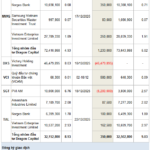

Recently, VinaCapital Fund Management Joint Stock Company (VinaCapital) has submitted reports detailing the results of stock transactions at Khang Dien House Investment and Trading Joint Stock Company (Stock Code: KDH, HoSE).

According to the reports, during the trading period from December 9, 2025, to January 7, 2026, two VinaCapital funds did not fully sell the registered KDH shares due to unfavorable market conditions.

Specifically, the VinaCapital Market Access Equity Fund successfully sold over 1.01 million KDH shares out of the nearly 1.95 million shares registered for sale.

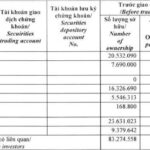

Following the transaction, the fund reduced its KDH shareholdings from nearly 1.95 million shares to 939,225 shares, decreasing its ownership stake from 0.1738% to 0.0837% of Khang Dien House’s capital.

Illustrative image

Another VinaCapital fund, the Modern Economy Equity Fund, sold nearly 1.26 million KDH shares out of the 1.5 million shares registered for sale. This reduced its ownership stake in Khang Dien House from 0.2327% (over 2.61 million shares) to 0.1209% (nearly 1.36 million shares).

In related news, on November 18, 2025, Mr. Ly Dien Son completed the transfer/gift of 17.7 million KDH shares to his mother, Ms. Doan Thi Nguyen. The total value of the shares transferred, based on par value, was 177 billion VND.

The transaction was executed through the Vietnam Securities Depository and Clearing Corporation (VSDC) via a securities ownership transfer due to gift/donation.

After the transaction, the Deputy Chairman of Khang Dien House reduced his KDH shareholdings from over 18.8 million shares to more than 1.1 million shares, decreasing his ownership stake from 1.68% to 0.1% of the company’s capital.

Conversely, Ms. Doan Thi Nguyen increased her ownership stake in Khang Dien House from 0.012% (129,383 shares) to 1.59% (over 17.8 million shares).

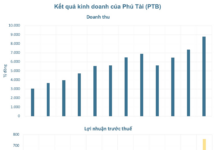

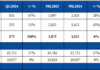

Regarding business performance, in the first nine months of 2025, Khang Dien House reported net revenue of nearly 2,857.5 billion VND, a 132.1% increase compared to the same period in 2024. After-tax profit reached over 840.8 billion VND, up 104.8%.

For 2025, Khang Dien House set a target after-tax profit of 1,000 billion VND. By the end of the first three quarters, the company had achieved 84% of its profit target.

As of September 30, 2025, Khang Dien House’s total assets increased by 7.6% from the beginning of the year to nearly 33,081 billion VND. Inventory accounted for 69.8% of total assets, amounting to over 23,086.4 billion VND.

On the liabilities side, total payables stood at over 12,703 billion VND, a 12.4% increase from the beginning of the year. Short-term and long-term loans totaled nearly 9,884.2 billion VND, representing 77.8% of total liabilities.

Sustained Buying Momentum in Investment Fund Transactions

Last week (December 22–26, 2025), despite only one new purchase transaction being announced, investment fund activity indicated sustained demand. This resilience comes as the market continues to grapple with volatility and profit-taking pressures, with the VN-Index testing its previous peak levels.

Prime Minister Issues New Directive on $3 Billion LNG Power Project Involving VinaCapital

In Tay Ninh (formerly Long An), two major projects, Long An I and II, with a combined capacity of 3,000 MW and an investment of $3.13 billion, are slated to break ground by late 2025. Spearheaded by GS Energy (South Korea) and VinaCapital, these initiatives aim to bolster energy infrastructure. However, a Government Inspectorate report previously highlighted procedural irregularities during the project’s preparatory phase, necessitating thorough review and corrective measures.

Viconship Group Aims to Significantly Increase Stake in Hai An Port Services

Viconship and its two subsidiaries have collectively registered to purchase 14 million shares of HAH, with the strategic aim of increasing their ownership stake in Xếp dỡ Hải An.