The Ho Chi Minh City Stock Exchange (HSX) is set to announce the new constituent stocks for the VN30 and VNFin Lead indices on January 21 and January 19, 2026, respectively, with the official effective date from February 2, 2026. Consequently, ETFs tracking these indices will rebalance their portfolios between January 26 and January 30, 2026.

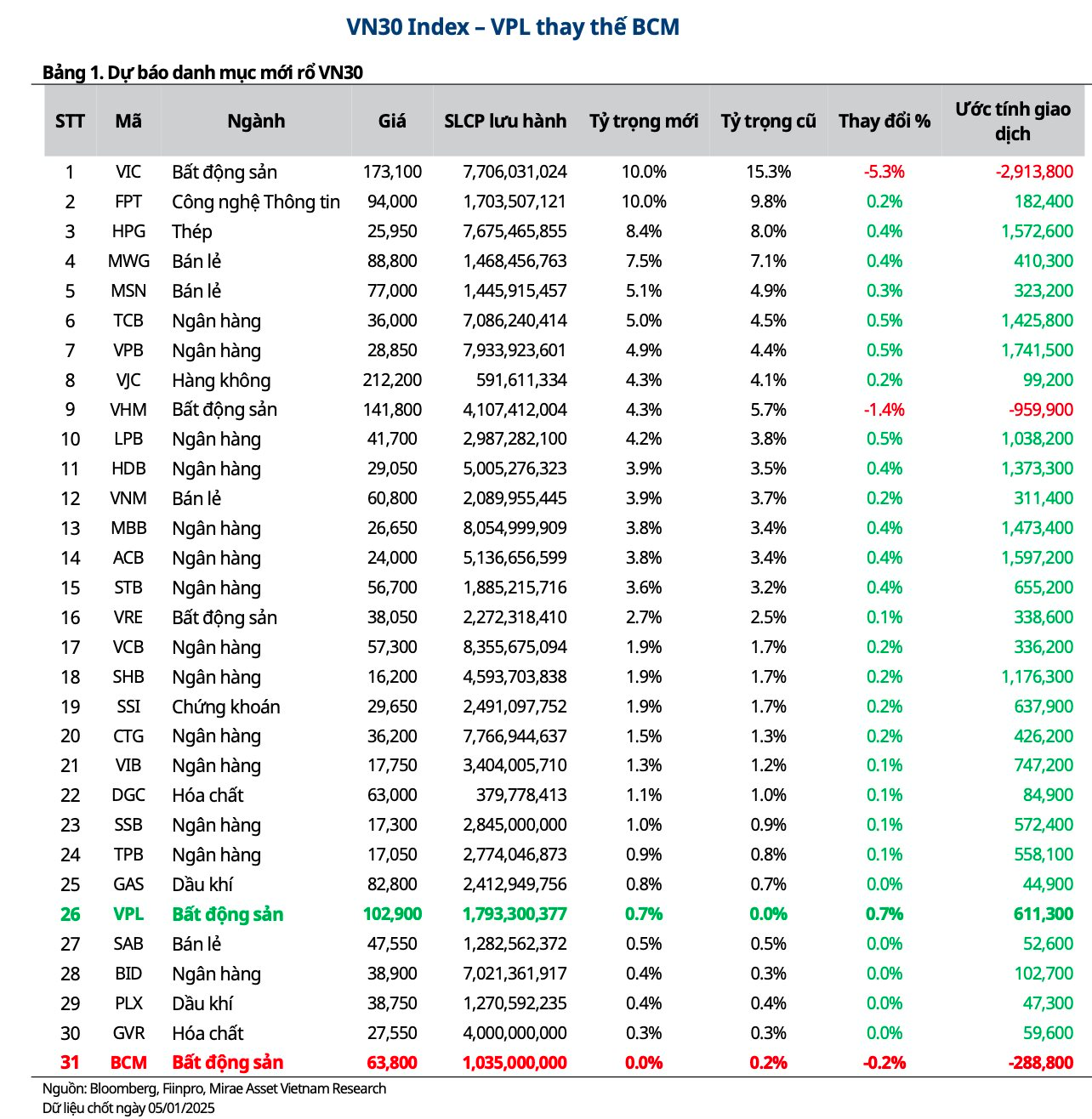

In a recent forecast, Mirae Asset Securities predicts that VPL shares are likely to be added to the VN30 index, replacing BCM in the upcoming adjustment. Based on Mirae Asset Securities’ capitalization estimates, VPL is expected to rank among the top 20 largest-cap stocks, while BCM is anticipated to be removed due to failing to meet the minimum trading value criteria.

As of December 31, 2025, VPL’s market capitalization is estimated at VND 154,691 billion, ranking 11th overall and meeting the six-month listing requirement since its official debut in May 2025. Conversely, BCM—similar to the previously delisted BVH—is projected to have an average daily matched trading value of only VND 26.8 billion, falling short of the VND 30 billion threshold.

Under this scenario, ETFs are expected to purchase over 600,000 VPL shares during the rebalancing period, representing approximately 0.7% of their portfolios. This allocation is constrained by the index’s sector composition and the 15% maximum weight cap for individual securities.

Conversely, VIC and VHM are likely to see significant weight reductions due to their recent strong performance and substantial contributions to the index’s gains. Post-rebalancing, the top-weighted VN30 constituents will remain FPT (10.0%), VIC (8.7%), HPG (8.5%), TCB (7.1%), and MWG (6.4%), collectively accounting for over 40% of the index’s capitalization.

