I. MARKET TRENDS IN WARRANTS

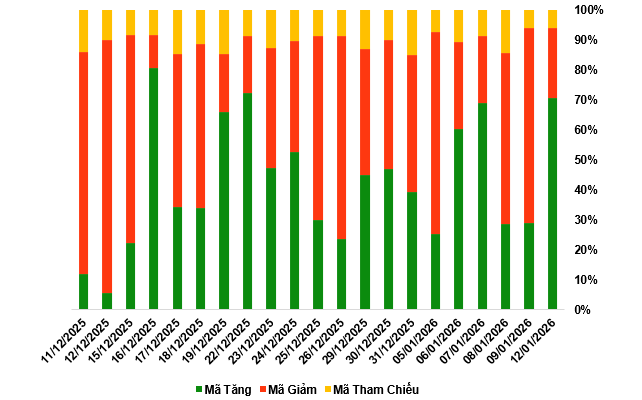

By the end of the trading session on January 12, 2026, the market saw 173 gainers, 57 decliners, and 15 unchanged securities.

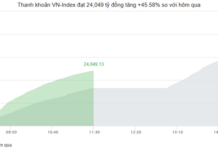

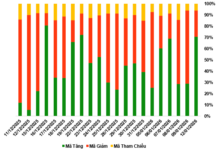

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

During the January 12, 2026 trading session, buyers regained control, driving most warrant prices higher. Notable gainers included CVPB2513, CMBB2511, CSTB2515, and CMWG2511.

Source: VietstockFinance

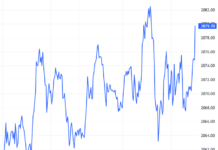

Total market volume on January 12 reached 61.52 million warrants, up 16.58%; trading value hit 131.54 billion VND, a 38.5% increase from January 9. CTCB2518 led in volume with 3.18 million warrants, while CVPB2513 topped trading value at 8.74 billion VND.

Foreign investors continued net selling on January 12, totaling 805.37 million VND. CFPT2525 and CMWG2521 saw the highest net outflows.

Securities firms HCM, SSI, KIS, and ACBS currently issue the most warrants in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from January 13, 2026, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturities.

According to this valuation, CVHM2512 and CTCB2518 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CFPT2516 and CVNM2517 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 January 12, 2026

Warrant Market Outlook for January 12-16, 2026: Short-Term Prospects Deteriorating

At the close of trading on January 9, 2026, the market saw 71 stocks rise, 159 fall, and 15 remain unchanged. Foreign investors resumed net selling, with a total net sell-off of 1.66 billion VND.

January 8, 2026: Warrant Market Rallies Alongside Underlying Market

At the close of trading on January 7, 2026, the market saw 178 stocks rise, 59 fall, and 21 remain unchanged. Foreign investors continued their net selling streak, offloading a total of VND 367.7 million.