I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON JANUARY 12, 2026

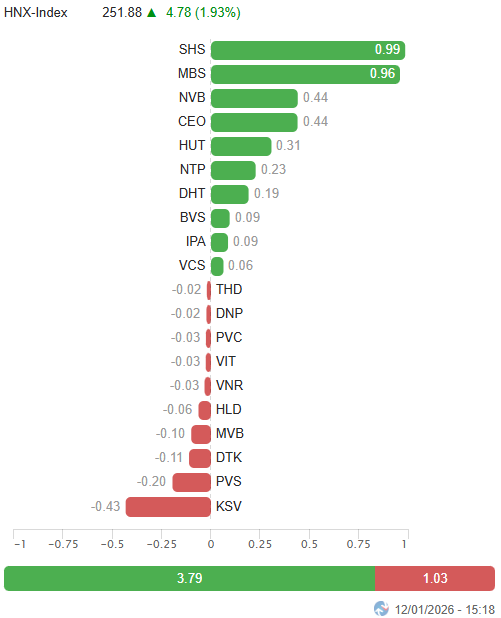

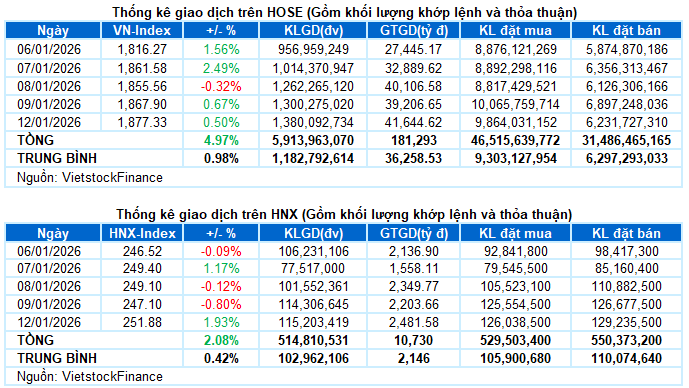

– Major indices unanimously rose during the January 12 trading session. The VN-Index increased by 0.5%, reaching 1,877.33 points, while the HNX-Index surged by 1.93%, closing at 251.88 points.

– Trading volume on the HOSE floor rose by 8.5%, exceeding 1.3 billion units. The HNX floor recorded over 110 million matched units, a slight 1.9% increase compared to the previous session.

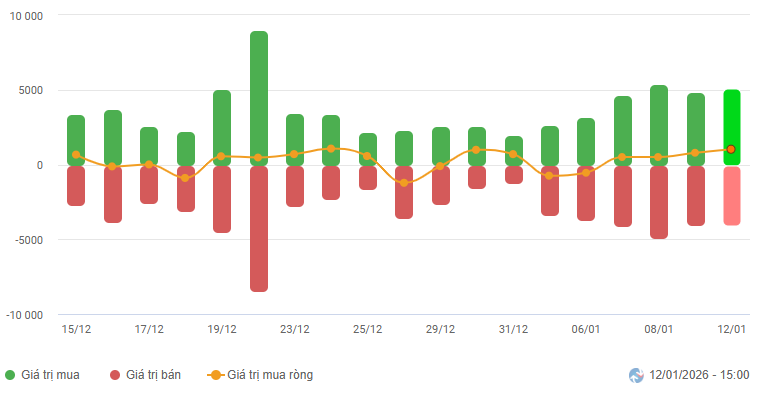

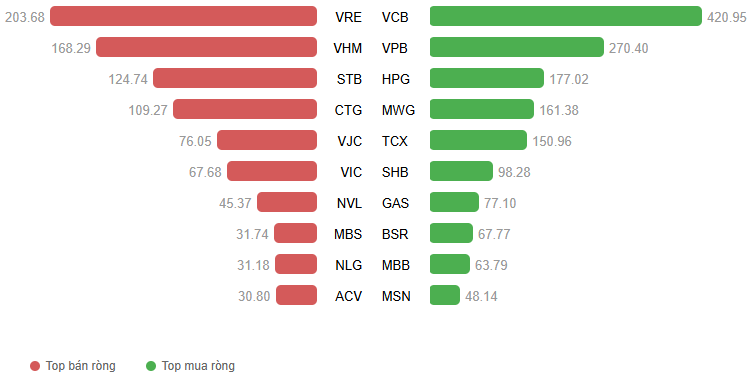

– Foreign investors continued to net buy with a value of nearly VND 988 billion on the HOSE floor, while slightly net selling VND 13 billion on the HNX floor.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– Continuing the upward momentum from the previous week, the market remained vibrant on January 12. From the opening session, widespread buying pressure across various sectors quickly propelled the VN-Index to nearly touch the 1,890-point mark within just over half an hour. Although the upward trend later narrowed significantly due to counter-pressure from Vingroup’s major stocks, the overall market sentiment remained positive, with a dominant breadth favoring gains. Liquidity was notably concentrated in the securities and banking sectors. The index maintained its green hue until the end of the session, closing at 1,877.33 points, a 0.5% increase from the previous session.