For VN30-tracking ETFs—E1VFVN30, FUEMAV30, FUEKIV30, and FUESSV30—approximately 2.9 million VIC shares are expected to be sold, while around 1.7 million VPB shares will be purchased during this rebalancing cycle.

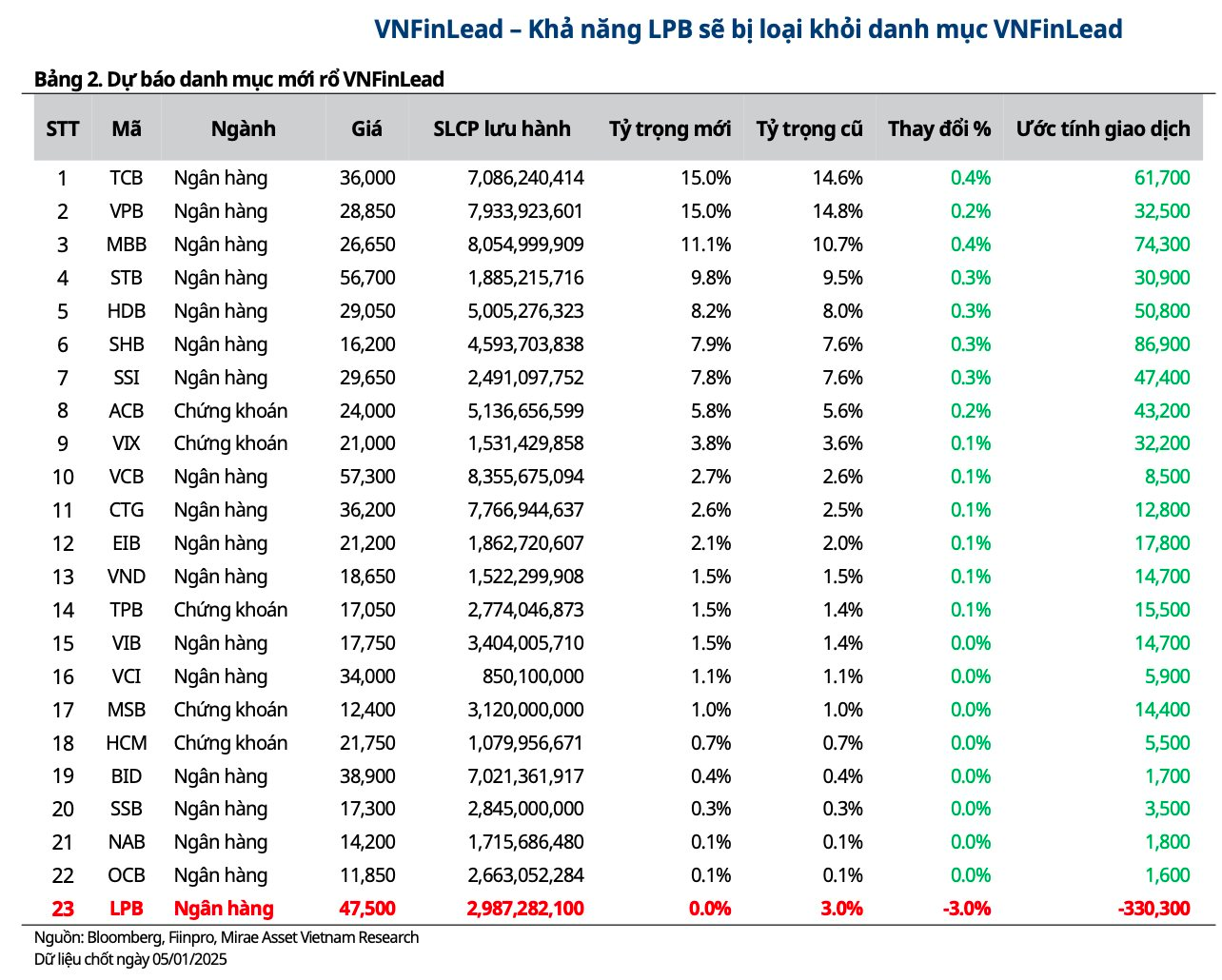

Regarding the VNFin Lead index, LPB is likely to be removed due to insufficient liquidity. Specifically, LPB’s current turnover ratio stands at 0.09%, below the 0.1% minimum requirement. LPB’s exclusion is highly probable in the Q1 2025 rebalancing. Data indicates no new additions outside the current basket, as most candidates fail the liquidity screening.

LPB’s removal will reduce the VNFin Lead constituents to 22 stocks, comprising 17 banks and 5 securities firms. The index’s largest weights are currently TCB (15%), VPB (15%), and MBB (11.1%).

Global Top Funds Rush to Buy Silver: Bank of America Predicts Stunning Price Surge

Silver may present a more enticing opportunity for investors willing to embrace higher risk in pursuit of greater returns, according to BofA experts. Historical trends suggest silver prices could potentially peak between $135 and $309.

Stock Market Nears All-Time High

The trading session on December 22nd was notably vibrant, with the VN-Index surging by 46 points, nearing its historic peak of 1,760. Investor sentiment rebounded as capital flowed back into the market, primarily targeting large-cap stocks. Among these, banking and real estate sectors emerged as the key drivers of the rally.