I. MARKET TRENDS IN WARRANTS

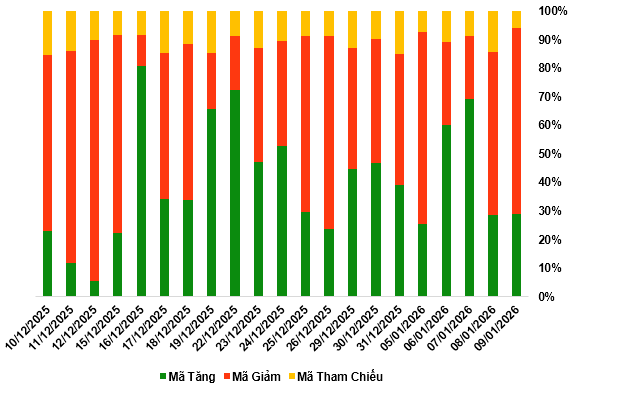

By the close of trading on January 9, 2026, the market saw 71 gainers, 159 decliners, and 15 unchanged stocks.

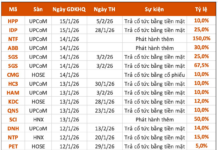

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

Source: VietstockFinance

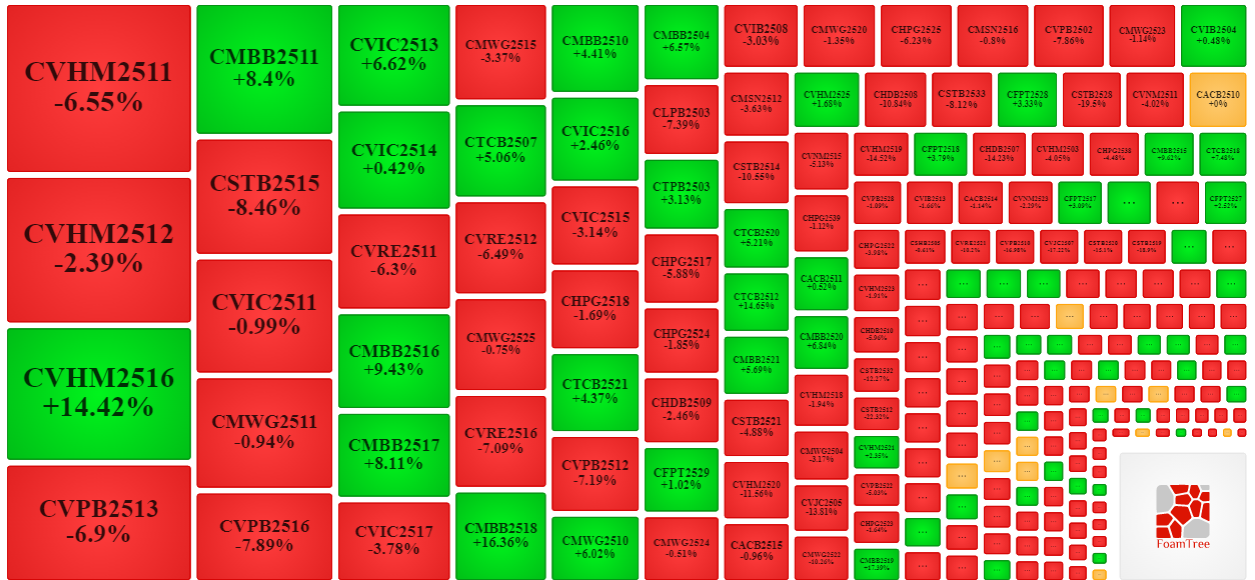

During the January 9, 2025 session, sellers dominated the market, driving down prices for most warrant codes. Notably, the major warrant codes in the declining group were CVHM2511, CVHM2512, CVPB2513, CSTB2515, and CVIC2511.

Source: VietstockFinance

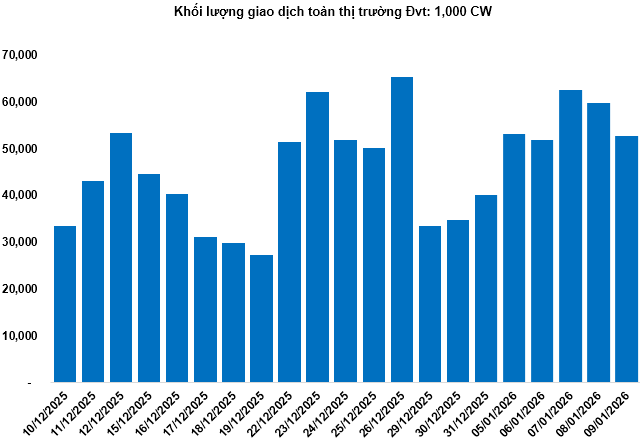

Total market volume on January 9 reached 52.77 million CW, down 11.73%; trading value hit 94.97 billion VND, a 29.3% decrease compared to January 8. Among these, CSTB2528 led the market in both volume and trading value, with a total volume of 3.47 million CW, equivalent to 5.75 billion VND.

