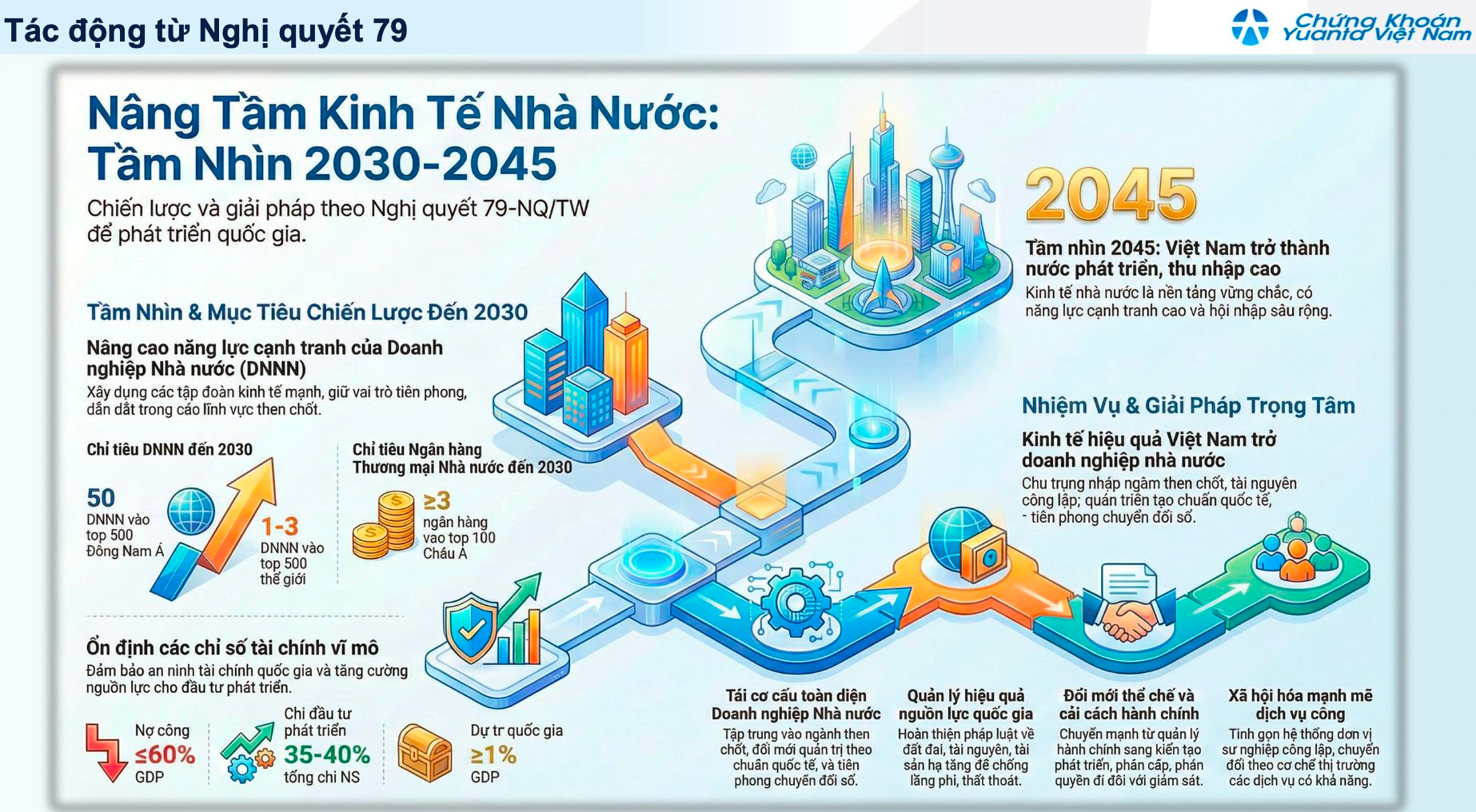

In a recent update, Nguyen The Minh, Director of Securities Analysis at Yuanta Vietnam, outlined the impact of Resolution 79-NQ/TW on the stock market through three key transmission mechanisms.

