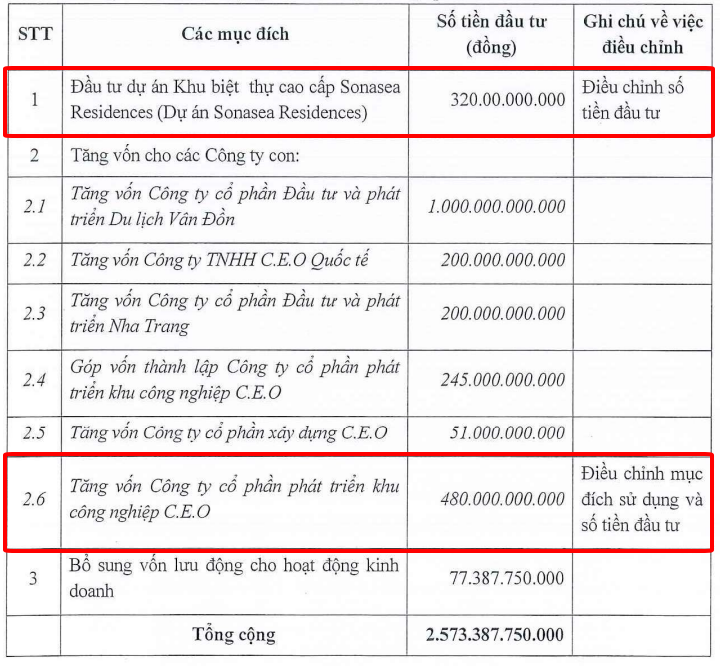

The Board of Directors of C.E.O Group Joint Stock Company (CEO Group, HNX: CEO) has approved adjustments to the allocation of nearly 2.6 trillion VND raised from the 2022 capital increase share issuance.

According to the resolution dated January 10th, the CEO Board approved reducing the investment in the Sonasea Residences luxury villa project to 320 billion VND, down from the previously approved 800 billion VND.

The 480 billion VND reduction will be reallocated to increase the capital of C.E.O Industrial Park Development JSC (CEO IP). Other capital allocation items remain unchanged.

|

Detailed capital allocation plan after adjustments by CEO

Source: CEO

|

In mid-2025, the CEO Board also approved allocating 245 billion VND to establish CEO IP, replacing the initially planned 105 billion VND investment in Phu Quoc Investment and Development JSC. The remaining funds will be reallocated from the working capital reserve.

Established in early June 2025, CEO IP is headquartered in Hanoi with a charter capital of 450 billion VND, 99% owned by CEO. The company is the developer of the Tien Lang Airport Industrial Park – Zone B project, covering over 186 hectares in Chan Hung Commune, Hai Phong City.

According to the 1/2000 construction zoning plan approved by the Hai Phong People’s Committee on June 24, 2025, the Tien Lang Airport Industrial Park spans nearly 451.7 hectares, including Zone A (over 256 hectares) and Zone B (nearly 186.5 hectares). The park is envisioned as an eco-industrial park focusing on high-tech industries (electronics, electrical appliances, electrical equipment, etc.) and supporting industries.

On July 15, 2025, the Hai Phong People’s Committee approved the investment policy and designated CEO IP as the developer of the Tien Lang Airport Industrial Park – Zone B, with a total investment of over 2.795 trillion VND. The project is scheduled for implementation from 2025 to 2027.

Regarding the Sonasea Residences project, by late September 2025, CEO had spent nearly 616 billion VND on land compensation and clearance.

Sonasea Residences is a luxury villa complex located on the slopes of Duong To Mountain, Phu Quoc, covering 160 hectares. The project includes villas, commercial townhouses, mixed-use buildings, a medical center, hotels, and schools.

Rendering of Sonasea Residences. Source: CEO

|

– 11:41 12/01/2026

Becamex IJC to Invest Over VND 231 Billion, Boosting Stake in Becamex – Binh Phuoc to Above 40%

Becamex IJC has announced its intention to acquire an additional 23.1 million shares in Becamex – Binh Phuoc at a price of 10,000 VND per share. This strategic move is expected to result in a total transaction value exceeding 231 billion VND.

Revitalizing Ho Chi Minh City’s Public Investment: Replacing Underperforming Officials to Accelerate Capital Disbursement

The Chairman of Ho Chi Minh City has issued a directive to promptly replace underperforming civil servants, officials, and public employees who demonstrate incompetence, lethargy, or engage in corrupt practices that cause harassment and inconvenience to the public. The directive emphasizes a zero-tolerance policy towards negative behaviors in public investment management, ensuring swift and decisive action against any misconduct.

An Binh Securities Aims to Triple Capital to Over 3,000 Billion VND

An Binh Securities JSC (HOSE: ABW) is seeking shareholder approval for a capital increase plan. The proposal involves issuing new shares to existing shareholders and an Employee Stock Ownership Plan (ESOP). If successful, the company aims to raise up to VND 2,073 billion, bringing its total chartered capital to VND 3,084.5 billion.