The year 2025 marks a pivotal shift in the real estate market toward greater transparency and standardization following a period of market purification. The legal framework is gradually being refined, with clearer and stricter regulations governing land, investment, and real estate operations. This compels businesses and developers to fully disclose project legalities, progress, and financial plans.

Concurrently, buyer psychology has shifted significantly. Instead of chasing short-term price increases, end-users and investors are increasingly focused on transparency, legal safety, and actual value. Projects with robust legal frameworks, assured construction timelines, and strong financial backing from developers are experiencing better liquidity compared to the broader market, while less transparent projects continue to be filtered out.

Mr. Vo Hong Thang, Deputy General Director of DKRA Group, remarked, “Transparency is not only a defining feature of the 2025 real estate market but also a prerequisite for its stable and sustainable development in the coming years.”

Mr. Vo Hong Thang, Deputy General Director of DKRA Group, noted that 2025 saw a marked recovery and robust growth in the residential real estate segment.

Assessing the 2025 real estate market, Mr. Thang highlighted a notable recovery and strong growth in residential real estate. The apartment segment led the market with significant growth in both supply and liquidity.

According to DKRA statistics, in 2025, Ho Chi Minh City and its surrounding areas saw over 29,000 new apartment units launched, a 2.5-fold increase year-on-year. Sales volume also surged impressively, with over 26,000 units sold, a 3.1-fold increase compared to 2024, indicating improved buyer confidence and demand. Similarly, the townhouse/villa segment experienced a strong recovery after a sluggish period, with over 16,000 new units launched, a 7.5-fold increase, and sales volume rising 8.8 times compared to 2024.

In contrast, the hospitality real estate sector in 2025 remains in a cautious restructuring and recovery phase. While new supply and sales show some improvement compared to the previous year, market scale remains significantly lower than pre-2022 peak levels.

Mr. Thang stated, “The recovery in this segment is selective, with liquidity concentrated in projects with clear legal frameworks, prime tourist locations, practical product models, and reputable management. Meanwhile, projects previously developed with high-profit commitments, incomplete legalities, or heavy financial leverage continue to struggle to attract buyers and improve liquidity.”

Additionally, investor sentiment toward hospitality real estate has shifted significantly. Instead of high-profit expectations, the market now prioritizes operational efficiency, occupancy rates, and actual cash flow, slowing the segment’s recovery compared to residential real estate.

According to Mr. Vo Hong Thang, in 2025, stable credit policies and low interest rates significantly improved homebuyer sentiment. Reasonable mortgage rates facilitated easier access to capital, boosting market liquidity and recovery.

Moreover, macroeconomic stability and selective credit control measures created a positive psychological foundation. Capital was prioritized for affordable housing and projects with complete legal frameworks and clear timelines, reducing risks and enhancing market growth quality.

Policy-wise, the amended Land Law and related laws (Housing Law, Real Estate Business Law) have addressed long-standing legal issues, particularly for housing projects. This enabled many projects to restart, supplementing market supply and boosting buyer confidence.

Looking ahead to 2026, macroeconomic factors and policies are expected to remain stable and sustainable. If interest rates stay reasonable and economic growth remains positive, the real estate market, especially the residential segment, will have further growth potential. This period will also see new laws implemented, enhancing investment transparency, standardizing legal processes, and shortening project timelines.

Forecasting 2026, Mr. Thang predicted clearer market growth, with recovery varying between residential and hospitality real estate.

For residential real estate, 2026 is expected to continue the 2025 recovery trend, with improved supply from legally cleared projects and rising liquidity as buyer and investor confidence strengthens. However, the focus will be on affordable housing for end-users.

Mr. Vo Hong Thang, Deputy General Director of DKRA Group

The market will maintain a positive yet highly selective trajectory: projects with transparent legalities, strategic locations, and proximity to key infrastructure will perform well, while those with legal delays, poor connectivity, or undeveloped infrastructure will struggle to attract buyers.

Prices are expected to rise due to input cost pressures, interest rates, and infrastructure expectations, but increases will vary by segment rather than occurring uniformly across the market.

“Post-Fever, Resale Condos Witness ‘Loss-Cutting’ Transactions in the Market”

According to VARS IRE, “stop-loss” transactions in the condominium market are primarily observed among properties purchased at high premiums or driven by FOMO-induced buying during previous short-lived price surges.

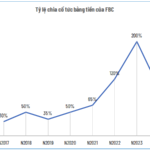

“Motorcycle Parts Company Locks in 100% Cash Dividend”

Fomeco, a leading automotive parts supplier to renowned brands such as Honda, Yamaha, and Piaggio, has announced an upcoming cash dividend for the year 2024. Shareholders will be delighted to know that the record date for this dividend is set for September 26, with payments commencing from November 12 onwards.