MARKET ANALYSIS FOR THE WEEK OF JANUARY 5-9, 2026

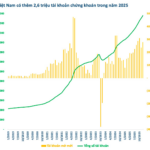

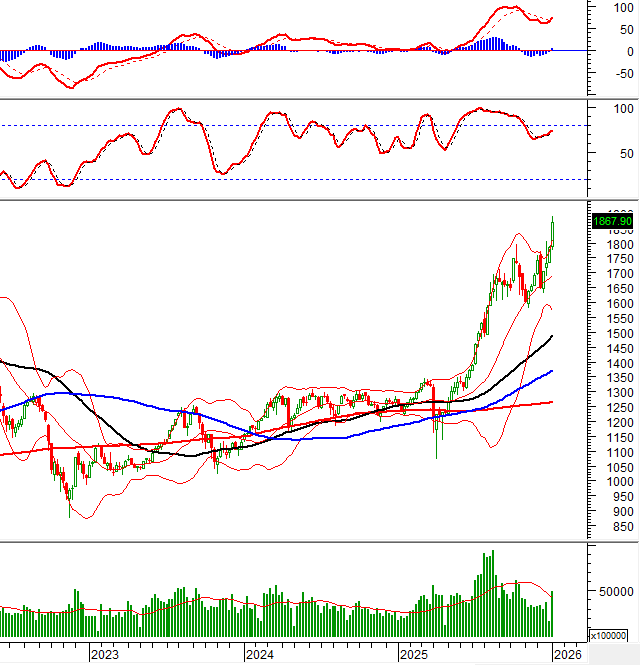

During the week of January 5-9, 2026, the VN-Index marked its fourth consecutive week of gains, decisively breaking through the previous peak from October 2025 and setting a new all-time high. Trading volume surged above the 20-week average, reflecting a significant improvement in liquidity and investor optimism.

The index’s adherence to the Upper Band of the Bollinger Bands, coupled with a renewed buy signal from the MACD, underscores the continued strength of the medium-term uptrend.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – New 52-Week High

In the trading session on January 9, 2026, the VN-Index experienced sideways movement, forming a small-bodied candlestick pattern with above-average trading volume, indicating investor hesitation. However, the index achieved a new 52-week high and remained close to the Upper Band of the Bollinger Bands, signaling persistent positive momentum.

Additionally, the MACD indicator continues to form higher highs and higher lows, further supporting the medium-term upward trajectory.

HNX-Index – Stochastic Oscillator Signals Buy

On January 9, 2026, the HNX-Index declined, forming a Big Black Candle pattern with above-average trading volume, reflecting continued investor pessimism. The index remains below the 200-day SMA, while the MACD continues to signal selling pressure and remains below zero, indicating a bearish medium-term outlook.

Conversely, the Stochastic Oscillator has formed a bullish divergence and is signaling a buy opportunity in the oversold region. If the indicator rises above this level in upcoming sessions, a short-term rebound is likely.

Liquidity Analysis

Smart Money Flow: The Negative Volume Index for the VN-Index is currently above the 20-day EMA. If this trend persists in the next session, the risk of a sudden downturn will diminish.

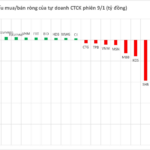

Foreign Investor Flow: Foreign investors continued to net buy in the session on January 9, 2026. Sustained buying by foreign investors in upcoming sessions would further enhance market optimism.

Technical Analysis Team, Vietstock Advisory Department

– 16:58 January 11, 2026

January 8th Stock Market Update: VCB Hits Ceiling, VN-Index Adjusts

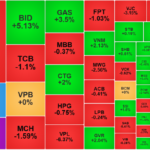

The stock market on January 8th witnessed profit-taking pressure in the Vingroup sector, while “king” stocks provided support. As a result, the VN-Index corrected following yesterday’s heated rally.