I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

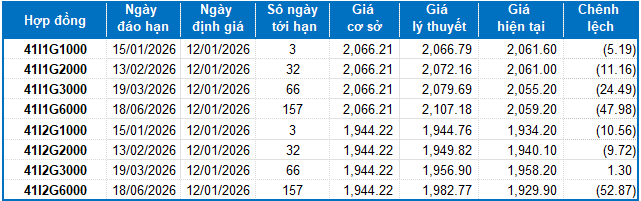

On January 9, 2026, VN30 futures contracts experienced a collective decline. Specifically, 41I1G1000 (I1G1000) dropped by 0.6% to 2,061.6 points; 41I1G2000 (I1G2000) fell by 0.58% to 2,061 points; 41I1G3000 (I1G3000) decreased by 0.95% to 2,055.2 points; and 41I1G6000 (I1G6000) declined by 0.59% to 2,059.2 points. The underlying index, VN30-Index, closed at 2,066.21 points.

Meanwhile, VN100 futures contracts showed mixed movements. The 41I2G1000 (I2G1000) contract fell by 0.99% to 1,934.2 points; 41I2G2000 (I2G2000) dropped by 0.76% to 1,940.1 points; 41I2G3000 (I2G3000) rose by 0.88% to 1,958.2 points; and 41I2G6000 (I2G6000) decreased by 0.54% to 1,929.9 points. The VN100-Index closed at 1,944.22 points.

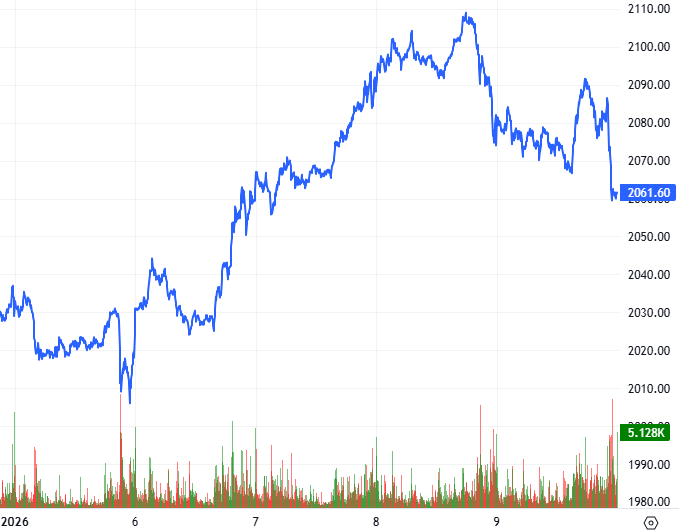

During the week of January 5–9, 2026, the 41I1G1000 contract exhibited volatile movements with alternating gains and losses. Early in the week, I1G1000 surged but gradually narrowed its gains before reversing due to increased selling pressure. However, in subsequent sessions, the contract rebounded sharply as Long positions regained dominance. Despite this, sellers reasserted control, limiting the contract’s gains and closing the week at 2,061.6 points, up 32.6 points from the previous week.

Intraday Chart of 41I1G1000 (January 5–9, 2026)

Source: https://stockchart.vietstock.vn

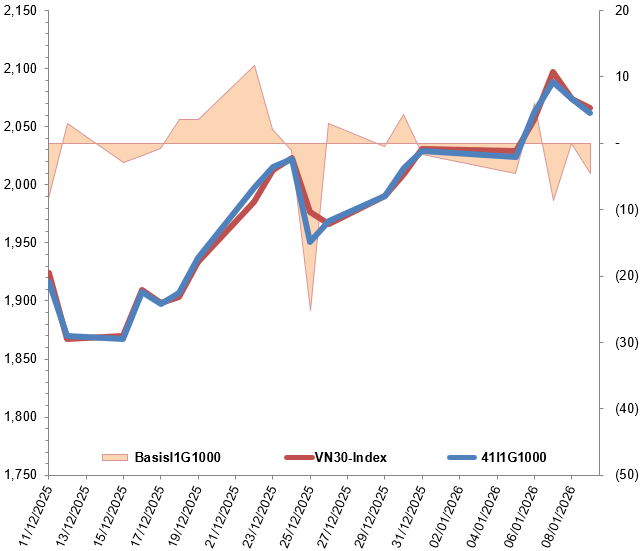

At the close, the basis of the I1G1000 contract widened compared to the previous session, reaching -4.61 points. This indicates a more bearish sentiment among investors.

