By the end of December, the VN-Index surged by 5.5%, closing at an unprecedented 1,784 points. However, the market’s rally was predominantly driven by stocks within the Vingroup ecosystem, while overall liquidity showed signs of contraction. As of December 24, credit growth reached nearly 18%, significantly outpacing deposit growth of 14%, which exerted upward pressure on interest rates in the final weeks of the year.

|

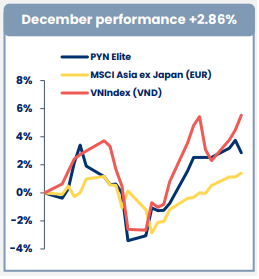

PYN Elite’s Performance vs. VN-Index

Source: PYN Elite Fund

|

Amid this backdrop, PYN Elite recorded a 2.9% increase in December, boosting its full-year performance to 17.38%, albeit modest compared to the VN-Index‘s 41% surge.

|

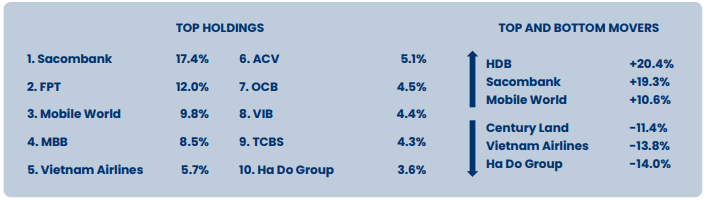

Top 10 Holdings in PYN Elite Fund’s Portfolio

Source: PYN Elite Fund

|

The fund highlights that Sacombank is poised for a significant catalyst following the appointment of its new Acting CEO—a highly regarded leader with a proven track record of transformative leadership during his tenure as Chairman of LPBank.

According to the Finnish fund, this move signals that Sacombank is entering the final stages of its multi-year restructuring process, raising expectations of “unlocking value” in the near future.

On the macroeconomic front, Vietnam’s GDP grew by 8.5% year-on-year in Q4/2025, pushing full-year growth above 8%. The industrial and construction sectors led with a 9% increase, followed by services at 8.6%. Total exports reached $475 billion (up 17%), while imports climbed to $455 billion (up 19.4%).

A notable highlight in December was the simultaneous groundbreaking, inauguration, and technical operation of 234 major projects nationwide on December 19, with a combined investment of over $137 billion. PYN Elite believes these large-scale projects will lay the foundation for Vietnam’s ambitious 10% GDP growth target in 2026.

– 13:30 13/01/2026

Foreign Investors Net Buy Over VND 1 Trillion, Aggressively Accumulating Two Banking Stocks in January 12 Session

Foreign investors’ trading activity has been a significant boost to the market, with a net buying value of approximately 1.036 trillion VND. This influx of investment highlights their confidence in the market’s potential and serves as a positive indicator for future growth.

Unveiling the Top 2 “King” Stocks Riding the Wave, Helping a $1.2 Billion “Shark” Achieve Positive Returns in December

Foreign funds rebounded in the final month of the year, snapping a three-month streak of negative performance and returning to positive growth.

Market Pulse 12/01: Financial Sector Leads the Charge, VN-Index Sustains Strong Green Momentum

At the close of trading, the VN-Index climbed 9.43 points (+0.5%) to reach 1,877.33, while the HNX-Index rose 4.78 points (+1.93%) to 251.88. Market breadth favored the bulls, with 480 advancing stocks outpacing 250 decliners. Similarly, the VN30 basket saw a dominant green trend, with 23 gainers and only 7 losers.