Vietnam’s Real Estate Market: From Traditional Development to TOD

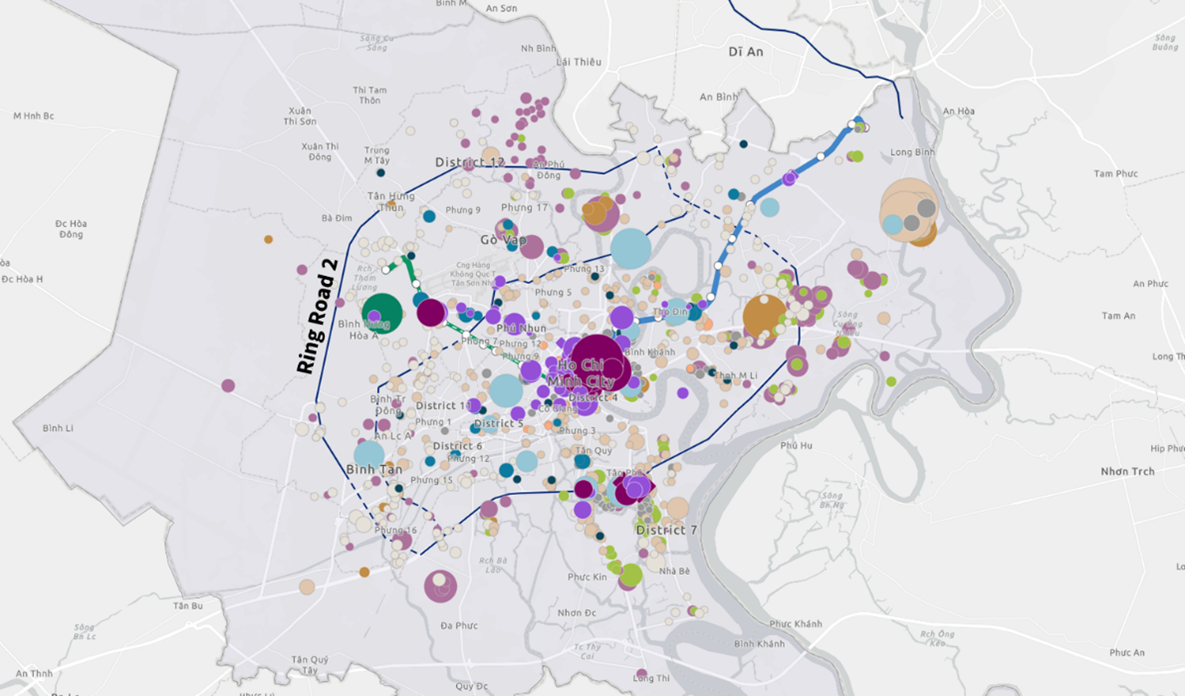

Over the two and a half decades from 1990 to 2015, real estate projects in Ho Chi Minh City were somewhat confined within the boundaries of Ring Road 2, primarily concentrated within a 10 km radius from the city center. The growth model followed the natural expansion along existing infrastructure, mainly the road network, while transit-oriented projects remained scarce,” shared Mrs. Le Thi Huyen Trang, Managing Director, Head of Advisory and Research at JLL Vietnam.

Initially, the concept of TOD—defined as urban development connected to public transit stations within a 1 km walking distance—did not gain significant traction in Vietnam. Residents in major cities previously prioritized road connectivity to the city center via private vehicles over public transportation options. However, this perspective has undergone a notable shift in recent years, driven by metro projects that, after years of delays, officially commenced operations in November 2021 (Hanoi) and December 2024 (HCMC).

Over more than a decade of metro line construction, both of Vietnam’s largest cities witnessed a vibrant real estate market with numerous projects emerging along these urban rail corridors, Mrs. Trang emphasized.

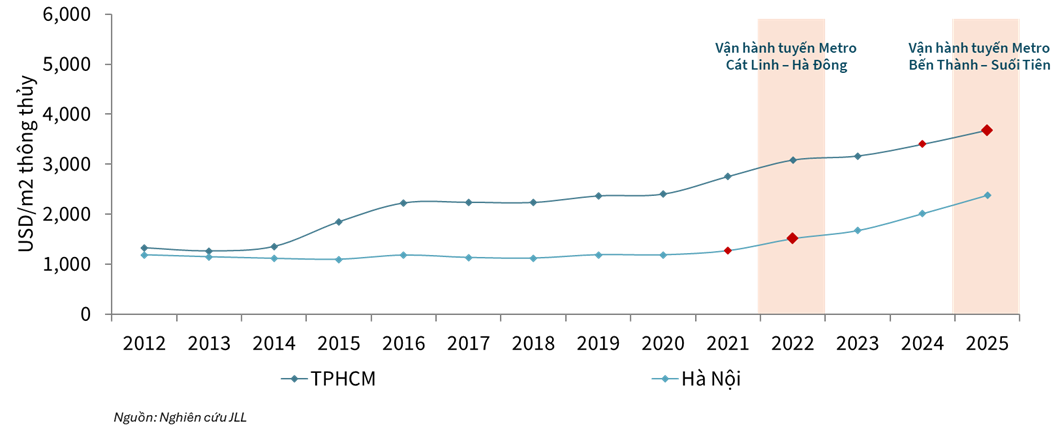

Price trends of apartments in areas developed along the first metro lines in HCMC and Hanoi.

According to Mrs. Phan Thi Anh Dao, Senior Manager, Advisory and Research at JLL Vietnam, JLL Vietnam’s report indicates that projects within a 10-minute walk from metro stations currently account for 14-16% of total commercial real estate supply and 4-9% of residential supply in both markets. These figures highlight the growing importance of transit-oriented projects within the overall real estate supply of Vietnam’s two largest cities.

