On January 9th, at the banking sector’s task deployment conference for Zone 2 (encompassing Ho Chi Minh City and Dong Nai), Deputy Governor of the State Bank of Vietnam, Pham Tien Dung, emphasized the need for close collaboration between the banking system and relevant ministries, sectors, and localities in developing the International Financial Center in Ho Chi Minh City.

Deputy Governor Pham Tien Dung addressing the conference (Photo: Hong Cuong).

According to the Deputy Governor, credit institutions should not only focus on capital provision but also enhance their capacity to deliver high-quality financial services. They must be prepared to seize significant opportunities arising from the Long Thanh International Airport, free trade zones, and the Southern region’s financial and commercial ecosystem.

Mr. Dung urged the State Bank of Vietnam’s Zone 2 branch and credit institutions to promptly study decrees and mechanisms related to the International Financial Center to ensure synchronized and effective implementation. Many new regulations, particularly in foreign exchange, are designed to be more open and even surpass current policies, allowing members of the International Financial Center to transact flexibly both domestically and internationally.

“The goal is to jointly build an international financial center, thereby creating new resources for the economic development of Ho Chi Minh City and the entire country,” said Mr. Dung.

Nguyen Cong Vinh, Vice Chairman of Ho Chi Minh City People’s Committee, stated that in 2026, the city will continue to focus on three traditional growth drivers: production, consumption, and exports. The city also pins high hopes on new drivers such as the International Financial Center, seaport-logistics systems, science-technology, innovation, green transformation, and digital transformation.

“Following the merger, Ho Chi Minh City is oriented to develop according to the model of ‘3 regions, 1 special zone, 3 corridors, 5 drivers.’ Based on this, I request the banking sector to research and develop specific, preferential credit products suitable for each area and key sector.

Particularly, accompany the city’s 77 key projects, such as Ring Road 4, Can Gio Bridge, Phu My 2 Bridge, the Can Gio –

Vung Tau sea route, and metro lines,” said Mr. Vinh.

Superior specific policies for the International Financial Center in Vietnam.

According to Vo Minh Tuan, Director of the State Bank of Vietnam’s Zone 2 branch, both Ho Chi Minh City and Dong Nai aim for double-digit GRDP growth in 2026. When the Ho Chi Minh City International Financial Center, Free Trade Zone, and Long Thanh International Airport become operational, the demand for capital and high-quality financial services will surge, opening new development opportunities for the entire banking sector in the region.

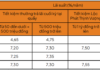

By the end of 2025, in Ho Chi Minh City, outstanding loans are estimated at approximately 5,080 trillion VND, up 13.5%, contributing to a GRDP of nearly 2,970 trillion VND, an increase of 8.03%, and accounting for 23.5% of the national GDP.

In Dong Nai province, outstanding loans are estimated at 600 trillion VND, up 13.45% compared to the previous year-end; banking capital closely follows the local economic development direction, helping achieve a GRDP of about 678 trillion VND in 2025, up 9.63%, ranking 7th nationally and leading the Southeast region.

Revolutionary Tap-to-Pay Feature Unveiled by Zalopay at New Year Fes

Zalopay unveiled a groundbreaking feature, Tap to Pay with Zalopay, at the New Year Fes 2026 event. This pilot launch serves as a strategic move to gather firsthand user feedback, enabling the platform to refine and optimize the solution before its full-scale rollout.

Elevating Phú Thuận’s New Development with Văn Phú’s “Human-Centric” Signature

Phú Thuận’s entry into infrastructure development has transformed a once-challenging area into a vibrant riverside urban destination. Recognizing its potential, Văn Phú has strategically chosen this location for long-term growth, seamlessly aligning the region’s natural value with its core philosophy: “Real Estate for Humanity.”

Which Area is Leading the Growth Wave on Ho Chi Minh City’s Real Estate Map?

For over a decade, South Saigon, particularly the former District 7, has been recognized as one of Ho Chi Minh City’s earliest and most systematically developed urban areas, anchored by the exemplary Phu My Hung urban center. However, the region’s growth potential has long been constrained by a critical bottleneck: infrastructure development that has failed to keep pace with its ambitions.