The stock market is undeniably alluring, offering lucrative opportunities for profit. However, it’s also a realm where volatility, losses, and poor decisions can leave even seasoned investors feeling overwhelmed. For those deeply entrenched in the market, the stress, tension, and sleepless nights often become an inescapable reality.

At the 2026 Asset Management Seminar hosted by FIDT Asset Management and Investment Consulting Company in Hanoi on January 11th, Mr. Huynh Minh Tuan, founder of FIDT, candidly remarked that stock market investing is inherently stressful. Among global markets, Vietnam’s stands out as one of the most pressure-inducing for investors.

“Simply contemplating how to invest in stocks without the headache is enough to give me a headache,” Mr. Tuan admitted.

With over 22 years of market experience and having weathered countless market cycles, Mr. Tuan asserts that eliminating stress entirely is nearly impossible. The stock market is influenced by countless variables, and Vietnam’s high beta coefficient and speculative nature amplify these challenges. While there’s no foolproof formula to avoid stress, adopting a long-term strategy and understanding economic cycles can mitigate pressure and enhance returns.

Mr. Tuan highlights a pervasive issue in Vietnam: most investors aspire to become experts without formal training, leading to fundamental errors. Many confuse asset management, wealth management, and financial advisory services. Through years of working with tens of thousands of clients, he’s observed a common mistake: investors often ask the wrong questions, such as, “Are there any stocks that can yield 30% returns for Tet?” Given Vietnam’s 8% GDP growth and rising interest rates, such expectations are unrealistic.

Approaching the market unprofessionally and misaligning one’s role often results in prolonged stress. Consequently, many investors exit the market within two years due to losses. They may then earn profits elsewhere and return to stocks with a short-term mindset, perpetuating a cycle of failure and eventual market abandonment.

Mr. Tuan believes that with a disciplined approach, investors can consistently outperform bank interest rates. However, achieving superior results requires a personalized strategy. A critical step is assessing one’s financial health and risk tolerance. Investors uncomfortable with volatility should opt for fixed-income products or savings accounts to maintain peace of mind. True investment success comes from aligning strategies with one’s emotional and financial capacity.

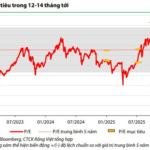

Looking ahead to 2026, Mr. Tuan is optimistic, predicting the VN-Index could surpass 2,000 points. He advises focusing on companies with strong financials, low debt, and robust cash reserves, particularly state-owned enterprises benefiting from Decree 79. Sectors like energy, banking, and infrastructure are also poised for growth.

Foreign Block “Pours Money In” with Strong Buying in First Week of 2026, Investing Over 500 Billion in a Bank Stock

Foreign investors initially sold off at the beginning of the week but returned to net buying by the end of the week.

VN-Index Officially Surpasses the 1,800-Point Milestone

The first trading week of the new year saw the VN-Index officially surpassing the 1,800-point milestone on January 6th, followed by a series of new highs. Despite an unexpected correction on January 8th and a capital outflow from the real estate sector in the subsequent session, the index continued its upward trajectory, closing the week at a new peak of 1,867 points.