Singapore’s UOB Bank, citing data from Vietnam’s General Statistics Office, reports that Vietnam’s GDP grew by 8.46% year-on-year in Q4 2025, surpassing the 8.25% growth in Q3 2025. This robust performance is attributed to resilient export and manufacturing activities, despite the impact of U.S. tariffs.

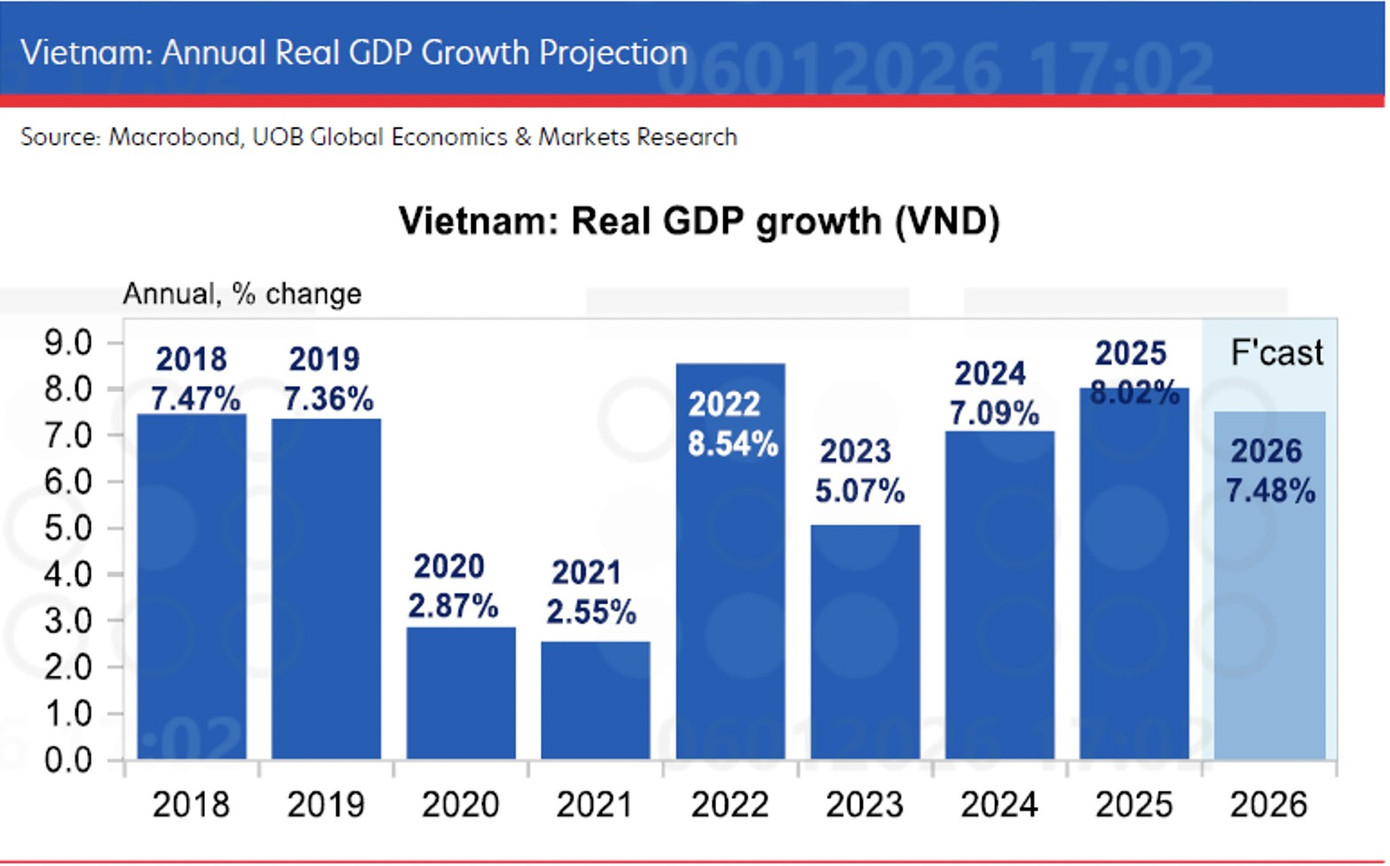

This growth outpaced Bloomberg’s forecast of 7.7% and UOB’s own prediction of 7.2%, marking the strongest quarterly expansion since 2009, excluding COVID-19 fluctuations. For the full year 2025, Vietnam’s economy grew by 8%, exceeding UOB’s forecast of 7.7%.

UOB revises 2026 growth forecast upward to 7.5%.

