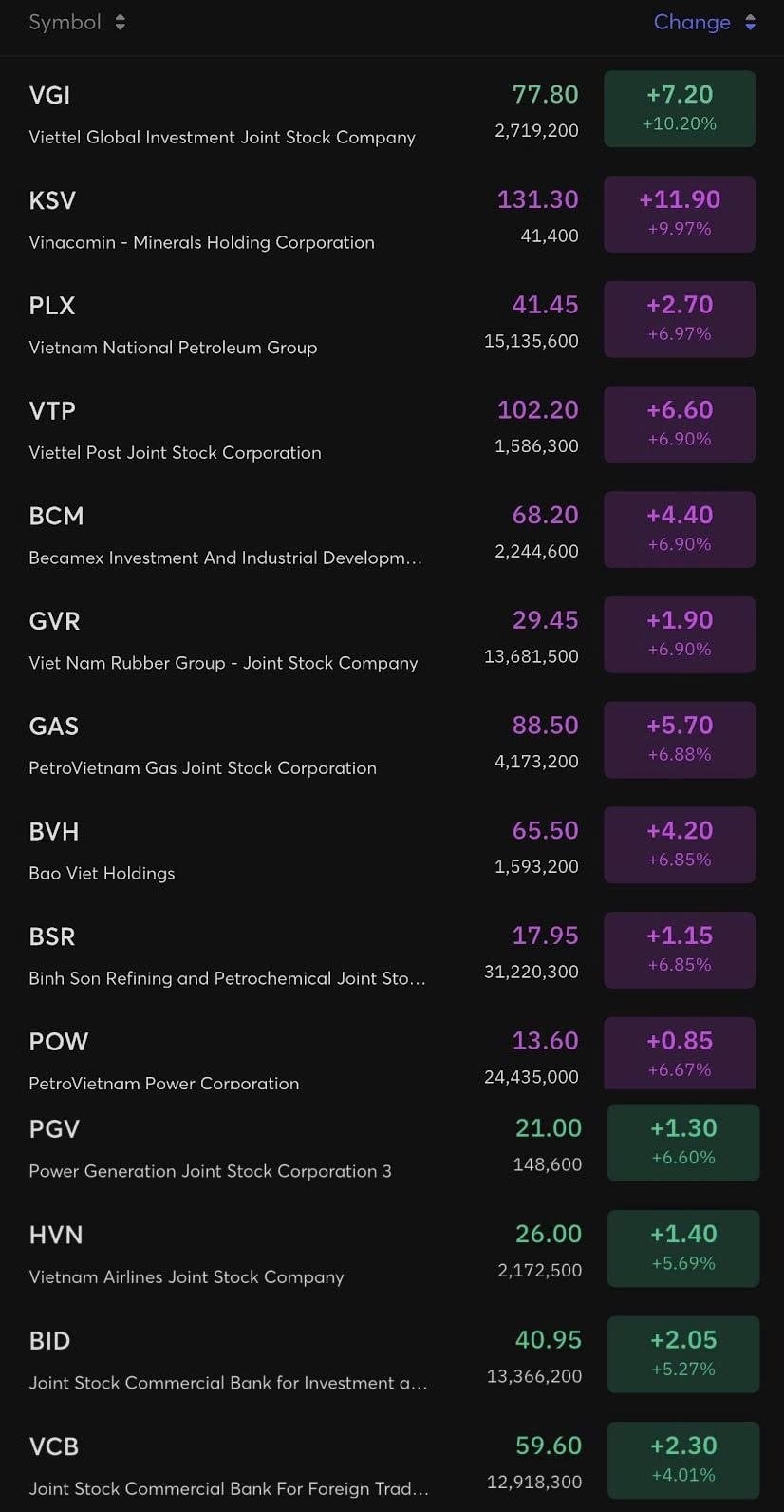

The early year market sessions witnessed widespread euphoria. Most notably, GAS (Vietnam Gas Corporation) saw three consecutive ceiling sessions, surging to VND 88,500 per share, nearing its historical peak set in June 2022.

Following suit, BVH (Bao Viet Group) also experienced its second ceiling session, closing at VND 65,500 per share—a five-year high. The bullish trend extended to other giants like KSV (4th ceiling session), GVR, BSR, PLX, and BCM, all hitting their upper limits.

Positive momentum of state-owned enterprises

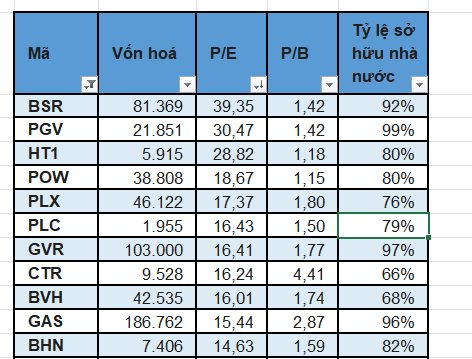

These companies have highly concentrated ownership structures, with state ownership exceeding 60%.

