Mrs. Tran Thi Ngoc Lien, Deputy Director of the State Bank’s Branch in Zone 2, advised in an interview with Nguoi Lao Dong Newspaper regarding the new regulations under Decree 340/2025/NĐ-CP on administrative penalties in the monetary and banking sectors, effective from January 9th.

According to Decree 340/2025, authorities will issue a warning for transactions under 1,000 USD when individuals exchange foreign currency with each other or at unauthorized organizations, also known as free market (black market) transactions.

For transactions from 1,000 to under 10,000 USD, the fine ranges from 10 to 20 million VND; for transactions from 10,000 to under 100,000 USD, the fine is 20-30 million VND; and for transactions of 100,000 USD and above, the fine is 80-100 million VND.

Additionally, these violations may result in supplementary penalties, including the confiscation of foreign currency or VND in specific cases.

Mrs. Tran Thi Ngoc Lien emphasized that individuals must conduct cash foreign currency transactions in compliance with foreign exchange regulations and other relevant laws.

Individuals with cash foreign currency needs should transact at authorized credit institutions, foreign bank branches, or licensed foreign exchange agents certified by the State Bank.

Official foreign exchange points display regulated signage. Photo: Thy Tho

Licensed foreign exchange agents can only purchase foreign currency from individuals using VND and are not permitted to sell foreign currency to individuals in exchange for VND (except for authorized agents in international border isolation areas, who may sell foreign currency to foreign passport holders upon departure as regulated).

During transactions, individuals must provide appropriate documents and evidence as guided by authorized credit institutions and foreign exchange agents to ensure compliance with legal purposes and regulations. Individuals will receive complete transaction receipts and invoices to protect their rights and minimize risks.

“All licensed foreign exchange agents display signage indicating their authorization by credit institutions and their agent name at the exchange counter. Therefore, individuals with legitimate foreign currency needs should contact authorized credit institutions and agents in their area for guidance and services in accordance with regulations. Avoid illegal free market transactions, which carry inherent risks,” Mrs. Ngoc Lien advised.

Legitimate Foreign Currency Needs

Under Article 7 of Decree 70/2014/NĐ-CP, which details the implementation of the Foreign Exchange Ordinance and its amendments, Vietnamese residents may purchase, transfer, and carry foreign currency abroad as regulated by the State Bank for specific purposes.

These purposes include studying and receiving medical treatment abroad; business trips, tourism, and visits abroad; payment of fees and charges to foreign entities; financial support for relatives abroad; inheritance transfers to beneficiaries abroad; one-way transfers for settlement abroad; and other legitimate needs.

“These legitimate foreign currency needs must be fulfilled through authorized credit institutions. Within their available foreign currency capacity, these institutions are responsible for meeting residents’ needs for the aforementioned transactions based on actual and reasonable requirements,” Mrs. Ngoc Lien added.

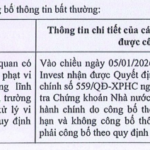

Two Individuals Manipulate SJS Stock Using 26 Accounts, Driving Prices Up 60% Without Illegal Profits

Two individuals manipulating SJS stock prices have been fined VND 1.5 billion each, banned from securities trading, and prohibited from holding positions at securities companies, investment fund management companies, branches of foreign securities and fund management companies in Vietnam, and securities investment companies for two years starting January 10, 2026.

Kita Invest Stuns with Nearly Sixfold Capital Increase to 6.650 Trillion

Just days before the end of 2025, Kita Invest stunned the market by dramatically increasing its chartered capital from 1.15 trillion VND to 6.65 trillion VND on December 25, 2025.