbed the ranks in other markets during the final months of the year. In Q4/2025, the newly IPO’d firm entered the top 9 on HOSE, top 6 on HNX, and maintained its top 10 position in derivatives.

Less fortunate were SHS Securities and BSC Securities, which dropped out of the top 10 in 2025. In 2024, SHS held the 8th position with a 3.62% market share, while BSC ranked 10th at 3.07%.

In Q4/2024, SHS and BSC recorded market shares of 6.16% and 4.24%, respectively. Had these figures been sustained through Q4/2025, both firms could have secured mid-tier positions within the top 10.

|

Top 10 Brokerage Market Share on UPCoM in Q4/2025 and 2025

Source: HNX, compiled by the author

|

– 15:29 09/01/2026

TCBS Revises Public Offering Plan for VND 5 Trillion Corporate Bonds

TCBS meticulously tailors each bond issuance by adjusting the volume of bonds offered, the timing of each release, and the detailed allocation of capital for every tranche.

Top 10 HNX Brokerage Market Share Sees Significant Fluctuations in Late 2025

According to the market share rankings of listed stock brokers published by the Hanoi Stock Exchange (HNX), VPS and TCBS maintained their top two positions in both Q4 2025 and the full year 2025, while other rankings experienced significant fluctuations compared to the same period last year.