For instance, Power Generation Corporation 3 (PGV) and TKV Power Corporation (DTK) have state ownership at 99%. Similarly, Vietnam Rubber Group (GVR), with a market cap over VND 100 trillion, is 97% state-owned, while Vietnam Gas Corporation (GAS), with a market cap nearing VND 187 trillion, has 96% state ownership.

Many such companies are listed on the stock exchange.

Several companies fail to meet the criteria for a public company as per Article 32, Clause 1(a) of the Securities Law No. 54/2019/QH14 (amended by Article 1, Clause 11(a) of Law No. 56/2024/QH15, effective from 01/01/2025).

Companies are proposing solutions, primarily involving state shareholders divesting or selling shares to the public. Expectations of such actions are fueling market sentiment, driving up share prices of these companies.

Meanwhile, state-owned enterprises are relying on the Law on Management and Investment of State Capital in Enterprises (Law No. 68/2025/QH15, effective from 01/08/2025) to address public company status issues with regulatory bodies.

Article 59, Clause 7 of this Law states: “During the implementation of an approved restructuring plan, state-owned enterprises transitioning from 100% state-owned to listed joint-stock companies, if they do not meet public company shareholder structure requirements under the Securities Law, shall not lose their public company status.”

Budget pressures and new mechanisms

Macro policy expectations are also shaping the narrative for state-owned enterprise stocks.

First, budget pressures. Entering the 2026-2030 budget cycle, capital needs for key infrastructure projects are substantial.

The 2026 budget deficit is estimated at VND 600 trillion (4.2% of GDP), with development investment spending up 41%. Divesting from efficient enterprises is a viable solution to bolster the national treasury.

Second, mechanism liberalization, with high hopes pinned on the Resolution on the State Economy expected in 2026. Experts liken this to a “boost” akin to Resolution 68 for the private sector, promising a smoother legal framework to enhance governance and revalue public assets.

State-owned enterprises currently contribute about 29% of GDP, leading in total assets, revenue, and market share, even holding monopolies in key sectors like aviation and energy. However, operational efficiency remains below potential due to underutilized capital. If these bottlenecks are removed, MBS believes state-owned enterprises could enter a new growth phase.

Technically, the Ministry of Finance recently proposed mechanisms to reduce starting prices (up to 10% per session) and sell capital in lots to SCIC. This flexibility aims to address overpriced starting points that led to previous auction failures.

However, capital flows reflect selective choices based on individual stock narratives.

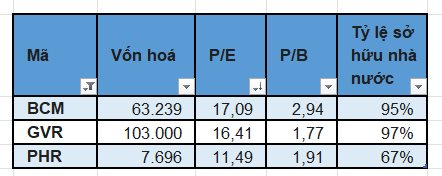

Beneficiaries of “hidden assets” and land conversion include Rubber and Industrial Zone enterprises. Investors accept higher P/E ratios for these companies, anticipating net asset value (NAV) gains from land funds.

GVR, for example, trades at a P/E of 16.41, driven by converting low-cost rubber land to industrial and commercial zones. Similarly, PHR maintains a P/E of 11.49, benefiting from land compensation and rubber sector recovery.

Energy monopolies also attract attention. Binh Son Refinery (BSR) trades at a P/E of 39.35, reflecting high expectations for its refinery upgrade and listing transition. GAS, with a P/E of 15.44 and P/B of 2.87, is seen as a defensive choice due to strong cash flow and stable dividends.

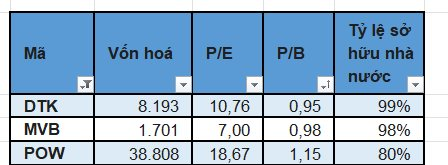

Conversely, the market undervalues some companies. TKV Power Corporation (DTK) trades at a P/B of 0.95, and Vinacomin (MVB) at 0.98, both below book value.

Secretary-General Tô Lâm Signs Politburo Resolution on State Economic Development

Resolution No. 79-NQ/TW, dated January 6, 2026, emphasizes that the state-owned economy is a critically important component of the socialist-oriented market economy. By 2030, Vietnam aims to have 50 state-owned enterprises among the 500 largest companies in Southeast Asia and 1-3 state-owned enterprises among the 500 largest companies globally.

Anticipating a Capital Withdrawal Wave to Mirror the 2016-2018 Boom, Experts Highlight Notable Businesses to Watch

Numerous state divestment plans in several listed companies have been implemented and are currently underway.

General Secretary To Lam Signs Politburo Resolution on State Economic Development

Resolution No. 79-NQ/TW, dated January 6, 2026, emphasizes that the state-owned economy is a critically important component of the socialist-oriented market economy. By 2030, Vietnam aims to have 50 state-owned enterprises among the top 500 largest companies in Southeast Asia and 1-3 state-owned enterprises in the global top 500.

Resolution No. 79-NQ/TW of the Politburo on State Economic Development

General Secretary Tô Lâm has recently signed and issued a Resolution of the Politburo on the development of the state economy (Resolution No. 79-NQ/TW, dated January 6, 2026).