Fluctuations of 41I1G1000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN30-Index

Similarly, the basis of the I2G1000 contract widened to -10.02 points, reflecting increased investor pessimism.

Fluctuations of 41I2G1000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN100-Index

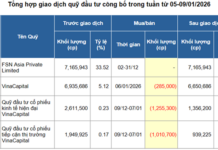

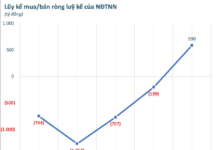

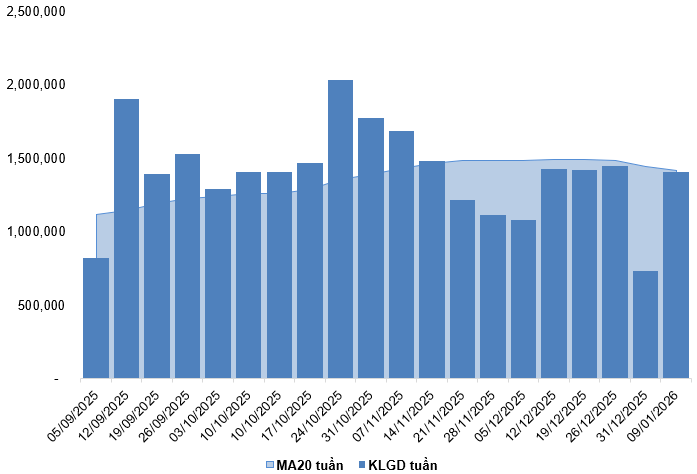

Derivatives market trading volume and value increased by 13.51% and 12.51%, respectively, compared to January 8, 2026. For the week, trading volume and value rose by 91.38% and 96.81%, respectively, compared to the previous week.

Foreign investors resumed net selling, with a total of 3,042 contracts sold on January 9, 2026. For the week, foreign investors net sold 224 contracts.

Weekly Trading Volume Fluctuations in the Derivatives Market (Unit: Contracts)

Source: VietstockFinance

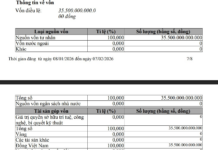

I.2. Futures Contract Valuation

Using a fair pricing method as of January 12, 2026, the reasonable price range for actively traded futures contracts is as follows:

Valuation Summary of Derivatives Contracts for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments for each futures contract.

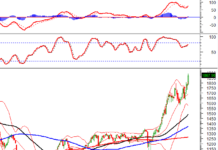

I.3. Technical Analysis of VN30-Index

On January 12, 2026, the VN30-Index traded sideways, forming a small-bodied candlestick with above-average trading volume over 20 sessions. Currently, the index is retesting the October 2025 high (2,010–2,055 points), which was previously breached. This level will serve as critical support in upcoming sessions.

Additionally, the Stochastic Oscillator has issued a sell signal in the overbought zone. If these technical factors do not improve, the short-term outlook may become less optimistic.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

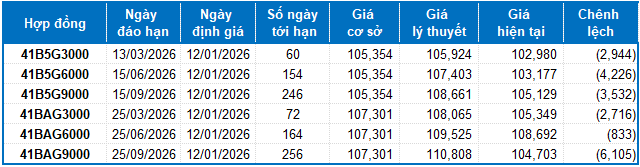

II. FUTURES CONTRACTS OF THE BOND MARKET

Using a fair pricing method as of January 12, 2026, the reasonable price range for actively traded bond futures contracts is as follows:

Valuation Summary of Government Bond Futures Contracts

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments for each futures contract.

According to the above valuation, contracts 41B5G3000, 41B5G6000, 41B5G9000, 41BAG3000, 41BAG6000, and 41BAG9000 are currently attractively priced. Investors should focus on these contracts and consider buying, as they offer significant value in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:58 January 10, 2026

Derivatives Market Update 09/01/2026: Mixed Signals Emerge

On January 8, 2026, futures contracts for the VN30 and VN100 indices predominantly closed in negative territory. The VN30-Index reversed its trend, forming a Big Black Candle pattern accompanied by above-average trading volume over the past 20 sessions, signaling a cautious sentiment among investors.

Derivatives Market on January 8, 2026: Optimistic Sentiment Spreads Across the Market

On January 7, 2026, both VN30 and VN100 futures contracts surged in a robust trading session. The VN30-Index extended its gains, supported by consistently rising trading volumes that exceeded the 20-session average, reflecting sustained investor optimism.