During the 2026 Estate Management Seminar organized by FIDT Investment Consulting and Asset Management Corporation in Hanoi on January 11th, Mr. Ngo Thanh Huan, CEO of FIDT, used three terms to describe the global economy in 2026: “desynchronization,” “rebalancing,” and “uncertainty.”

According to Mr. Huan, the current context is relatively desynchronized, lacking a leading force to drive major economies in unison. The US maintains growth through consumption and technology, while China slows down due to prolonged real estate adjustments; Europe faces stagnation due to its aging structure and energy burdens; Japan tightens further; and emerging economies face increasingly limited policy space. This desynchronization makes global capital costs uneven, capital flows harder to direct, and supply chains and logistics more unstable. When monetary policies among major economies are not synchronized, forecasting capital flows, export markets, or asset cycles becomes significantly more challenging.

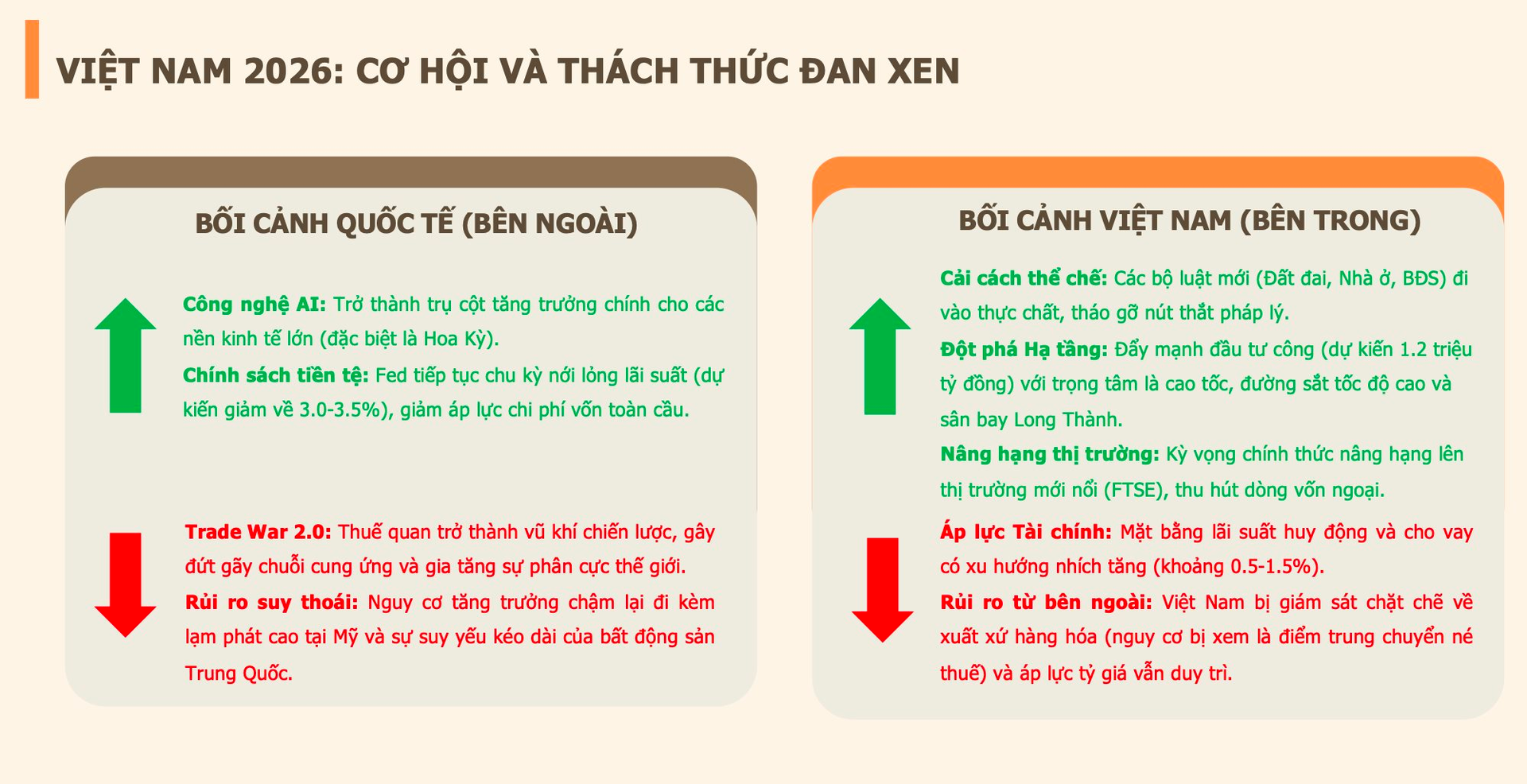

For Vietnam, the outlook for 2026 is a mix of opportunities and challenges, influenced by both external and internal factors. The FIDT CEO pointed out that Vietnam is facing structural opportunities. Firstly, institutional reforms are taking more concrete shape, with key laws such as the Land Law, Housing Law, and Real Estate Business Law beginning to address long-standing legal bottlenecks that have hindered investment for years. Additionally, public investment is expected to gain momentum, with a planned disbursement of approximately 1.2 million billion VND, focusing on strategic infrastructure projects like highways, high-speed railways, and Long Thanh Airport.

Another key support, according to the FIDT CEO, is the expectation of upgrading the stock market to emerging market status under the FTSE classification. If realized, this would be a significant boost, helping Vietnam attract long-term foreign capital, improve the quality of its capital market, and reduce reliance on bank credit—a risk that has been exposed in previous cycles.

However, Mr. Huan also candidly highlighted significant internal pressures. Deposit and lending interest rates are expected to rise by 0.5-1.5%, as monetary easing room diminishes. External risks persist, and exchange rate pressures remain.

The FIDT CEO emphasized that 2026 is not a “bad” year, but certainly a more challenging one. If last year was about “playing aggressively” (investing boldly), 2026 will be the year of “liquidity.”

