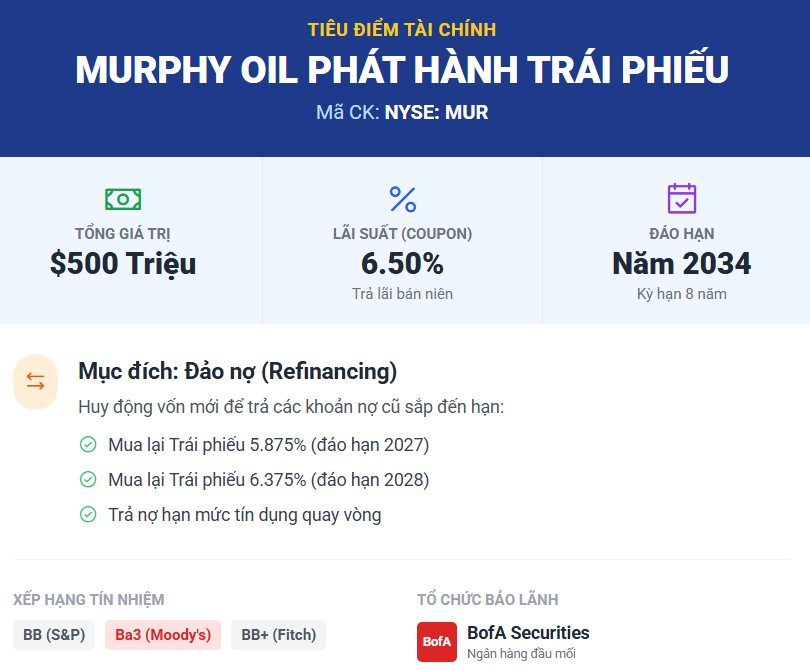

Murphy Oil Corp. (NYSE: MUR) has announced a strategic move to issue $500 million in senior notes with an 8-year term, maturing in 2034. This debt offering carries a coupon rate of 6.50% and is being sold at par value.

The issuance is executed under a shelf registration with the U.S. Securities and Exchange Commission (SEC), led by Bank of America Securities as the bookrunner.

Proceeds from this bond sale will primarily refinance existing lower-interest debt maturing in 2027 (5.875%) and 2028 (6.375%). The remaining funds will service revolving credit facilities and support general corporate operations, effectively extending debt maturity and easing short-term liquidity pressures.

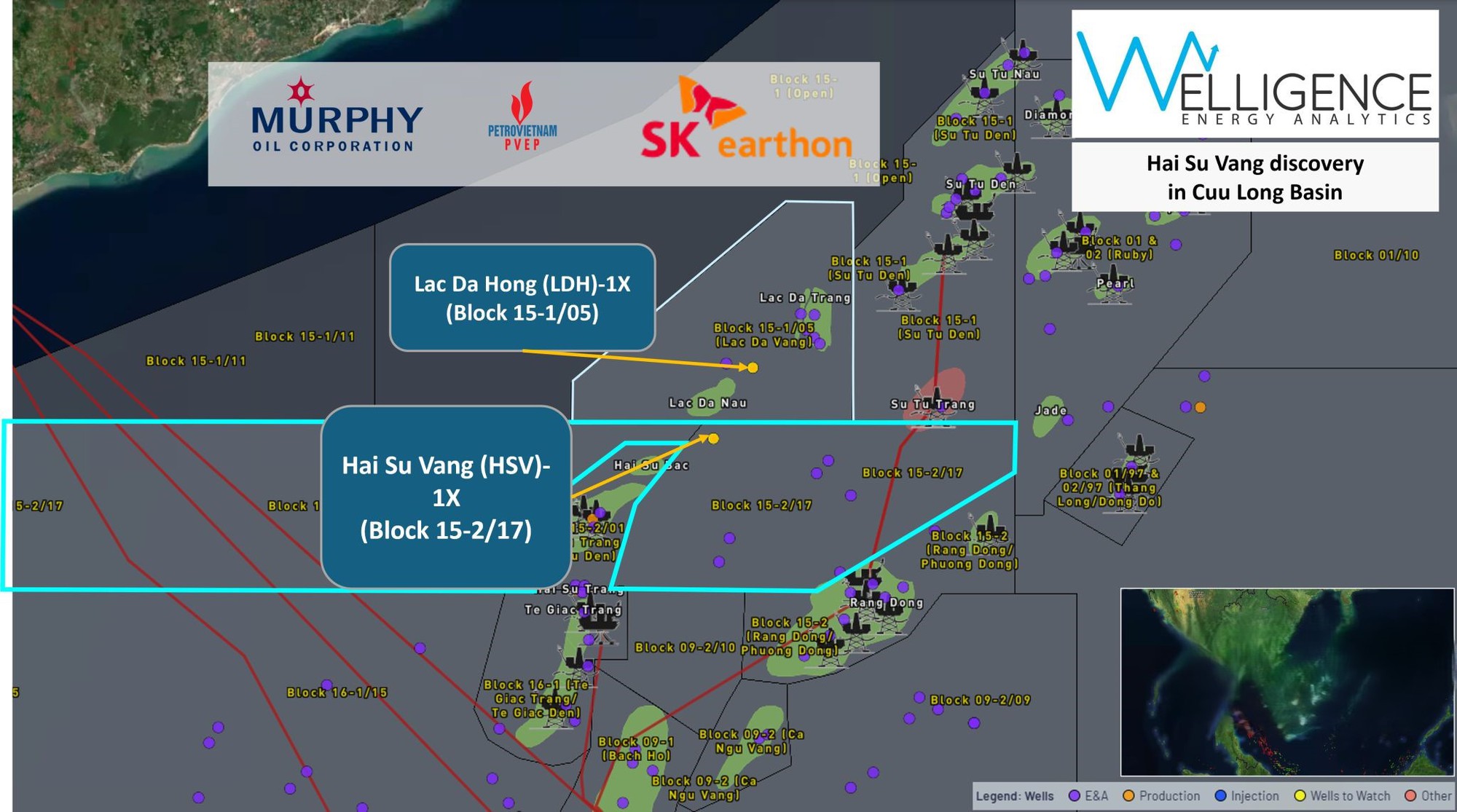

Recent exploration successes in Vietnam bolster Murphy Oil’s growth prospects. The Hai Su Vang-2X appraisal well in Block 15-2/17 (Cuu Long Basin) achieved a 6,000 bbl/day test rate, with January 2026 updates revealing recoverable reserves exceeding 430 MMBOE—significantly surpassing earlier estimates.

Despite credit rating downgrades to BB/Ba3 by S&P Global and Moody’s—driven by increased revolving credit limits ($2B from $1.35B)—Murphy Oil maintains aggressive 2026 CAPEX targets ($1.1–1.3B). The Hai Su Vang development remains central to its diversified portfolio spanning North American shale, Gulf of Mexico, and Ivory Coast assets.

Bond terms include a 3-year non-call period, with callable provisions starting February 15, 2029 at 103.25% of par, stepping down to par by 2031. Settlement is scheduled for January 23, 2026. This follows a September 2024 issuance of $600M 2032 notes at 6%, currently trading near 99% of face value.