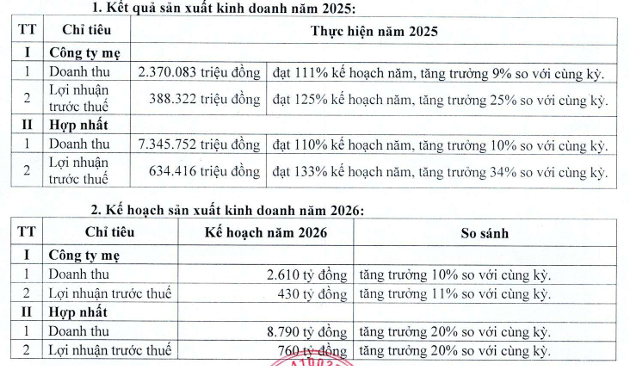

Regarding the 2025 business results, PTB reported consolidated revenue of nearly VND 7,346 billion, a 10% increase compared to the same period in 2024; pre-tax profit exceeded VND 634 billion, up by 34%. These results helped the company surpass its revenue and profit targets by 10% and 33%, respectively.

This also marks the highest pre-tax profit in the past four years for PTB, second only to the record of approximately VND 650 billion in 2021. Furthermore, with these results, it can be calculated that PTB earned a pre-tax profit of nearly VND 160 billion in the final quarter of 2025, as the actual profit for the first nine months was reported at nearly VND 475 billion.

| PTB Achieves Highest Pre-Tax Profit in Four Years |

For 2026, the company aims to achieve VND 8,790 billion in revenue and VND 760 billion in pre-tax profit, both representing a 20% increase compared to 2025. If successful, the company will set a new profit record in its operating history.

Specifically, for the parent company, the targets are set at VND 2,610 billion in revenue and VND 430 billion in pre-tax profit, increasing by 10% and 11%, respectively, compared to 2025.

Source: PTB

|

In other notable developments, PTB announced adjustments to several timelines related to the offering of nearly 13.4 million shares to existing shareholders.

Accordingly, the transfer period for purchase rights from December 22, 2025, to January 7, 2026, has been extended to January 20, 2026. Meanwhile, the subscription and payment period from December 22, 2025, to January 12, 2026, has been extended to January 30, 2026. These adjustments aim to provide shareholders with more time to exercise their rights.

This offering involves nearly 13.4 million shares to existing shareholders (at a ratio of 5:1), with the ex-rights date being December 12, 2025. At a price of VND 12,000 per share, the company expects to raise nearly VND 161 billion to supplement capital for two subsidiaries: TNHH MTV Gỗ Phú Tài Bình Định (over VND 116 billion) and TNHH MTV Phúc Tân Kiều (VND 44.5 billion).

Notably, PTB shares have seen a strong surge in recent weeks, rising from around VND 43,500 per share to above VND 50,000 per share. Thus, the offering price of VND 12,500 per share is equivalent to only 25% of the current market price.

| PTB Shares Surge Strongly in Recent Weeks |

– 15:31 12/01/2026

DPM Targets Double-Digit Revenue Growth and 12% Dividend Yield

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo – Phu My, HOSE: DPM) aims to boost its revenue by 10% in 2026, targeting a total of VND 17,600 billion.