In pursuit of Vietnam’s socio-economic development goals and the 2026 monetary policy objectives, the State Bank of Vietnam (SBV) has outlined its credit policy and credit growth strategy for the year. This strategy introduces innovative adjustments to align with market dynamics, capital supply and demand, and banking safety, while ensuring the effective implementation of monetary policy and meeting the economy’s capital needs.

The SBV continues to empower credit institutions (CIs) to proactively manage their credit operations and expand credit growth in accordance with their financial capacity, capital scale, operational efficiency, and banking safety. CIs are expected to control credit growth based on targets set by the SBV at the beginning of the year, derived from 2025 credit balances, credit ratings, and other relevant factors.

According to Mr. Nguyen Duc Lenh, Deputy Director of SBV Branch in Zone 2, a key innovation in the 2026 credit growth management is the SBV’s proactive role in reviewing and adjusting CIs’ credit growth targets as needed, without requiring formal requests from the institutions.

This flexible approach to credit growth targets marks a significant shift in the SBV’s credit and monetary policy management. By setting initial credit targets early in the year, CIs can plan their lending and capital mobilization activities effectively. The SBV will monitor market conditions, economic growth, macroeconomic trends, inflation, and other relevant factors to adjust its monetary and credit policies, ensuring the fulfillment of monetary policy objectives and market stability, while maintaining banking safety. This flexible management of overall credit targets aims to maximize the effectiveness of monetary policy and satisfy the economy’s capital demands.

Credit growth is closely tied to capital utilization efficiency and economic growth support. The SBV emphasizes the role of credit in fostering business production and economic growth drivers, ensuring that credit is directed towards productive sectors. This focus aims to enhance capital efficiency and absorption capacity, facilitating safe and efficient capital circulation within the banking system. Adherence to credit activity regulations and the pursuit of safe, efficient credit growth will be central to each CI’s expansion strategy, significantly contributing to the banking sector’s role in economic growth and development.

Mr. Lenh highlights these innovations in credit policy management and the SBV’s guidance on credit growth for CIs, as outlined in Document 11686/NHNN-CSTT. Effective implementation of this document and compliance with credit and banking regulations by CIs will be crucial in achieving the objectives of SBV Governor’s Directive 01 on monetary, credit, and banking tasks for 2026.

– 16:34 12/01/2026

Key Highlights in the Regulation of Banking System Liquidity for 2025

In 2024, the State Bank of Vietnam proactively employed a flexible approach, utilizing both injection and withdrawal operations through treasury bills and the OMO’s outright purchase channel to stabilize exchange rates while balancing systemic liquidity. By 2025, however, the operational strategy underwent a notable shift.

Small Businesses to Resume Bank Deposits as They Adapt to New Regulations

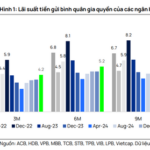

Vietcap believes that the current pressure to raise deposit interest rates remains manageable, and the absolute interest rate levels generally continue to provide support. In the medium term, system liquidity and capital sources are expected to be sustained by four key factors.

Central Bank Narrows Net Injection Scale

During the week of December 8–15, 2025, the State Bank of Vietnam (SBV) continued its net injection streak for the ninth consecutive week to support system liquidity. However, the scale of net injection significantly narrowed, dropping over 87% compared to the previous week and marking the lowest level in the past six weeks.

Central Bank’s Move Signals Potential Start of Interest Rate Hike Cycle, Experts Say

According to Mr. Trần Ngọc Báu, the State Bank of Vietnam’s (SBV) decision to raise the OMO interest rate by 0.5 percentage points could be seen as the first signal foreshadowing a policy rate hike cycle.