Damsan’s Board of Directors has approved a capital divestment plan from Thai Binh – Cau Nghin Joint Stock Company, scheduled for Q1/2026, with an initial divestment value of approximately VND 120 billion. The remaining capital will be fully divested by the end of 2026.

Thai Binh – Cau Nghin is one of Damsan’s four affiliated companies, in which Damsan holds a 45% stake. Based in Thai Binh, the company primarily operates in the construction of bridges and roads.

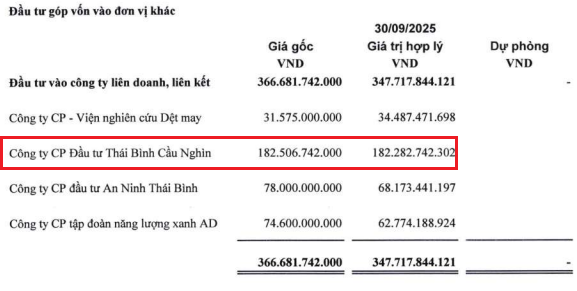

Damsan’s investments in affiliated companies. Source: Damsan’s Q3/2025 Consolidated Financial Report

|

As of September 30, 2025, Damsan’s initial investment in Thai Binh – Cau Nghin was valued at VND 182.5 billion. The fair value of this investment slightly decreased to VND 182.3 billion, indicating minimal fluctuation before the divestment plan.

If executed as planned, Damsan will fully withdraw its capital from this construction-focused affiliate, narrowing its investment portfolio outside its core business.

Additional VND 81 Billion Investment in Subsidiary Eiffel

Conversely, Damsan has decided to increase its capital in Eiffel Joint Stock Company (formerly known as Eiffel Fiber Joint Stock Company), its only subsidiary consolidated into its financial statements. Eiffel plans to issue an additional 12 million shares, of which Damsan will subscribe to 8.1 million shares, equivalent to VND 81 billion at par value.

Upon completion of this capital increase in Q1/2026, Damsan’s total investment in Eiffel will reach VND 336 billion, representing 33.6 million shares, or 80% of the charter capital. Damsan will maintain its role as Eiffel’s parent company, despite a slight adjustment in ownership ratio.

According to the Q3/2025 financial report, prior to this issuance, Damsan held an 85% stake in Eiffel. The subsidiary’s capital increase will reduce Damsan’s ownership from 85% to 80%, while still retaining absolute control.

Established in 2015 and headquartered in Hung Yen, Eiffel specializes in fiber production. The company is currently led by Ms. Vu Phuong Diep, born in 1986, serving as both Director and Legal Representative. Eiffel’s most recent capital increase occurred in August 2023, raising its charter capital from VND 175 billion to VND 300 billion, five times its initial registered capital of VND 60 billion.

On the HOSE, ADS shares closed at VND 8,190 per share on January 9, up over 3.4% in the first trading week of 2026. Average liquidity reached more than 104,000 shares per day.

| ADS Share Price Performance Over the Past Year |

In this context, Ms. Luong Thi Dung, wife of Damsan’s Chairman Vu Huy Dong, has registered to purchase an additional 1 million ADS shares between January 7 and February 5. If the transaction is completed, her ownership in Damsan will increase from 0.55% to approximately 1.8% of the charter capital, equivalent to over 1.4 million shares. This will raise the combined ownership of the Chairman and his spouse in Damsan to 13.85% of the charter capital.

– 15:17 09/01/2026