Real estate projects adjacent to metro stations have also recorded significant price increases following the official operation of metro lines. Specifically, the average price increase is approximately 200-250 USD/m2 per year. This equates to an impressive annual growth rate of 8% for metro-adjacent properties, double the 4% market average in HCMC in 2025. This disparity underscores the distinct value that TOD projects bring compared to traditional real estate development.

In Hanoi, this disparity is even more pronounced. Projects near metro stations recorded a 19% price increase compared to the market average of 12% in 2022, according to JLL. This remarkable 19% growth rate is particularly notable given the challenges faced by the broader real estate market during this period.

Government Policies and New Development Directions

The construction of the city’s first metro line from 2015 to 2024 marked a significant historical turning point. All stakeholders—from developers and homebuyers to government authorities—began to recognize the transformative potential of the TOD model.

Specifically in HCMC, TOD projects have driven unprecedented urban expansion to the east, moving beyond the traditional urban core into previously undeveloped areas up to Ring Road 3. Meanwhile, the western corridor between Ring Roads 2 and 3 remains largely untapped due to the lack of infrastructure catalysts.

Current supply map of residential and commercial projects in HCMC.

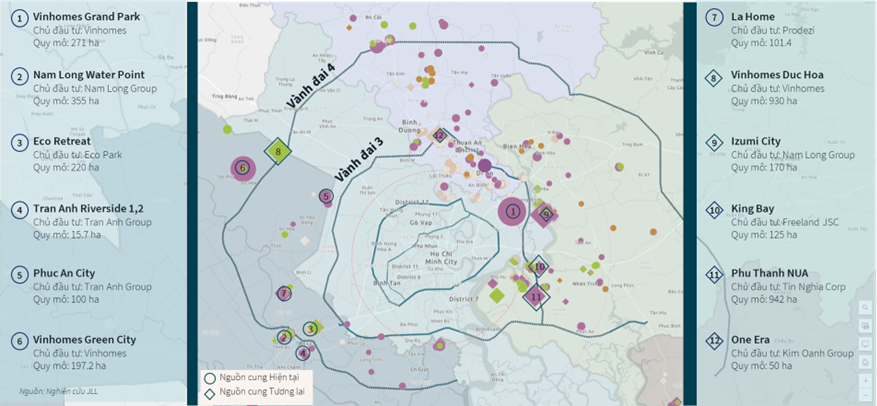

From 2025 onward, the Vietnamese government has adopted TOD as a solution to reduce population concentration in inner-city areas. This policy shift, combined with the emergence of integrated urban areas along ring roads, has created new momentum, promising to enhance the ring road system with balanced development in all directions.

This change aligns with the broader trend that has emerged over the past decade: large-scale integrated urban developments. Real estate developers have adopted comprehensive approaches to Integrated Urban Developments, seeking to overcome locational disadvantages by creating private commercial and entertainment amenities. This approach has proven particularly valuable for projects in the city’s western areas, where residential development has not naturally extended beyond Ring Road 2.

Number and scale of future large urban areas along Ring Roads 3 and 4 in HCMC.

Moving forward, the application of TOD in Vietnam may extend beyond rail systems to include road-based public transportation such as Bus Rapid Transit (BRT). Essentially, TOD aims to create multifunctional, walkable communities centered around high-quality public transit hubs, regardless of the underlying technology, Mrs. Trang emphasized.

The market’s positive response to metro-adjacent projects has reinforced authorities’ confidence in accelerating urban development under the TOD model. Notably, the TOD concept has garnered significant interest from both government and developers since 2023, particularly after being supported by Resolution 98/2023/QH15 for piloting transit-oriented urban development in HCMC. As a result, TOD has become a cornerstone of urban planning and project marketing strategies.

Local governments have recognized that TOD is not just a real estate development trend but also a critical policy tool for guiding sustainable urban growth. Encouraging TOD development serves a dual purpose: acting as both a vital transportation hub and a “third place”—a shared social environment where people can gather, interact, and build strong community bonds.

Based on market observations from a real estate perspective, JLL experts emphasize that successful TOD projects must be built on four fundamental pillars: connectivity, non-motorized transport, amenities, and mixed-use development. Each pillar plays a crucial role and complements the others in creating a complete and sustainable TOD ecosystem.

Currently, most developers primarily focus on establishing physical connectivity between their projects and public transit stations. Unfortunately, they often overlook or underutilize the potential to enhance connectivity through green spaces and non-motorized transport infrastructure.

Fundamentally different from traditional real estate development, TOD requires developers to expand their roles and incorporate new operational departments that function like mall operators but on an urban scale, actively nurturing pedestrian traffic and fostering community engagement through events, cultural activities, and meaningful experiences.

Most planned TOD projects in HCMC and Hanoi are located in suburban areas with significant land reserves, positioned for large-scale, high-density urban development with diverse property types. Therefore, developers must carefully consider the appropriate mix of residential and commercial components.

Unmissable Expert Insights on the 2026 Real Estate Market

According to experts, the 2026 market will not favor incomplete projects, lack of transparency, or investors overly reliant on short-term leverage.

THACO Strategically Positions Itself for Billion-Dollar Infrastructure Battle, Targeting Highways, Metro Systems, North-South High-Speed Rail, and Unprecedented Mega-Projects

After solidifying its position in the automotive industry and establishing a robust foundation in mechanics and logistics, THACO, led by Tran Ba Duong, is making a notable shift. The company is now re-emerging as a formidable player in the strategic infrastructure sector, presenting a series of large-scale investment proposals and commitments since 2025.