HSBC’s Global Investment Research team has released a report titled Vietnam at a Glance: Asia’s Growth Champion Navigates Tariff Turbulence.

2025: Joining the “8% Club”

The year 2025 proved to be a turbulent one. When the initial “tariff liberation day” was announced in April, Vietnam was identified as one of the Asian economies most vulnerable to tariff risks, second only to China. However, Vietnam weathered the tariff storm, demonstrating remarkable economic resilience with a surprising GDP growth rate of 8% for the year. This growth, the second-highest in 15 years, solidified Vietnam’s position as the growth champion of 2025, not just within ASEAN but across Asia.

Despite the persistent tariff shocks in 2025, Vietnam’s trade thrived, reaching a record high of $928 billion, an 18% increase year-on-year. While this could be partly attributed to the front-loading effect, HSBC believes there’s more to the story. The front-loading impact on the US market has subsided, yet Vietnam’s export growth remained significantly stronger than other countries, with a 30% year-on-year increase on a 3-month moving average (3mma). This success isn’t solely due to front-loading but also stems from the strategic export of “right” products.

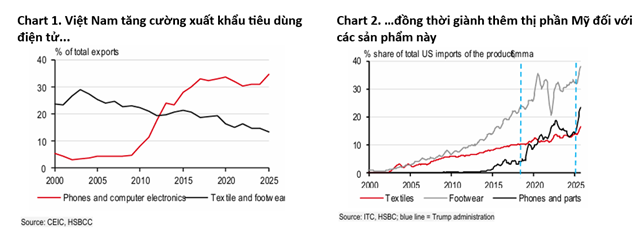

Artificial Intelligence (AI) has undoubtedly been a buzzword, but its impact on global trade is undeniable. The surge in demand for AI-application processors, fueled by the escalating chip race between the US and China, has reshaped the global semiconductor landscape. This presented an opportune moment for exporting electronic products as a hedge against tariff impacts. Fortunately, Vietnam was well-positioned to capitalize on this trend, despite its exports still being concentrated in lower-end consumer electronics. Refer to Chart 1 for the shift in Vietnam’s export composition. Electronics now account for 35% of total exports, a significant leap from just 5% in 2010. Meanwhile, exports of textiles and footwear have declined from a peak of 30% in 2005 to just over 10% today, reflecting Vietnam’s ascent in the value chain.

Beyond choosing the right products, Vietnam has successfully expanded its market share in the US. Vietnamese exports to the US surged by nearly 30% year-on-year in 2025, despite tariff concerns. Chart 2 illustrates this clearly. Despite facing a 20% retaliatory tariff, Vietnam gained export market share in the US for products like electronics, textiles, and footwear.

Concerns about ASEAN’s increasing imports from China are more nuanced than they appear. The issue isn’t just about the volume of imports but also about transforming these imports into increased exports with cheaper input materials and capturing benefits in end-consumer markets like the US. Vietnam exemplifies the successful leveraging of the “China+1” strategy. While Vietnam’s trade deficit with China widened to $116 billion, its trade surplus with the rest of the world expanded to $136 billion, resulting in a significant overall trade surplus of $20 billion.

