Thượng Đình Paper JSC (UpCOM: GTD) has announced that Ms. Mai Huyền Trang has become a major shareholder after acquiring 6,385,800 shares, representing 68.67% of the company’s charter capital. Prior to the transaction, Ms. Trang held no shares in the company.

The shares were purchased from a public auction of 6,385,867 shares owned by the Hanoi People’s Committee. According to the auction results, two investors successfully bid, with the highest bid at VND 216,000 per share and the lowest at VND 134,000 per share. The average successful bid was VND 215,999 per share.

The Hanoi People’s Committee is estimated to have earned over VND 1,379 billion from the divestment. Ms. Mai Huyền Trang also invested approximately VND 1,379 billion.

Meanwhile, on the stock market, GTD shares closed at VND 87,000 per share on January 9th, a 54% increase from the previous month. Based on market value, Ms. Trang’s holdings are worth over VND 555 billion, resulting in a temporary loss of VND 824 billion.

Established in 1957 as Workshop X30 under the Military Supply Department, Thượng Đình initially produced hard hats and rubber sandals for the military. The company transformed into a Joint Stock Company on July 19, 2016, and listed 9.3 million shares on the UPCoM under the code GTD on December 16, 2016.

Headquartered at 277 Nguyen Trai Street, Thanh Xuan District, Hanoi, Thượng Đình has expanded its exports to the EU, Australia, and several Asian countries over its 60-year history. However, in recent years, the influx of global brands like Adidas, Puma, and Nike has intensified competition, significantly challenging local brands like Thượng Đình.

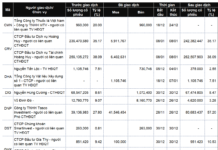

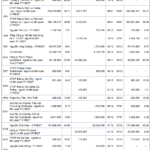

According to the 2024 audited financial report, Thượng Đình’s revenue dropped to VND 78.8 billion, the lowest in a decade. Rising production costs led to a net loss of nearly VND 13 billion, more than double the 2023 loss. Accumulated losses now exceed VND 67 billion.

One notable asset is Thượng Đình’s 36,105 m² land plot at 277 Nguyen Trai, Hanoi. This prime location, with extensive frontage on Nguyen Trai Street, is earmarked for relocation under Hanoi’s urban planning policy.

Hanoi Approves Land Use Conversion for SRC’s VND 18.6 Trillion Sao Vang – Hoanh Son Complex

The Sao Vang – Hoanh Son Commercial and Residential Complex, spanning over 6.2 hectares in Khuong Dinh Ward, boasts a total investment of nearly 18.6 trillion VND. This ambitious project is set to reach a maximum height of 50 floors and is slated for completion by 2031.