|

The year 2025 marked an exceptionally vibrant period for Vietnam’s stock market, with the VN-Index reaching its highest annual increase since 2018, soaring to nearly 1,800 points. Amid this landscape, banking stocks continued to play a pivotal role. With 19 listed codes on the HOSE, the banking sector accounted for approximately 28.8% of the total trading volume on the exchange, maintaining significant influence over the market’s overall dynamics.

Among the 27 banking stocks, 11 outperformed the VN-Index. Notably, KLB emerged as the top performer in the sector, surpassing even the stocks of larger banks with higher liquidity and market capitalization. According to consolidated data, KLB surged by 131.4% in 2025, positioning it as one of the most outstanding banking stocks in the market.

By the end of 2025, KienlongBank’s total assets nearly reached VND 100 trillion. The net interest margin (NIM) over the last 12 months stood at around 4%, while the return on equity (ROE) exceeded 21%, placing KienlongBank among the most profitable institutions in the system. This performance lays a robust foundation for the medium and long-term growth of KLB shares. Asset quality remained strong, with a low non-performing loan ratio compared to the industry average, and a debt coverage ratio consistently around 80%.

In the first nine months of 2025 alone, KienlongBank’s credit growth reached 15.6% compared to the beginning of the year, while capital mobilization increased by 11.6%. Accumulated pre-tax profit hit VND 1,537 billion, doubling the same period last year and fulfilling 112% of the annual profit plan.

A significant milestone for KLB in 2025 was the completion of its transfer from UPCoM to HOSE, as approved by the Shareholders’ Meeting. KLB shares will commence trading on HOSE on January 15, 2026, with a reference price of VND 16,200 per share.

With a market capitalization of nearly VND 9.5 trillion at its HOSE debut, approximately 2.3 times higher than at the start of 2025, KLB is entering a new growth phase, backed by a positive market revaluation. The transition to a more prestigious exchange is expected to enhance KLB‘s access to institutional capital and gradually elevate its valuation to align with its long-term growth potential and market position.

Services

– 11:48 AM, January 12, 2026

Market Pulse 13/01: VN-Index Nears 1,900, Banking Sector Faces Selling Pressure

The VN-Index surged to a high of 1,900 during today’s morning session, fueled by the strong performance of VIC and VHM. VIC alone contributed nearly 14 index points, rising almost 5 points. This upward momentum extended to the real estate sector, with another Vingroup affiliate, VRE, climbing over 4%.

Technical Analysis for the Afternoon Session of January 12: Aiming for New Targets

The VN-Index continues its upward trajectory, eyeing a new target range of 1,935-1,950 points. Meanwhile, the HNX-Index has seen a robust increase, positioning itself to potentially test the upper boundary of the Falling Wedge pattern.

PYN Elite Fund Anticipates Sacombank’s Imminent “Value Unlock”

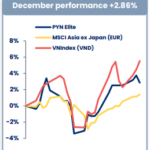

The Finnish investment fund PYN Elite has released its December 2025 report, revealing a nearly 3% portfolio growth, primarily driven by the strong performance of two banking stocks: HDBank (HDB) and Sacombank (STB). This achievement comes amidst a highly polarized Vietnamese stock market, despite the VN-Index closing the year at a record high.

Foreign Investors Net Buy Over VND 1 Trillion, Aggressively Accumulating Two Banking Stocks in January 12 Session

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately 1.036 trillion VND. This influx of investment highlights their confidence in the market’s potential and serves as a positive indicator for future growth.