The primary driver of this Q4 2025 surge was export activity, which rose by 19% year-on-year, defying tariff challenges. Total export turnover for 2025 reached a record $473 billion, up from approximately $400 billion in 2024.

Suan Teck Kin, Managing Director of Global Markets and Economics Research at UOB Singapore, noted that other economic indicators from the quarter further dispel concerns about the impact of U.S. tariffs. Foreign investor confidence remains strong, with registered FDI reaching $38.4 billion in 2025.

Alongside trade and business activities, international tourist arrivals in Vietnam surged by 20%, hitting a record 21.17 million in 2025, surpassing the previous record of 18 million in 2019.

Suan Teck Kin emphasized that Vietnam’s economy demonstrated exceptional resilience in 2025, despite U.S. tariff pressures. With an 8% growth rate, Vietnam enters 2026 on solid footing, showcasing its economic robustness.

“We have revised our 2026 growth forecast upward to 7.5% from 7%, reflecting the economy’s resilience, momentum, and positive outlook. However, high statistical bases, potential export slowdowns after previous surges, and U.S. tariff policy uncertainties pose risks to sustained growth,” Suan Teck Kin stated.

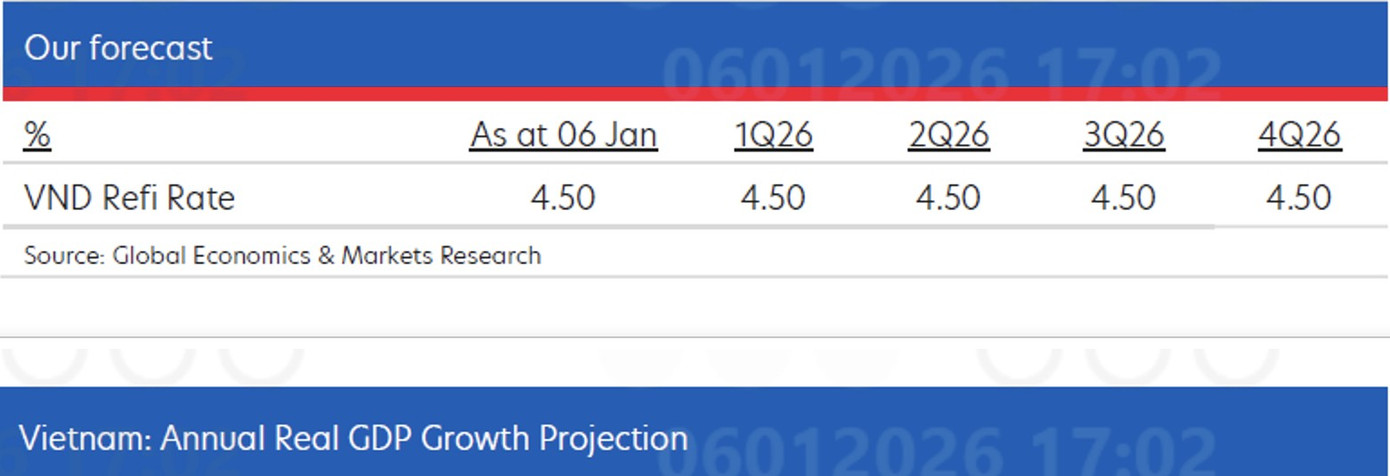

Given the strong 2025 performance and optimistic 2026 outlook, the State Bank of Vietnam has limited room to ease policies at this juncture.

Meanwhile, inflationary pressures persist, with 2025 average inflation at 3.2% (headline) and 3.3% (core, excluding food and energy), compared to 3.6% and 2.85% in 2024. Healthcare and education costs remain key drivers of higher inflation, though trends have stabilized somewhat.

UOB expects the State Bank to maintain the refinancing rate at 4.5% throughout 2026.

The foreign exchange market is another critical factor for the State Bank. The Vietnamese Dong was the third-worst performing Asian currency in 2025, depreciating by 3.1% against the USD, trailing only the Indian Rupee (4.8%) and Indonesian Rupiah (3.5%), but outperforming the Philippine Peso.

In contrast, regional currencies benefited from a weakening USD, with gains ranging from 10% for the Malaysian Ringgit to 0.3% for the Japanese Yen. Based on these factors, UOB anticipates the State Bank will hold the refinancing rate steady at 4.5% throughout 2026.

UOB Revises Vietnam’s 2026 GDP Growth Forecast to 7.5%

UOB’s latest report, authored by Suan Teck Kin, Global Head of Market and Economic Research at UOB Singapore, has revised Vietnam’s economic growth forecast for 2026 upward to 7.5%.