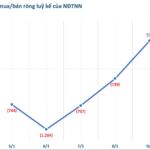

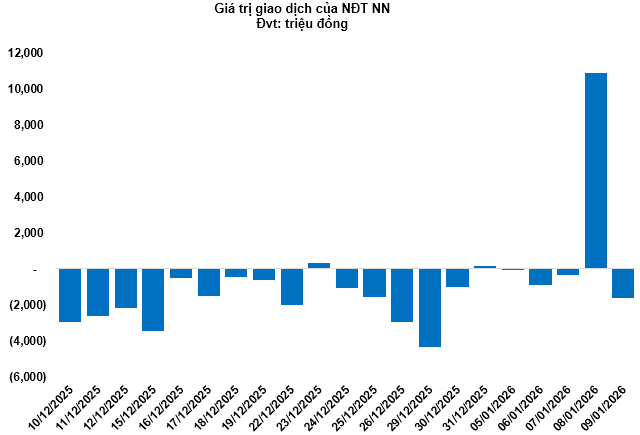

Foreign investors resumed net selling on January 9, with a total net sell-off of 1.66 billion VND. CFPT2525 and CMWG2511 were the two most heavily net-sold codes. For the week, foreign investors net bought over 7.84 billion VND.

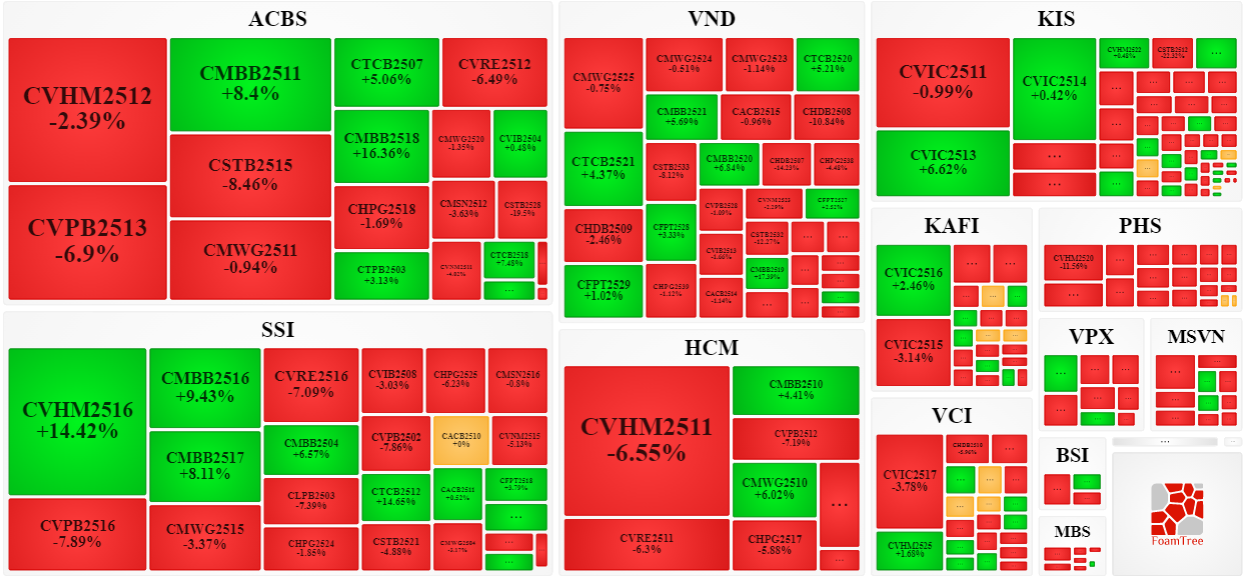

Securities companies ACBS, VND, KIS, and SSI are currently the issuers with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

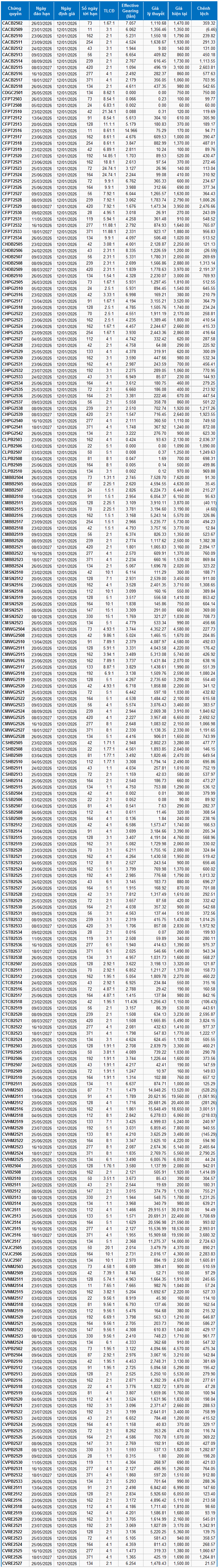

III. WARRANT VALUATION

Based on the valuation method appropriate as of the starting date of January 12, 2026, the fair prices of warrants currently trading on the market are as follows:

Source: VietstockFinance

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to align with the Vietnamese market. Specifically, the risk-free treasury bill rate (Government Treasury Bill) is replaced by the average deposit rate of major banks, with maturity adjustments suitable for each type of warrant.

According to the above valuation, CVHM2511 and CVHM2503 are currently the two most attractively priced warrant codes.

Warrant codes with higher effective gearing will experience greater fluctuations in response to underlying securities. Currently, CFPT2516 and CTCB2518 are the two warrant codes with the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 17:58 January 11, 2026

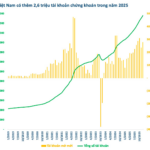

Foreign Block “Pours Money In” with Strong Buying in First Week of 2026, Investing Over 500 Billion in a Bank Stock

Foreign investors initially sold off at the beginning of the week but returned to net buying by the end of the week.

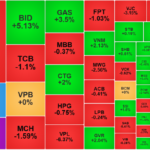

January 9th Stock Market Recap: VN-Index Surges Over 12 Points, Real Estate Stocks Face Sell-Off

The VN-Index’s upward momentum in the recent session was almost entirely reliant on the performance of state-backed blue-chip stocks, which played a pivotal role in driving the market’s gains.