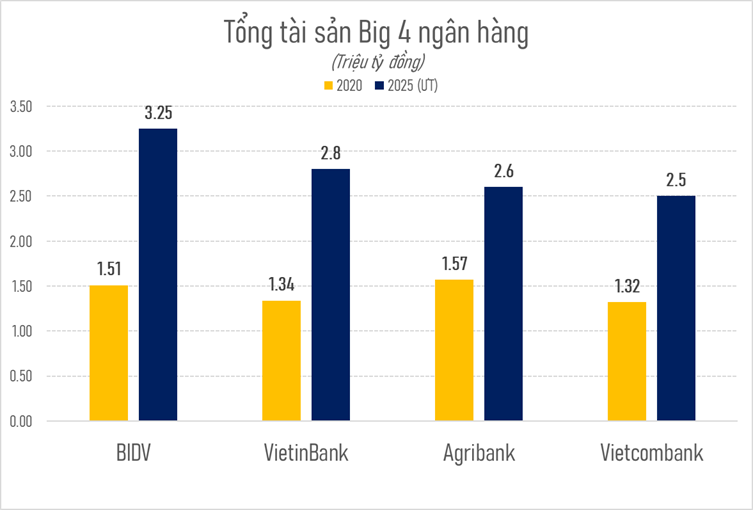

In Vietnam, BIDV currently holds the title of the largest bank by total assets within the credit institution system. By the end of 2025, the bank’s assets reached an impressive 3,250 trillion VND, marking a 20% growth compared to 2024. BIDV’s total assets are equivalent to approximately 123 billion USD.

BIDV isn’t alone in this remarkable growth. Two other major banks have also seen their total assets surpass the 100 billion USD mark. VietinBank recently announced that its total assets grew by about 18% in 2025 compared to 2024, reaching nearly 2,800 trillion VND, or roughly 105 billion USD.

Meanwhile, Agribank reported that its total assets exceeded 2,600 trillion VND by the end of 2025, placing its asset size at nearly 100 billion USD.

Vietcombank ranks fourth in the system by total assets. In 2025, its asset size grew by nearly 20% compared to the end of 2024, reaching approximately 2,500 trillion VND, or about 95 billion USD.

Over the past five years, these banks have demonstrated astonishing growth rates. BIDV led with a 115% increase, followed by VietinBank at over 100%, while Vietcombank and Agribank grew by 89% and 65%, respectively.

These shifts in asset size have significantly altered the rankings. Agribank, once the largest bank with 1,570 trillion VND in total assets at the end of 2020, has slipped to third place by the end of 2025. Meanwhile, BIDV has risen to the top spot in the system.

In 2020, VietinBank and Vietcombank had nearly identical total assets, at 1,340 trillion VND and 1,320 trillion VND, respectively. Today, VietinBank has pulled ahead significantly, with a gap of approximately 300 trillion VND.

Beyond their asset size, the Big 4 banks also lead in profitability in 2025. Vietcombank and VietinBank both reported pre-tax profits exceeding 40 trillion VND, while BIDV recorded around 36 trillion VND.

The influence of the Big 4 banks in Vietnam’s financial system is undeniable. Recently, Resolution 79 of the Politburo outlined a goal to further develop these four state-owned commercial banks as leaders in technology, governance, and market regulation by 2030. Vietnam aims to have at least three of these banks rank among the top 100 largest banks in Asia by total assets.

On the Asian stage, Vietnamese banks have been steadily climbing the ranks. According to The Asian Banker, by early 2025, BIDV ranked 101st among the largest banks in the Asia-Pacific region, rising six places from 2024. Vietcombank climbed 11 spots to 129th, VietinBank rose 10 places to 115th, and Agribank advanced nine positions to 123rd.

Banks Attract Record-Breaking Deposits

In 2025, numerous banks reported significant growth in deposits from individuals and businesses, bolstering their capital inflows and creating a robust foundation to accelerate credit expansion. This surge in deposits enables banks to meet the increasing demand for capital, supporting the recovery and growth of economic production and business activities.

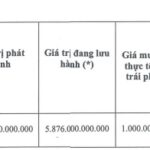

HAGL Welcomes New Creditor: Ministry of Finance’s Debt Trading Company

On December 30, 2025, Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG) disclosed an unusual announcement, revealing the receipt of information regarding the transfer of ownership rights for Group A bonds from bondholder BIDV (HOSE: BID) on December 29, 2025.