Saigon-Hanoi Securities Corporation (SHS) has announced a resolution by its Board of Directors regarding changes in senior leadership.

The SHS Board of Directors has issued a resolution approving the resignation of Mr. Nguyen Chi Thanh from his positions as Board Member and CEO due to personal reasons. Concurrently, the Board has appointed Mr. Nguyen Duy Linh as the new CEO. This leadership transition, including the change in the company’s legal representative, will take effect upon approval by the State Securities Commission.

This appointment is part of SHS’s strategic initiative to strengthen its executive team, enhance governance capabilities, and prepare leadership resources for the next phase of growth. This move comes as Vietnam’s securities market enters an increasingly competitive cycle, requiring brokerage firms to redefine their operational models, elevate governance standards, and improve service quality.

Profile of SHS’s New CEO

Born in 1982, Mr. Nguyen Duy Linh holds a Master of Business Administration (MBA) from Solvay Brussels School and a Bachelor’s degree in Finance, along with multiple professional certifications in financial analysis, corporate governance, leadership development, and team building.

With nearly 20 years of experience in the securities industry, Mr. Linh has held senior leadership roles at VPBank Securities (VPBankS), Mirae Asset Securities Vietnam, and SSI Securities.

Mr. Nguyen Duy Linh, New CEO of SHS.

Leveraging his extensive expertise in securities, asset management, investment banking, digital transformation, and high-performance culture, Mr. Linh is expected to further modernize SHS’s operational model, enhance transparency, prioritize customer-centricity, and bolster sustainable competitiveness in alignment with the company’s long-term strategy.

SHS Poised for Its Next Growth Phase

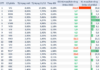

The CEO appointment comes as SHS continues to stabilize operations and refine its governance and operational frameworks to adapt to evolving market dynamics. SHS’s 2025 pre-tax profit is projected to reach VND 1,648 billion, exceeding the annual plan by 20%.

Moving forward, SHS will prioritize the execution of its strategic roadmap, focusing on upgrading its technology and trading platforms, enhancing customer experience across service channels, and embedding a customer-centric approach as the core of its “Service Branding” strategy. Simultaneously, SHS will standardize internal governance systems to improve operational efficiency and risk management. Based on this framework, SHS’s financial products and services will be tailored to meet the specific needs of diverse investor groups, emphasizing transparency, flexibility, and long-term value.

SHS is also committed to enhancing its research and investment advisory capabilities, with macro, market, and corporate reports consistently receiving positive feedback from professionals and investors. Its customer service and asset management divisions will continue to strengthen, aligning with sustainable development goals in a volatile market environment.

Beyond business operations, SHS is dedicated to advancing corporate governance standards, reinforcing compliance, internal controls, and risk management to meet the escalating demands of regulators and the market. Comprehensive human resource development and corporate culture initiatives are being implemented to support long-term growth.

The appointment of the new CEO marks a significant step in SHS’s governance enhancement efforts, ensuring leadership continuity and readiness for the next growth phase. SHS remains committed to sustainable development, creating long-term value for shareholders, customers, and partners.

SHS Welcomes New CEO, Projects 2025 Profits at Nearly 1.65 Trillion VND

SHS (HNX: SHS), a leading securities company, has appointed Mr. Nguyen Duy Linh as its new CEO, succeeding Mr. Nguyen Chi Thanh, who stepped down for personal reasons.

New State-Owned Enterprise Evaluation Rules: Profitable Firms May Still Receive Low Ratings

The new regulations shift the focus from mere profit and loss statements to a comprehensive evaluation of state-owned enterprises’ operational efficiency. This includes assessing growth quality, financial risk, and individual accountability. Even profitable companies with high debt levels or scattered investments may receive lower ratings under this stringent framework.

Shareholder Agreement: Indirect Recognition Through Beneficial Ownership Mechanisms

A shareholders’ agreement, by its very nature, is a “contract among owners” designed to establish a clear power structure within a company. While it plays a crucial role in corporate governance, it remains unaddressed in corporate law. Beginning in 2025, a notable shift occurred, marking a significant evolution in the role and recognition of shareholders’ agreements.

VPBank Suspends Issuance of VND 4 Trillion in Bonds for 2025

VPBankS has not yet implemented its plan to issue VND 4,000 billion in bonds in 2025, as there is currently no need for capital mobilization.

KIS Vietnam: 15 Years of Sustainable Growth, Aiming for Top 5 Market Position

With 15 years of operation in Vietnam, KIS Vietnam Securities Corporation (KIS Vietnam) has steadily established its position with a robust financial foundation, stable operations, and a long-term development strategy. This 15-year milestone marks a new acceleration phase, aiming to become one of the top 5 securities firms by 2030.