On the evening of January 8th, the cryptocurrency market unexpectedly reversed its trend. Data from the OKX exchange reveals that over the past 24 hours, Bitcoin dropped by nearly 2.5%, falling to the $89,950 range.

Other major cryptocurrencies also experienced declines: Ethereum fell by almost 4% to $3,090, while BNB and Solana both decreased by over 2%, reaching $884 and $133, respectively. Notably, XRP saw the most significant drop, plunging more than 7% to $2.

According to Cointelegraph, Bitcoin’s price today hit a low of approximately $89,530, reflecting investors’ cautious sentiment.

Bitcoin’s movement mirrors that of gold, as both assets cooled off after an early-year rally. The previous surge was driven by geopolitical factors, but these were insufficient to sustain a long-term upward trend.

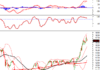

Bitcoin is trading at around $89,950. Source: OKX

Analysts suggest that Bitcoin’s retreat to test key short-term price levels is a common occurrence.

Prices may even dip below support levels, but this isn’t necessarily negative. Such adjustments are essential for balancing buying and selling pressures in the market.

Currently, Bitcoin is oscillating between $89,000 and $92,000 and may continue to trade sideways in the near term.

Experts believe that if prices decline further, the market could stabilize ahead of a new rally. Conversely, maintaining the current range suggests that a short-term bottom may already be in place.

Over 54.6% of cryptocurrency investors are in the red

According to the Vietnam Crypto Market Report 2025 by Kyros Ventures, Coin68, and BingX, 54.6% of Vietnamese investors reported losses in the past year.

This figure not only highlights the increasing volatility and risks in the digital asset market but also exposes inherent weaknesses in individual investment behaviors. These include a tendency to chase trends, lack of risk management discipline, and overreliance on short-term expectations.

Survey data indicates that 88% of Vietnamese cryptocurrency investors are under 35, an 11 percentage point increase from 2024.

Most of these investors have been in the market for 2–3 years, long enough to experience at least one major market cycle. However, this seemingly experienced group suffered the most significant losses in 2025.

A common issue is that many young investors entered the market when prices were already high, driven by fear of missing out or community trends rather than a clear strategy.

The lack of risk management discipline led many to allocate over 50% of their portfolios to digital assets, making price fluctuations a direct shock when the market turned.

Conversely, investors who kept their crypto exposure below 25% of their total portfolio achieved significantly better returns.

This reality underscores that in a highly volatile market like crypto, disciplined capital allocation can be as crucial as selecting promising assets.

Income levels also sharply divide investment outcomes. Investors earning between $1,000 and $3,200 monthly saw a 55% profit rate, while those earning over $3,200 achieved a 73% profit rate.

Financial stability allows higher-income investors to withstand market downturns and avoid short-term panic selling.

Venezuela’s Shocking Announcement Rocks Bitcoin: Today’s Crypto Market Update (Jan 3)

Should tensions between Venezuela and the United States fail to escalate further, Bitcoin could soon rebound, targeting the $96,000 to $100,000 range in the coming period.

Prime Minister Urges Ministry of Finance to Pilot Crypto Asset Market Licensing for Businesses by November 15

At the Financial Sector Year-End Conference on the afternoon of January 6th, Prime Minister Pham Minh Chinh not only emphasized the need to “turn the tide” in public investment disbursement but also provided specific directives to the Ministry of Finance. He urged the ministry to pilot a Sandbox mechanism for digital assets within the first half of January 2026.

Exposing the Dark Side: Shark Tank Vietnam’s ‘Sharks’ Accused of Fraud and Tax Evasion

Over the past decade of broadcasting, approximately 20 “sharks” have graced the hot seat on Shark Tank Vietnam. Shockingly, several of these high-profile investors, including Shark Thủy, Shark Tam, and Shark Bình, have faced legal repercussions, including prosecution and imprisonment, for fraud and tax evasion.