First is the reinvestment retention mechanism. For the first time, the Resolution allows the full use of proceeds from equitization and divestment to increase the charter capital of state-owned enterprises (SOEs), rather than mandating their return to the state budget. This directly addresses the Tier 1 capital shortfall faced by state-owned banks like BIDV (BID) and VietinBank (CTG), which are under pressure to meet Basel II/III capital adequacy requirements while maintaining cash dividend payouts.

Second is the clear separation between “strategic” and “commercial” enterprises. The state will retain 50% to 100% ownership in strategic sectors such as defense, security, energy, finance, banking, and critical transportation infrastructure. Conversely, in commercial sectors where the private sector can operate effectively, state ownership will be reduced to a non-controlling stake (≤50%), triggering a wave of divestments in 2026–2027.

Third is the efficient utilization of land resources, particularly for SOEs with substantial land holdings. Market-based land management and valuation are expected to accelerate the conversion of agricultural land into industrial zones, significantly boosting net asset value (NAV) for companies like those in the rubber industry.

According to Yuanta experts, Resolution 79-NQ/TW marks a fundamental shift in state capital management, from “restrictive management” to “development facilitation.” It repositions state-owned enterprises as material tools to guide, lead, and regulate the economy.

This shift is operationalized through the clear distinction between two enterprise groups. For strategic enterprises, the state retains 50% to 100% ownership, focusing on key sectors like defense, security, energy, finance, banking, and critical infrastructure. Here, the focus is on consolidating resources to create large-scale, regionally competitive state conglomerates.

In contrast, for commercial enterprises where the private sector can operate efficiently, the Resolution aims to reduce state ownership to a non-controlling stake (below 50%). This approach paves the way for private management and deeper international investment participation.