Opportunities remain, but they are no longer evenly distributed; they are closely tied to institutional reforms, infrastructure investment, and the ability to leverage new trends like technology and capital markets. Conversely, external risks and internal pressures require businesses and investors to be more cautious, shifting from hot growth to sustainable management and long-term adaptability.

According to Mr. Huan, individual investors should not start by choosing products but by understanding their own financial health. Clearly define your “risk profile” before deciding on asset allocation, enabling steady and effective investment.

“The current 2025-2026 period is a rare phase, with GDP growth determined at a high level. Leveraging more internal strength, we are not passively relying on exports but must play a new role. Recent interest rate hikes are not forced but proactive. Fiscal policy, public investment, and infrastructure still have significant room for growth,” Mr. Huan shared.

Vietnam’s Economic Highlights in the Global Landscape of 2026

Building on the remarkable growth of 8.3% – 8.5% in 2025, Vietnam’s economy is poised for robust expansion in 2026, fueled by a strong domestic foundation and its position as the fastest-growing economy in the region. Hong Leong Bank Vietnam (“HLB” or “the Bank”) forecasts a GDP growth rate of approximately 6.6% for 2026.

Gold Market and USD Exchange Rate Forecast for 2026

UOB Bank forecasts the USD/VND exchange rate at 26,300 in Q1/2026, 26,100 in Q2/2026, 26,000 in Q3/2026, and 25,900 in Q4/2026. For gold, UOB has revised its price predictions to $4,300/oz in Q1/2026, $4,400/oz in Q2/2026, $4,500/oz in Q3/2026, and $4,600/oz in Q4/2026.

Vietstock LIVE #21: Riding Stocks, Holding Land, or Hoarding Gold for the Year-End Wave?

What will the economic landscape of Vietnam and the world look like in the final months of 2025? As investors adopt a cautious approach to capital allocation, which asset class—stocks, real estate, or gold—will emerge as the optimal investment channel to capitalize on the year’s remaining opportunities? Tune in to Vietstock LIVE #21, streaming live at 3 PM on Friday, November 14, 2025, for expert insights and answers to these critical questions.

UOB Revises Vietnam’s 2025 GDP Growth Forecast to 7.7%

UOB maintains its Q4/2025 growth forecast at 7.2%, while revising upward its full-year growth projection to 7.7% from the previous 7.5%. However, to meet the official growth target of 8.3-8.5%, Q4/2025 would require an exceptionally high growth rate of 9.7-10.5%.