Illustrative Image

China’s independent refineries are gearing up to increase crude oil purchases from Iran, as supply disruptions from Venezuela persist. This shift could significantly alter the flow of affordable crude into the world’s largest oil-importing market.

According to traders and market analysts, crude oil loading activities at Venezuela’s key ports have virtually halted since early January. This follows an agreement between Caracas and Washington allowing Venezuela to export up to $2 billion worth of oil to the U.S. Consequently, the volume of oil allocated for Asia, particularly China, has sharply declined.

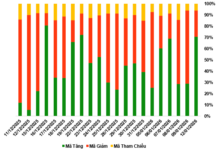

In 2025, China imported an average of approximately 389,000 barrels of oil daily from Venezuela, accounting for about 4% of its total seaborne crude imports. A significant portion of this was consumed by independent refineries, which heavily rely on heavy, low-cost oil from sanctioned nations.

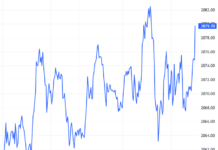

Data from Kpler reveals that at least 10 tankers loaded with Venezuelan crude in December departed early in January, carrying roughly 12 million barrels of oil and fuel products. This shipment is en route to Asia and may help China sustain its short-term supply. Amid these developments, Iranian crude has emerged as the most cost-effective alternative. Traders report that Iran’s heavy oil is currently offered at a discount of approximately $10 per barrel compared to Brent, with ample availability.

Beyond sanctioned sources, China may also boost oil imports from non-restricted countries such as Canada, Brazil, Iraq, and Colombia. Notably, Canadian crude prices for exports via the Trans Mountain pipeline, including Cold Lake and Access Western Blend, have dropped significantly this week, trading at a $4–5 discount per barrel to April Brent futures, amid expectations of weakening U.S. demand.

Traders in Singapore indicate that Chinese refineries might also consider heavy crude varieties from the Middle East, such as Iraq’s Basrah, to offset the shortfall from Venezuela. In the medium term, this shift could elevate the role of sanctioned oil exporters in China’s energy import structure.

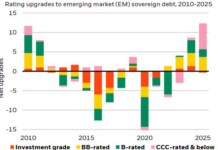

According to Reuters, Iran’s crude oil exports in 2025 rebounded to their highest level in seven years, despite prolonged U.S. sanctions, primarily driven by China’s demand for affordable oil. Commodity analytics firm Kpler reports that Iranian crude shipments reached approximately 1.67 million barrels per day, a 5% increase from 2024 and the highest since Washington reimposed sanctions in 2018.

Source: Reuters

China Investigates Imported Goods from Japan

China has announced the initiation of an anti-dumping investigation into imported dichlorosilane from Japan.

China Strikes Back: Immediate Ban on Rare Earth Exports to Japan Imposed

Should China extend its ban for approximately one year, estimates suggest Japan could face a potential loss of half a percentage point in GDP.