Billions in Bonds Issued: Many Details Remain Unclear

On the evening of January 9th, multiple news outlets reported that the People’s Procuracy of Hung Yen Province, along with the provincial police, had initiated legal proceedings against Mr. Trinh Phan Thien, CEO of Ngoc Thien Global Group Joint Stock Company and Deputy CEO of Ngoc Thien Limited Liability Company. The charges are for fraud and misappropriation of assets, as outlined in Article 174 of the 2015 Penal Code. Preliminary investigations by the Hung Yen Provincial Police reveal that between April 2021 and 2022, Mr. Thien allegedly used multiple companies under his control to issue three rounds of bonds in violation of regulations, totaling over 1.253 trillion VND.

“Through these three bond issuances, Mr. Thien raised a total of over 456 billion VND from secondary investors. The Hung Yen Provincial Police determined that the funds raised were not used for business activities as promised in the bond issuance documents but were instead used for personal purposes, leading to an inability to repay,” according to media reports.

Data obtained by reporters from the Hanoi Stock Exchange (HNX) shows that during 2021-2022, Ngoc Thien Global Group Joint Stock Company (Ngoc Thien Global) issued two private bond lots with a total value of 753.3 billion VND. Additionally, Ngoc Thien Limited Liability Company, a subsidiary of Ngoc Thien Global, issued a bond lot worth 500 billion VND.

Notably, critical information related to these bond lots, such as collateral, capital usage, bondholder lists, and affiliated entities, was not fully disclosed on the information disclosure system.

Specifically, on April 8, 2021, Ngoc Thien Global Group Joint Stock Company issued the NTGCH2124001 bond lot valued at 300 billion VND. This bond has a 3-year term, an 11% annual interest rate, and matures on April 8, 2024.

This non-convertible bond, without warrants, is secured and issued through book-entry, with a fixed 11% annual interest rate (paid quarterly). The purpose of the issuance is to invest in its subsidiary, Ngoc Thien Limited Liability Company, for constructing factories and expanding production.

The collateral is Ngoc Thien Global’s equity contribution in its subsidiary, Ngoc Thien Limited Liability Company, valued at over 606 billion VND, representing more than 90.2% of the subsidiary’s capital.

The buyer is a domestic organization, but its identity has not been disclosed by Ngoc Thien Global.

The advisory firm for the offering documents, bond issuer, registrar, and bond custodian is HDB Securities Joint Stock Company (HDBS).

|

On February 18, 2022, Ngoc Thien Limited Liability Company announced the completion of the NTCCH2124001 bond issuance, valued at 500 billion VND. This bond has a 3-year term, matures on November 30, 2024, and carries a fixed 11% annual interest rate. Other key details, such as collateral and issuance purpose, were not fully disclosed. The bond custodian is HDB Securities Joint Stock Company (HDBS).

On March 28, 2022, Ngoc Thien Global completed the issuance of the NTGCH2124002 bond, totaling 453.3 billion VND, with a 3-year term, a 11.5% annual interest rate, and maturing on December 30, 2024. The bond custodian is Guotai Junan Securities (Vietnam) Joint Stock Company. Other details, such as collateral, issuance purpose, issuing agent, and bondholder list, remain incomplete on the system.

Key Highlights About the Company

Ngoc Thien Global is headquartered in Dong Mai Village, Chi Dao Commune, Van Lam District (formerly), Hung Yen Province, with its main business in wholesale of metals and metal ores. According to the 2021 Audited Financial Statements, Mr. Trinh Phan Thien serves as Chairman of the Board and CEO, while Ms. Do Hong Hanh is a Board Member and Deputy CEO.

The headquarters of Ngoc Thien Limited Liability Company, a subsidiary of Ngoc Thien Global, is also located at the same address.

According to the 2021 Audited Consolidated Financial Statements, Ngoc Thien Global recorded a significant surge in both revenue and total assets in 2021.

Specifically, in 2021, Ngoc Thien Global’s sales revenue and service provision reached over 11,960 billion VND, approximately 5.7 times higher than the nearly 2,089 billion VND in 2020. Interest expenses also rose sharply from nearly 11.9 billion VND to over 21.5 billion VND. After-tax profit increased slightly from nearly 6.1 billion VND to nearly 8.2 billion VND.

Ngoc Thien Global’s total assets at the end of 2021 skyrocketed to nearly 15,200 billion VND, compared to over 3,300 billion VND at the end of 2020. However, over 13,900 billion VND were receivables, more than five times higher than at the end of 2020.

