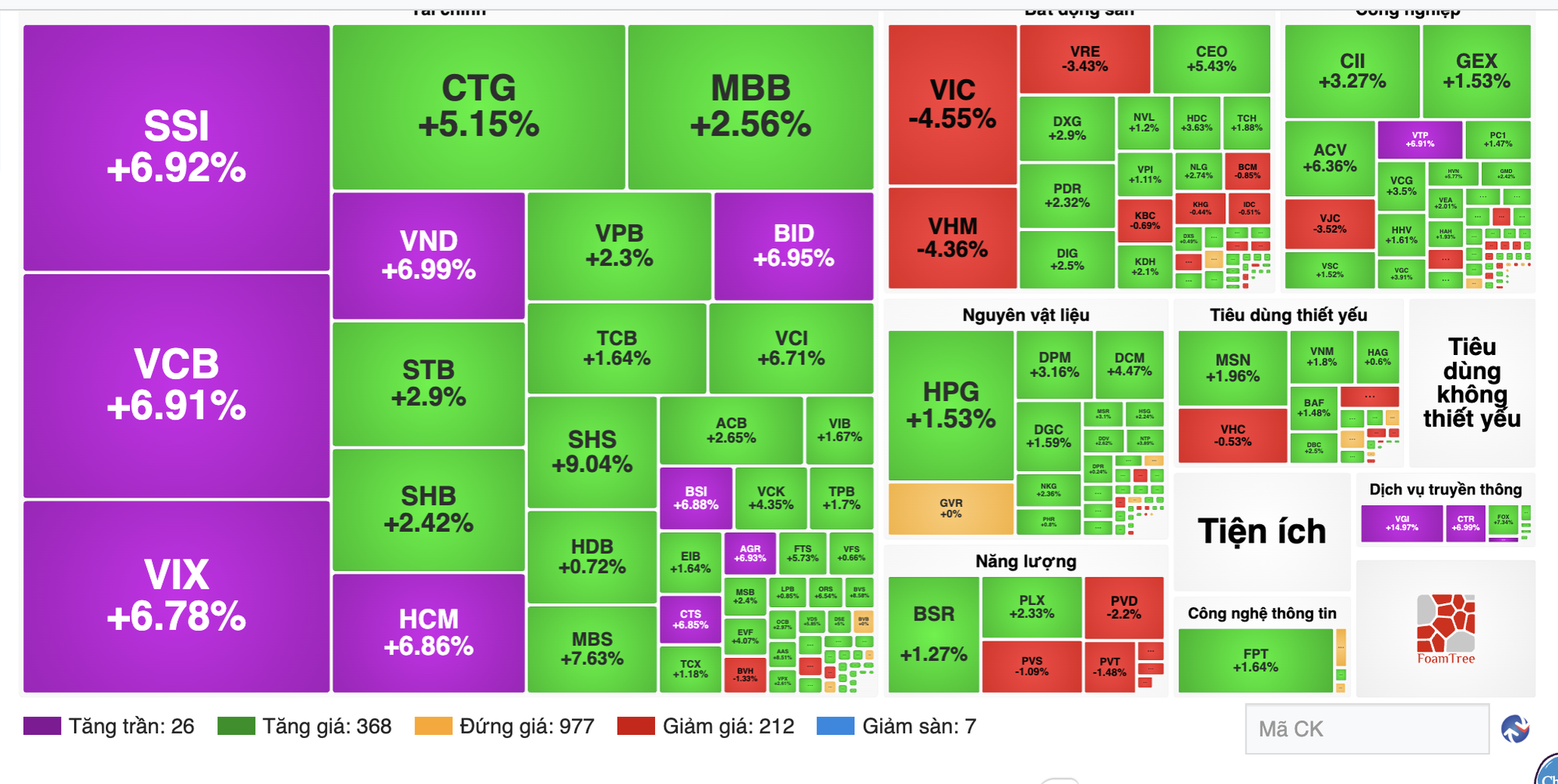

Following the upward momentum from the previous session, the stock market opened the first trading day of the week on January 12 with the VN-Index surging by 20 points to reach 1,887. This rally was fueled by state-owned bank stocks hitting their upper limits, such as VCB, BID, and CTG. Additionally, securities sector stocks like HCM, SSI, VND, MBS, and SHS also reached their maximum daily increase.