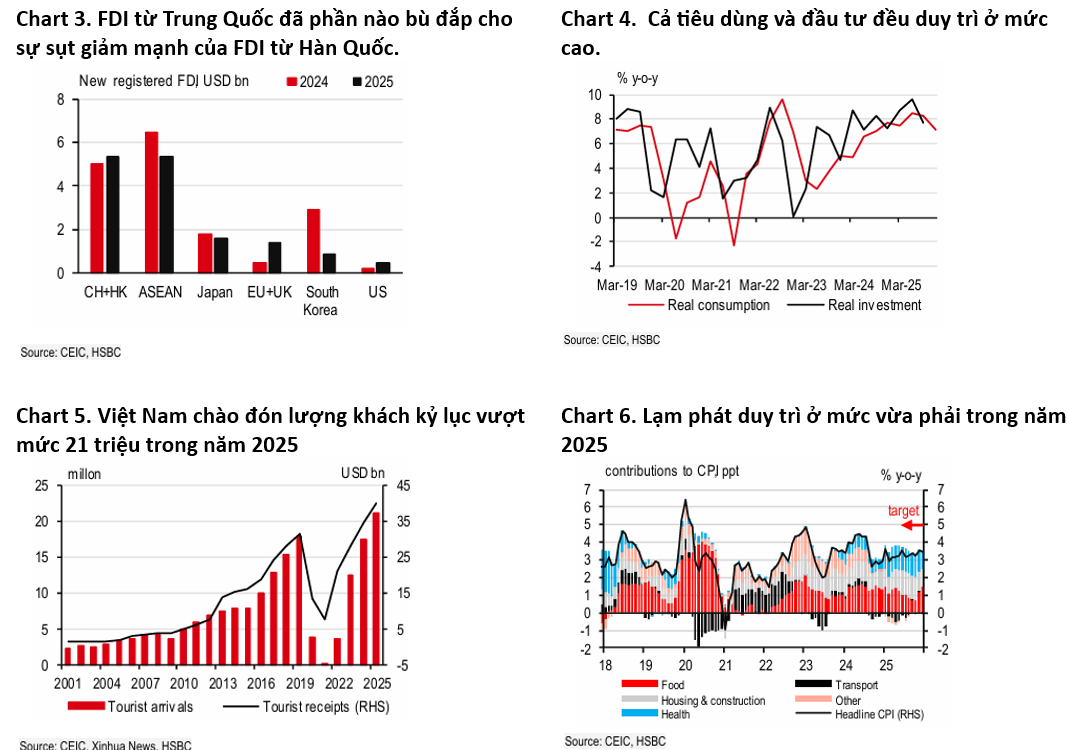

Regarding tariffs, FDI trends are also noteworthy. Although new FDI registrations in 2025 decreased by 12% year-on-year, the absolute value remains high by historical standards. Beyond the headline figure, the shift in investment composition is even more intriguing. The primary driver of the decline was reduced investment from South Korea, which fell to a 14-year low, despite being a pioneering investor. However, FDI from China partially offset this shortfall, rising to the top position with a 30% market share, closely followed by Singapore.

While tariff challenges haven’t deterred Vietnam, risks remain that could cloud its trade outlook. The recurring question, “What’s next?” persists, with answers still unclear. One particularly ambiguous yet crucial issue for Vietnam is the US announcement of a 40% tariff on “transshipment goods” without a precise definition or enforcement mechanism. Another critical concern for many Asian economies is the fate of potential tariffs in the semiconductor sector.

Trade remains robust, but domestic strength is also supporting Vietnam’s economy. Personal consumption grew by 8%, driven by a large consumer base, while investment accelerated to nearly 9% in 2025 (Chart 4). Infrastructure development remains a key strategy for Vietnam.

In tourism, although initial targets weren’t met, Vietnam welcomed a record-breaking 21 million visitors, generating $40 billion in tourism revenue, equivalent to 7% of GDP. Tourism recovery was strong, with visitor numbers reaching nearly 120% of 2019 levels. This was largely due to the swift return of Chinese tourists, an impressive feat given Vietnam’s lack of a visa-waiver program with mainland China.

Inflation remains under control. December’s headline inflation rose by 0.2% month-on-month (3.5% year-on-year), primarily due to a 1% increase in food prices. This reflects ongoing food supply disruptions caused by previous flooding, though the impact is expected to be short-lived. Overall, 2025 inflation remained moderate at 3.3%, in line with HSBC’s forecast. This was achieved through low oil prices and stable food costs, despite recent slight increases in food prices.

In summary, HSBC forecasts GDP growth of 6.7% in 2026, with inflation remaining moderate at 3.5%.

What to Expect in 2026?

Vietnam will begin 2026 with a significant political event: the 14th National Congress of the Communist Party of Vietnam, scheduled for January 19-25. This quinquennial event will elect new leadership and set economic and social goals for the next 5-10 years.

During each National Assembly session, key economic targets, including GDP growth and per capita GDP for the next five years, are announced. Vietnam’s average GDP growth from 2021-2025 was 6.2%, slightly below the 6.5-7% target set in the five-year socio-economic development plan, primarily due to slower growth in 2021 caused by the pandemic. In the medium term, Vietnam aims to become a upper-middle-income country by 2030 and a high-income country by 2045.

In November 2025, the National Assembly approved a series of socio-economic targets for 2026, offering a glimpse into expectations for 2026-2030. The 2026 growth target is set at “at least 10%” with per capita GDP ranging from $5,400 to $5,500. It’s important to note that this double-digit growth target is based on the previous year’s high 8% GDP growth, requiring a strong impetus for comprehensive growth, including outstanding trade, significant investment, and robust consumption.

The reforms to support this growth are also crucial to monitor. Vietnam has implemented various reforms, with the reorganization of state agencies and the merger of provinces and cities being key highlights in 2025, aimed at reducing administrative barriers and streamlining management processes.

– 11:53 13/01/2026

Vietnam’s Wood Industry Exports Surpass $17 Billion for the First Time

Despite facing numerous challenges and obstacles, the export of timber and wood products in 2025 demonstrated remarkable resilience, achieving positive growth and surpassing the $17 billion milestone for the first time.

2026 Capital Challenge: Achieving 15% Growth on High Debt Levels Without Capital Shortages for Businesses

Looking ahead to 2026, Ms. Nguyễn Thúy Hạnh, CEO of Standard Chartered Bank Vietnam, believes that a 15% credit growth rate, built upon the substantial outstanding loans of 2025, will be more than sufficient to support the economy. She emphasizes that this year’s strategy focuses on steady disbursement, prioritizing capital for production and real estate projects that meet genuine demand, thereby effectively managing bad debt risks.