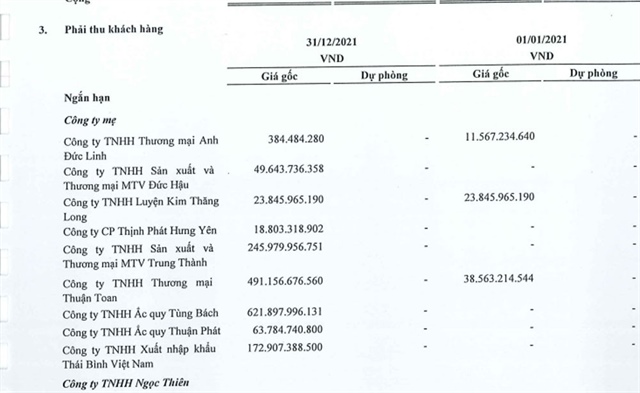

Ngoc Thien Global’s receivables are concentrated in companies such as: Tung Bach Battery Limited Liability Company (nearly 622 billion VND), Thuan Toan Trading Limited Liability Company (491 billion VND), Trung Thanh Manufacturing and Trading Private Enterprise (246 billion VND), and Thai Binh Vietnam Import-Export Limited Liability Company (173 billion VND). These companies are newly established and/or share similar addresses.

Ngoc Thien Global’s receivables. Source: Audited Financial Statements |

Conversely, Ngoc Thien Global also recorded a short-term payable to suppliers of over 10,200 billion VND, nearly ten times higher than the previous year. Notably, these payables are also primarily to the same companies with which it has significant receivables.

A noteworthy point is that Vietnam Audit and Valuation Limited Liability Company (AVA), the auditor of Ngoc Thien Global’s 2021 financial statements, issued a qualified opinion.

According to AVA, they were not present to witness the physical inventory count of cash, inventory, and fixed assets as of December 31, 2021. Therefore, AVA cannot provide an opinion on the existence of these items or their impact (if any) on other related items presented in the company’s consolidated financial statements.

AVA also noted that Ngoc Thien Global had not fully reconciled the balances of receivables and payables as of December 31, 2021. While AVA applied audit procedures to review these balances, they were unable to obtain sufficient evidence to express an opinion on the accuracy of these balances in the 2021 Consolidated Financial Statements.

Additionally, AVA stated that, except for the financial statements of Ngoc Thien Limited Liability Company, the financial statements of other subsidiaries as of December 31, 2021, included in the consolidated financial statements, were not audited.

|

According to the company’s website, Ngoc Thien Limited Liability Company was established in 2005 in Vietnam and specializes in the collection, recycling, and treatment of batteries, scrap, and lead ingot production. Ngoc Thien Global originated from a long-standing metal casting and recycling village, focusing on metal trading, hazardous waste treatment, and recycling of non-ferrous metals such as lead, aluminum, copper, and zinc. The company has expanded into minerals, real estate, and financial investments. Ngoc Thien Global claims to have customers in Vietnam, Cambodia, China, Laos, India, Singapore, and targets international markets. |

Strange Story at Ngoc Thien Global: Abnormal Asset Inflation, Massive Revenue but Minimal Profit

Ngoc Thien Global Fined for Multiple Information Disclosure Violations

Mạnh Hà

– 09:52 10/01/2026

2026 Spotlight Industries: Is Vingroup Stock Still a Compelling Investment?

The year 2026 is poised to be a pivotal year for the stock market, driven by economic growth, capital upgrades, and a rebound in corporate earnings. Three standout sectors to watch are infrastructure and construction, finance, and consumer goods. Among these, Vingroup shares stand out due to their compelling narrative in infrastructure, real estate, and ecosystem restructuring. However, investors should carefully evaluate pricing dynamics and timing to maximize investment returns.

Vietnam’s GDP Surges 8.02%, Hailed by Global Media as Asia’s Shining Star

Leading international media outlets project Vietnam’s GDP to grow by 8.02% in 2025, highlighting the nation’s remarkable economic resilience even amidst global trade tensions and tariff fluctuations.

Lessons Learned: Strategies to Exceed Public Investment Disbursement Targets

Establishing a Land Clearance Steering Committee, proactively collaborating with neighboring localities to source construction materials, and implementing a ‘green lane’ mechanism for streamlined procedures in key projects are among the proactive solutions adopted by local authorities. These measures aim to ensure the full disbursement of allocated capital by 2025.

Vietlott Awards Over 5.342 Trillion VND in Prizes in 2025, Including a Record-Breaking Jackpot Winner

In 2025, Vietlott (Vietnam Computerized Lottery One Member Limited Liability Company) achieved a remarkable revenue of over 9.686 trillion VND, marking a 22% increase compared to 2024 and surpassing the Ministry of Finance’s target by 11%. The company contributed more than 2.495 trillion VND to local budgets, a 20% rise year-over-year. Vietlott recorded over 32 million winning entries and distributed prizes totaling over 5.342 trillion VND to players nationwide, reflecting a 25% growth in payouts.