Techno Commercial Joint Stock Securities Company (TCBS, stock code TCX, listed on HoSE) has recently approved amendments to its public bond issuance plan totaling VND 5,000 billion. The revisions were formalized in Resolution No. 010411/2025/NQ-HĐQT-TCBS dated November 4, 2025.

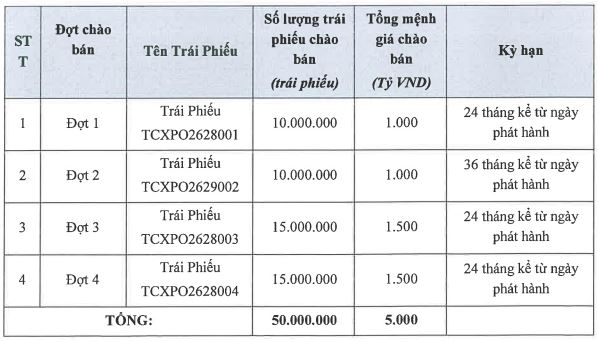

Specifically, TCBS has adjusted the number of bonds planned for issuance in each tranche as follows:

Source: TCX

Additionally, the company has postponed the expected issuance timeline for each tranche. Tranche 1 (code TCXPO2628001) is now scheduled for issuance in Q1-Q2/2026, pending approval from the State Securities Commission.

Subsequent tranches are expected to be offered between Q1-Q4/2026. The interval between each issuance will not exceed 12 months, with each tranche’s offering period limited to 90 days. These bonds are non-convertible, unsecured, and unaccompanied by warrants.

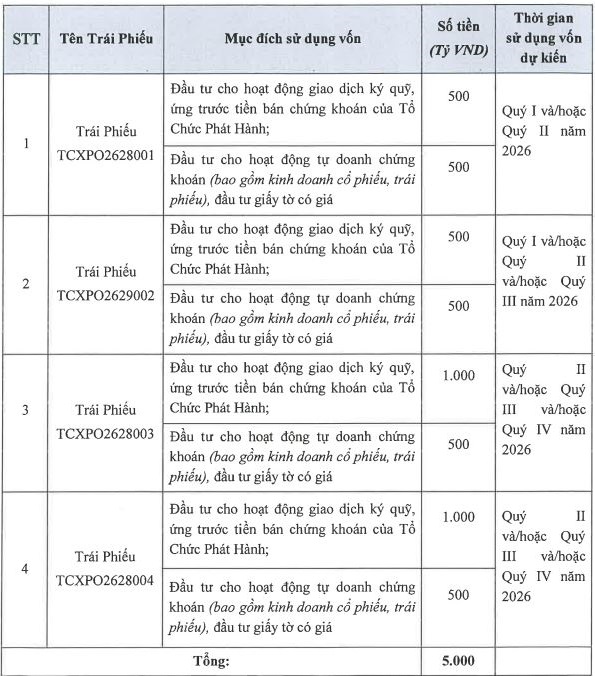

The detailed capital allocation plan for each issuance tranche has also been revised as follows:

Source: TCX

The bond interest rate structure has been modified to a hybrid model, combining fixed and floating rates. The first interest calculation period will apply a fixed rate of 8% per annum, while subsequent periods will utilize a floating rate of 2.7% per annum plus a reference rate.

In related news, on December 22, 2025, TCBS announced Resolution No. 012212/25/NQ-HĐQT-TCBS, approving the issuance of private bonds in multiple tranches, totaling up to VND 3,000 billion.

TCBS plans to issue 30,000 bonds across 6 tranches, with each tranche comprising 500 bonds, equivalent to VND 500 billion in capital raised.

These bonds are non-convertible, unsecured, and unaccompanied by warrants, with an offering price of VND 100 million per bond.

Regarding interest rates, for Tranches 1 and 4, the initial interest calculation period will apply a rate of 8% per annum. Subsequent periods will use a rate equal to the reference rate plus 2.5% per annum.

For Tranches 2, 3, 5, and 6, the initial interest calculation period will also apply a rate of 8% per annum. Following periods will utilize a rate equal to the reference rate plus 2.7% per annum.

TCBS Launches 15-Month Bond Issuance

On December 25, 2025, TCBS issued a VND 500 billion bond under the code TCX12504, with a 15-month maturity.