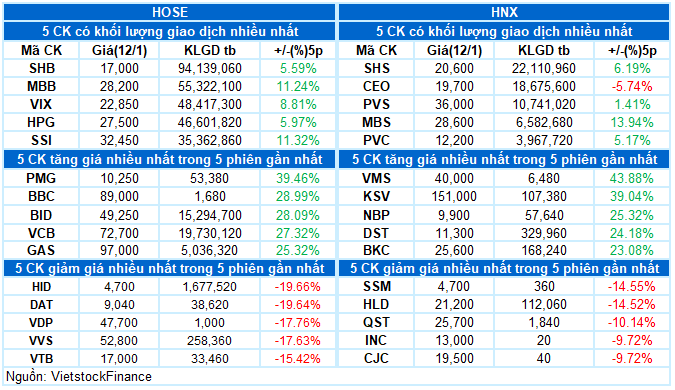

– Across market capitalization groups, green dominated all three segments. The VS-Large Cap continued to lead with a notable increase, while the VS-Mid Cap and VS-Small Cap also recorded positive movements due to significantly improved liquidity, indicating a strengthening market breadth.

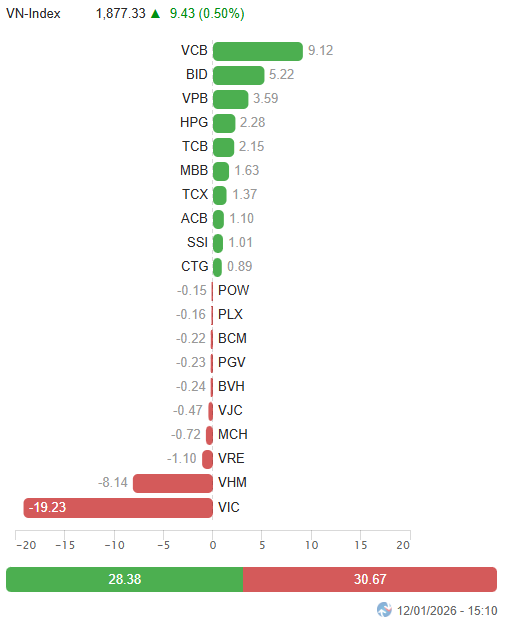

– In terms of influence, the financial sector was the primary driver of the VN-Index, occupying 9 out of the top 10 positions among stocks with the most positive impact. Leading the way was VCB, contributing 9.12 points, followed by BID, VPB, HPG, and TCB, which collectively added over 13 points to the index. Conversely, VIC and VHM exerted significant pressure, subtracting more than 27 points and becoming the market’s strongest drag during the session.

Top Impactful Stocks on the Index. Unit: Points

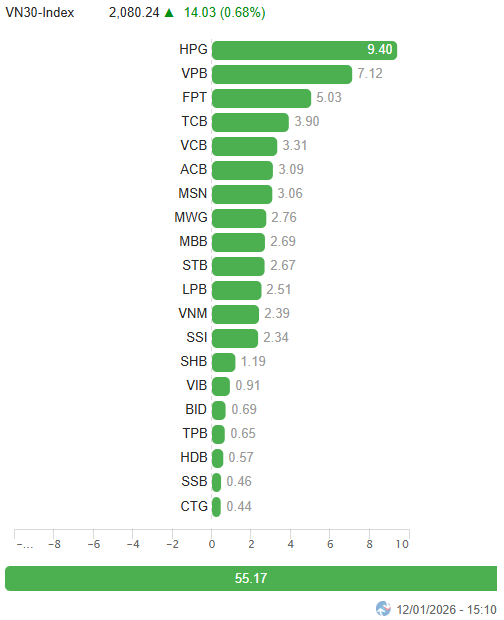

– The VN30-Index closed with a 14-point gain (+0.68%), reaching 2,080.24 points. The breadth was decidedly positive, with 23 gainers and only 7 decliners. Leading the upward trend were stocks like BID, SSI, VCB, and VPB, all hitting their ceiling prices, while HPG, ACB, STB, and TCB also recorded strong increases of over 3.5%. In contrast, the trio of VIC, VHM, and VRE bucked the trend with near-floor declines, alongside VJC, PLX, and BCM, which adjusted by more than 1%.

Green dominated most sectors. Communication services and finance were the most prominent, with ceiling prices seen in stocks like VGI, CTR, VTK; VCB, BID, VPB, SSI, VND, VCI, SHS, VIX, HCM, and FTS. Notable increases were also observed in FOX (+4.79%), MFS (+5.57%), ABC (+5.36%); F88 (+10.07%), MBS (+9.16%), BVS (+7.26%), and SBS (+6.78%).