By around 10 a.m., the gains narrowed as profit-taking pressure increased, leaving the VN-Index up by just over 10 points, trading around 1,880.

Observations from Bao Nguoi Lao Dong reporters indicate that several brokerage groups and investors shifted their capital from real estate and oil stocks to banking and securities, particularly state-owned enterprises.

Numerous banking and securities stocks hit their ceiling in the morning session.

Securities firms attribute the VN-Index’s peak and surging liquidity to market optimism surrounding Resolution 79-NQ/TW issued by the Politburo on state economic development. This resolution was released over the weekend.

Mr. Nguyen The Minh, Director of Individual Client Analysis at Yuanta Securities Vietnam, noted that the primary bottleneck for listed state-owned enterprises, especially banks, has been the conflict between retaining profits for capital increases (to meet Basel II/III standards) and the pressure to pay cash dividends to the state budget. Resolution 79 addresses this issue by allowing the use of proceeds from equitization and state capital divestment to boost chartered capital.

Consequently, these enterprises can retain profits or receive reinvestment capital from the State Capital Investment Corporation (SCIC). This creates a compounding effect on the book value of shares, enhancing valuation and laying the foundation for sustainable long-term price growth.

The VN30 index surpasses the 2,000 mark, driven by state-owned enterprise stocks.

Mirae Asset Securities Vietnam (MAS) views Resolution 79 as a new catalyst for the market and state-owned enterprises, making them the focal point. In the short term, MAS analysts maintain a positive outlook on market growth.

Improved liquidity, with over 30 trillion VND traded per session, reflects growing investor confidence. Resolution 79-NQ/TW is steering market sentiment and expectations of capital redistribution as the market enters the peak period for Q4/2025 earnings reports.

Experts at MBS Securities believe the market successfully shifted its leading sectors last week, with the VN-Index finding new drivers to offset pressure from stocks that surged last year.

Current leading sectors include banking, oil and gas, rubber, Viettel, retail, and insurance. However, the strong profit margins in banking and state-owned enterprise stocks may increase profit-taking pressure as the VN-Index approaches the 1,900 resistance level.

According to MBS Securities, besides profit-taking in leading sectors, investors should closely monitor weaker sectors like securities, residential real estate, and steel. In an optimistic scenario, these sectors may experience technical rebounds after deep declines, but further accumulation or declines remain possible.

Expert Analysis: Impact of Resolution 79 on the Stock Market and Beneficiary Stock Portfolios

According to Yuanta experts, Resolution 79-NQ/TW signifies a fundamental shift in the mindset of state capital management, transitioning from a “restrictive management” approach to one that “fosters development.”

Market Pulse 12/01: Financial Sector Leads the Charge, VN-Index Sustains Strong Green Momentum

At the close of trading, the VN-Index climbed 9.43 points (+0.5%) to reach 1,877.33, while the HNX-Index rose 4.78 points (+1.93%) to 251.88. Market breadth favored the bulls, with 480 advancing stocks outpacing 250 decliners. Similarly, the VN30 basket saw a dominant green trend, with 23 gainers and only 7 losers.

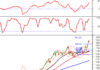

Vietstock Daily 13/01/2026: Sustaining the Upward Momentum

The VN-Index continued its upward trajectory, supported by trading volumes surpassing the 20-day average, reflecting investor optimism. Positive momentum is reinforced by the MACD sustaining its upward trend and widening its divergence from the Signal line. However, with the Stochastic Oscillator venturing deeper into overbought territory, investors should remain cautious of potential volatility should reversal signals emerge in upcoming sessions.

Three Key Factors That Could Propel the Stock Market Beyond 2,000 Points

Maybank anticipates that the VN-Index remains on a positive trajectory, with a potential scenario targeting the 2,000-point milestone by 2026.