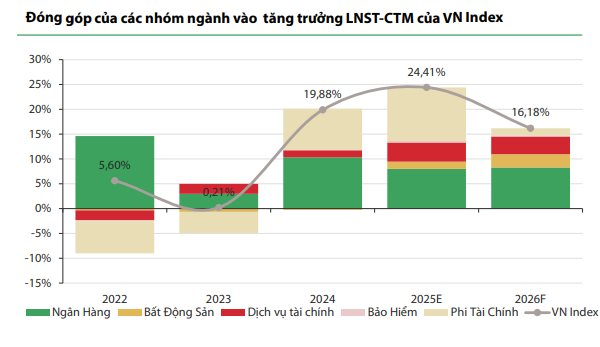

In a newly released market strategy report, Rong Viet Securities (VDSC) forecasts that 2026 will mark a shift from a market driven by “index-based valuation” to one characterized by “broad-based attractiveness.”

Specifically, profit growth will regain its leading role, while overall valuations are expected to rebalance as extreme P/E ratios in large-cap stocks adjust to reflect actual economic benefits.

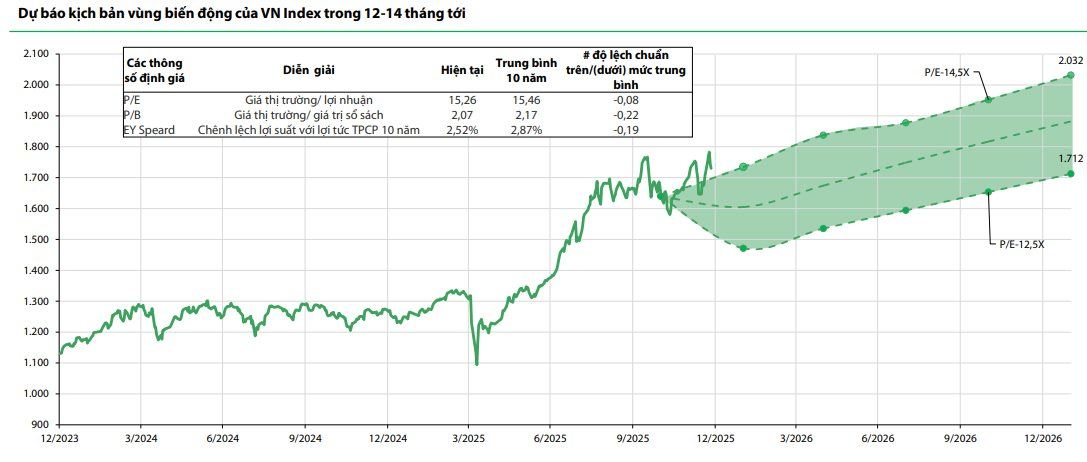

VDSC analysts project the VN-Index to target a range of 1,712 to 2,032 points over the next 12–14 months. This forecast is anchored by a 2026F EPS of approximately 137–140 dong (up 15%–19% year-on-year) and a target P/E of 12.5x–14.5x. This P/E level is more conservative than previous updates, reflecting a balance between growth momentum and macro/geopolitical risks.

Financial Sector Expected to Drive Growth

According to VDSC, the core driver will be profit expansion, supported by a high degree of consensus across various methodologies. Using a top-down approach, 2026 EPS is expected to grow by ~15.3% YoY, driven by GDP, credit, asset turnover, and profit margins. VDSC’s tracked company sample shows an average EPS growth of ~16.2% YoY, while bottom-up market consensus suggests a ~19% EPS growth.

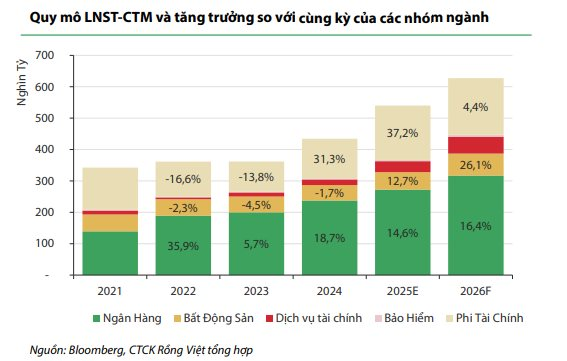

In its top-down profit outlook, VDSC highlights that the financial sector—including banking, securities, and insurance—will remain a key growth pillar. This is due to the economy’s need for substantial capital to meet investment and consumption demands.

Banks are expected to contribute significantly, with profit growth estimated at ~16.4% YoY.

Conversely, the non-financial sector is projected to see revenue growth in line with economic expansion, though profit margins may face pressure unless extraordinary income is realized. Net profit for this group is estimated to grow by ~4.4% YoY.

The real estate sector, however, is expected to outperform, with profit growth of ~26.1% YoY. This is driven by cyclical asset price increases and the resolution of legal issues over the past two years, enabling project restarts and sales in 2025, with further revenue recognition in 2026.

Ample Stock-Picking Opportunities Remain

VDSC emphasizes that current valuation metrics (P/E and P/B) are not overly stretched compared to historical averages. However, VDSC maintains a cautious margin due to (i) global policy uncertainties, (ii) interest rate and exchange rate volatility, and (iii) the risk of large-cap stocks with high P/E ratios failing to meet profit expectations.

Most stocks trade at low-to-mid P/E levels, while market capitalization is heavily concentrated in stocks with P/E >30x.

This concentration is primarily due to the VIC–VPL–VRE–VHM group, which held significant market capitalization but low profit contributions in late 2025 due to extremely high P/E ratios. This skewed the index’s P/E, distorting overall valuation perceptions. As a result, ample stock-picking opportunities exist beneath the surface.

VDSC also notes that foreign ownership on HSX is nearing a ~3-year low, despite high holdings, indicating concentrated ownership (especially in financials/banks). With the right catalysts, capital inflows could significantly improve.

Rong Viet Securities anticipates improved foreign inflows if: (1) the Fed cuts rates to ~3.25%, enhancing emerging market asset appeal by year-end; (2) foreign ownership reaches multi-year lows; and (3) Vietnam nears inclusion in the FTSE Emerging Market index, potentially triggering early-year inflows.

Additionally, the government is accelerating market transparency and infrastructure development. The 2026 regulatory framework aims to standardize, enhance transparency, and improve market operations. The CCP roadmap and upgrades (unified trading accounts, payment/settlement improvements, FOL reviews, product development) will pave the way for FTSE upgrade efforts, with operational assessments in 2026.

Circular 99/2025 marks a step toward global financial reporting standards. IFRS-aligned adjustments may not impact revenue but could slightly reduce net profit due to increased provisions and cost recognition changes, likely enhancing profit quality analysis.

Despite these drivers, VDSC identifies headwinds for 2026, including geopolitical tensions, U.S. policy uncertainty, delayed Fed rate cuts pressuring domestic rates/exchange rates, and adjustments in high-P/E large-caps with lagging profits.

Foreign Block “Pours Money” in Strong Buying Spree as VN-Index Hits Peak, Investing Over 500 Billion in a Single Banking Stock

Foreign investors’ net buying spree of VND 790 billion across the market has become a significant highlight in today’s trading session.