Additionally, the materials and industrial sectors showed clear improvement with widespread buying pressure. Many stocks rose by more than 2%, including HPG, DPM, NTP, HSG, NKG, ACV, HVN, GEE, MVN, VEA, GEX, and VCG. Several stocks also hit their ceiling prices, such as KSB, VTP, DPG, VNE, and FCN.

On the downside, real estate and energy were the only sectors in the red, with deep declines of 4.58% and 1.58%, respectively. The pressure primarily came from strong adjustments in leading stocks like VIC, VHM (both hitting the floor), VRE (-6.86%), BCM (-1.41%); PLX (-1.4%), PVS (-1.91%), PVD (-3.73%), OIL (-2.48%), PVT (-2.96%), PVP (-3.24%), PVC (-4.69%), and MVB hitting its lower limit.

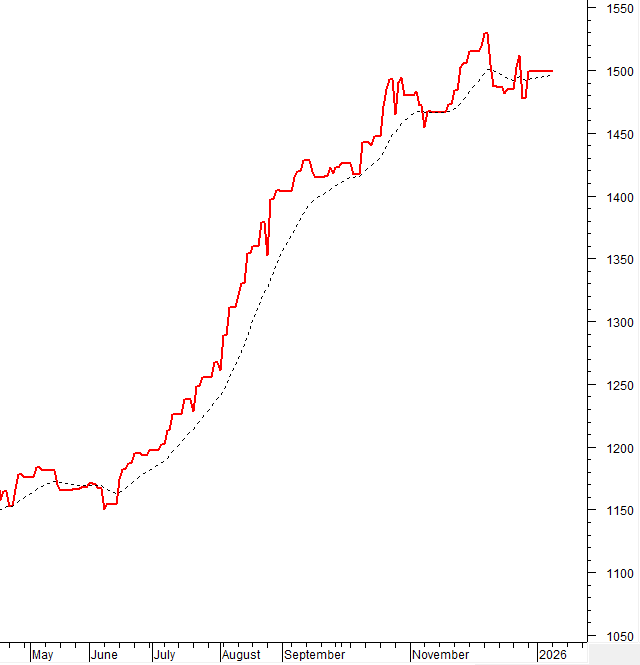

The VN-Index continued to rise with trading volumes above the 20-day average, reflecting investor optimism. The positive outlook was reinforced by the MACD maintaining its upward trend and widening its distance from the Signal line. However, the Stochastic Oscillator is deeply in the overbought zone, so investors should be cautious about potential volatility if a reversal signal emerges in upcoming sessions.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Stochastic Oscillator Deep in Overbought Territory

The VN-Index continued to rise with trading volumes above the 20-day average, reflecting investor optimism.

The positive outlook was reinforced by the MACD maintaining its upward trend and widening its distance from the Signal line. However, the Stochastic Oscillator is deeply in the overbought zone, so investors should be cautious about potential volatility if a reversal signal emerges in upcoming sessions.

The October 2025 peak has been completely breached and will serve as strong support in the near future.

HNX-Index – MACD Gives Buy Signal

The HNX-Index rebounded strongly, crossing above the Middle line of the Bollinger Bands. Trading volume continued to rise and remained above the 20-day average, indicating improving investor sentiment.

The short-term recovery outlook is supported as the MACD has given a buy signal, while the Stochastic Oscillator also continues to rise after giving a buy signal and exiting the oversold zone.

Liquidity Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden thrust down will be limited.

Foreign Investor Liquidity Movement: Foreign investors continued to net buy in the January 12, 2026, trading session. If foreign investors maintain this action in the coming sessions, the outlook will become even more optimistic.

III. MARKET STATISTICS FOR JANUARY 12, 2026

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:08 January 12, 2026

Top Executives Step Down from Leadership Roles

SMC Investment and Trading Joint Stock Company, Song Da 11 Joint Stock Company, Hai Minh Joint Stock Company, and Saigon – Hanoi Securities Joint Stock Company have announced leadership changes, including new appointments for the positions of CEO, Board of Directors members, and Board of Supervisors members.

Vietstock Weekly 12-16/01/2026: Reaching New Heights

The VN-Index extended its rally into a fourth consecutive week, decisively breaking through the previous October 2025 peak to establish a new all-time high. Surging trading volumes, surpassing the 20-week average, underscore a significant improvement in liquidity and a prevailing optimism among investors.

Foreign Block “Pours Money In” with Strong Buying in First Week of 2026, Investing Over 500 Billion in a Bank Stock

Foreign investors initially sold off at the beginning of the week but returned to net buying by the end of the week.