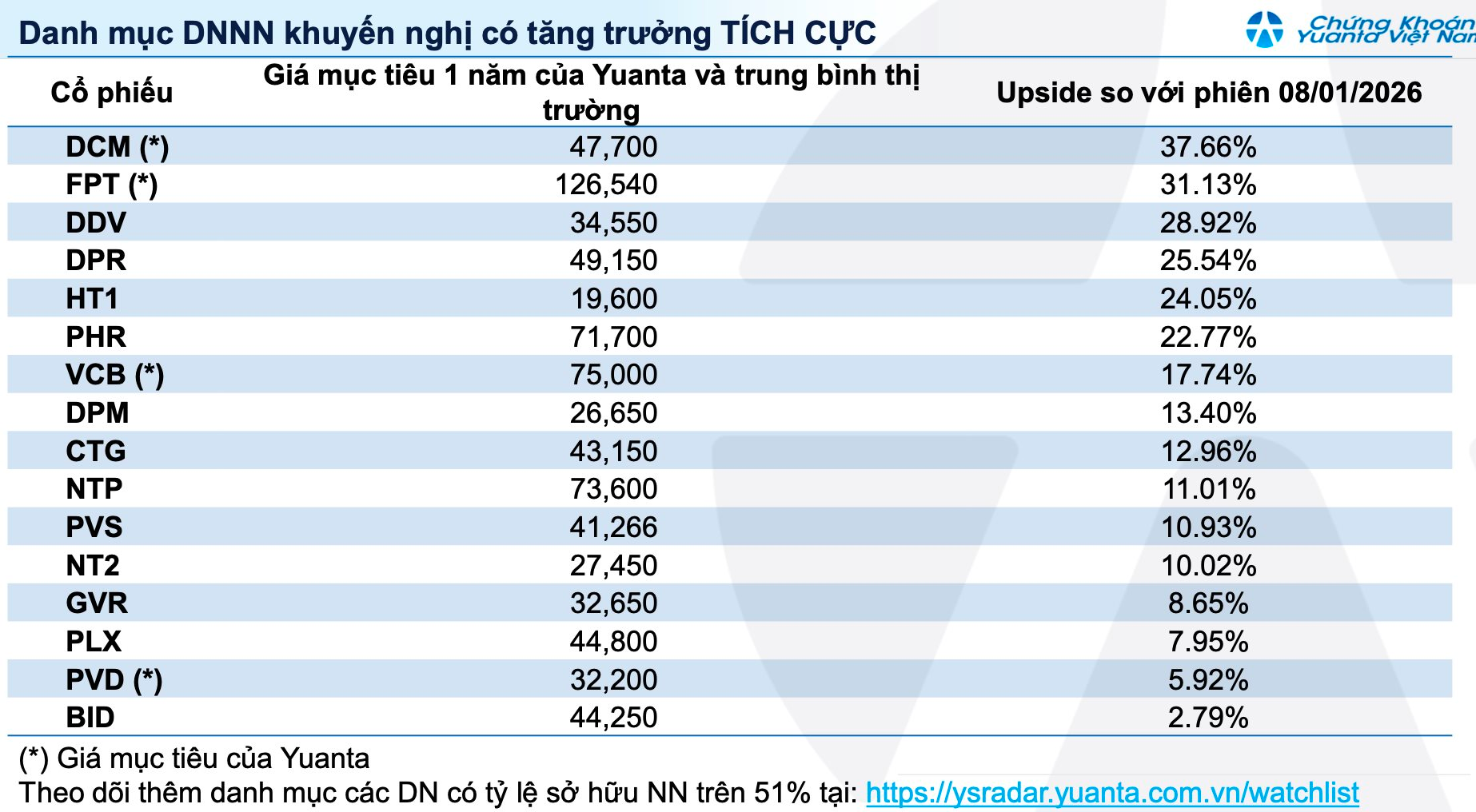

List of Beneficiary Stocks

Sector-wise, state-owned banks are among the primary beneficiaries. Vietcombank (VCB) remains the leader in efficiency and asset quality, likely becoming Vietnam’s first bank to enter Asia’s Top 100, with the highest P/B ratio in the sector. BIDV (BID) and VietinBank (CTG), despite their large asset bases but thinner capital buffers, stand to gain significantly from retained earnings and capital replenishment, enabling robust credit expansion in the coming period.

For industrial real estate, Resolution 79 is a “goldmine” in terms of land resources. The Vietnam Rubber Industry Group (GVR), managing approximately 400,000 hectares of land, plans to convert 40,000 hectares into industrial zones by 2030. Previously hindered by concerns over state asset valuation, the Resolution’s market-based accounting framework is expected to expedite this process. Related companies like PHR, DPR, and NTC will benefit from land compensation mechanisms and participation in new industrial projects, enhancing their RNAV-based valuations.

In the energy and oil & gas sector, Resolution 79 reaffirms the state’s critical role in ensuring national energy security. This policy assurance benefits PetroVietnam (PVN) and its subsidiaries. The emphasis on completing key national infrastructure projects is a positive signal for the $12 billion Lot B – O Mon gas-power chain. PVS is poised to benefit most from EPC contracts, while PVD will capitalize on increased exploration drilling demand. GAS will continue to regulate the gas market, with market-based pricing protecting margins amid rising LNG imports.

Conversely, PVI is a notable exception. Operating in the commercial insurance sector, PVI is on PVN’s divestment list. Full state withdrawal is expected to eliminate administrative barriers, unlocking potential stock revaluation opportunities.

VIX Stock Surges, Achieving 2025 Profit Targets Ahead of Schedule

VIX Securities Corporation is rapidly emerging as a standout player in the brokerage industry, showcasing exceptional profit growth that outpaces its peers.

SHS Welcomes New CEO, Projects 2025 Profits at Nearly 1.65 Trillion VND

SHS (HNX: SHS), a leading securities company, has appointed Mr. Nguyen Duy Linh as its new CEO, succeeding Mr. Nguyen Chi Thanh, who stepped down for personal reasons.