Resolution 79-NQ/TW (dated January 6, 2026) by the Politburo redefines the understanding of the state economy. The state economy is not merely state-owned enterprises. It encompasses a comprehensive “national asset-resource system,” including land, natural resources, infrastructure, budgets, reserves, and state capital in enterprises.

The key focus of the resolution is not the slogan “dominant role.” Instead, it emphasizes full accounting, clear separation of objectives, transparency, and accountability. These measures aim to prevent losses, reduce waste, and transform public assets into development capabilities.

Redefining “State Economy”: Broader – More Transparent

Traditionally, when discussing the state economy, many think of corporations and conglomerates. Resolution 79 goes beyond this understanding.

According to the resolution, the foundation of the state economy comprises resources controlled or dominated by the state. These resources serve development goals, macroeconomic stability, and national defense and security.

Vinashin, a state-owned enterprise, has experienced significant management fluctuations. Photo: Vinashin |

These resources include land, minerals, water, airspace, and underground spaces. They also encompass state-invested infrastructure, national budgets, reserves, and state financial funds outside the budget.

The state economy further includes state-owned enterprises, state credit institutions, state capital in enterprises (even when the state holds less than 50%), and public service units.

This “broader” definition carries significant legal and governance implications. If considered a national resource, it cannot be managed through “blanket contracting” or “vague accountability.”

Every link must adhere to standards of transparency, accountability, and public scrutiny. This applies to land management, resource extraction, infrastructure investment, capital allocation, and the operation of state-funded enterprises.

“Dominant Role” Does Not Mean “Special Privileges”

A notable point is the resolution’s emphasis on the state economy being equal before the law with other economic sectors.

All economic components cooperate and compete fairly. Access to resources, markets, and development opportunities must be equitable and transparent.

This message underscores that the path to development must be based on the rule of law and market discipline. It rejects favoritism, arbitrary “special treatment,” and practices that distort competition.

The resolution also addresses a societal concern: Why, despite vast state resources, is efficiency not commensurate, and why does waste and loss persist? A key reason identified is the slow renewal of policies and laws. Management and resource utilization remain inefficient, and inspection, auditing, and oversight are limited.

Three “New Disciplines” for Public Asset Management

Full accounting based on market principles. The resolution mandates that all state economic resources be reviewed, inventoried, evaluated, and fully accounted for according to market principles. It also aims to remove bottlenecks and combat losses and waste.

Without full accounting, it is impossible to identify where losses occur, determine weak links, or assign clear responsibilities.

Separation of public tasks from business activities. The resolution stresses separating the use of state resources for public goods and services and political tasks from business activities.

This separation aims to end the situation where “profits are enjoyed by enterprises, and losses are borne by society.” It allows citizens to monitor whether their taxes are funding public tasks or compensating for poor management.

Transparency and accountability. The resolution places “transparency and accountability” at its core. This applies to land and resource management, procedural reforms, decentralized supervision, public debt management, and the evaluation of state-owned enterprises and public service units.

State-Owned Enterprises: Must Be “Efficient” and “Trustworthy”

The resolution acknowledges state-owned enterprises as a core force. However, their efficiency is not yet commensurate, and their international competitiveness remains limited. In some key areas, innovation is not yet pronounced.

Therefore, the resolution directs restructuring according to market standards and modern governance. It aims to enhance regional and global competitiveness, with the goal of having state-owned enterprises among the world’s top 500 by 2030 and 2045.

Notably, the resolution encourages the development of large-scale state-owned enterprises. This includes increasing chartered capital, allowing the use of proceeds from equitization and divestment, and raising the proportion of after-tax profits retained by enterprises.

Equitization will continue according to the roadmap to improve efficiency and attract governance and resources from other sectors. However, it must ensure no loss of state assets and maintain control in key areas.

The resolution also calls for refining the performance evaluation mechanism for state-owned enterprises. The index system must include both financial and non-financial metrics, be quantifiable, transparent, and aligned with international practices.

Business tasks must be separately accounted for from political and public service tasks. The responsibilities of capital representatives, internal control mechanisms, and information disclosure must be standardized for public oversight.

What Citizens Need Most: Stopping Waste

The resolution mandates ending overlapping and prolonged inspections, audits, and checks. It also requires strict action against abuses of inspection powers that create difficulties.

Misused or embezzled assets and funds must be maximally recovered. No adverse effects on people’s livelihoods should be allowed.

In recent years, some state-owned enterprises have experienced prolonged losses. Photo: V.LONG

|

However, reducing overlap does not mean loosening discipline. Instead, the resolution aims for a more modern governance model. This includes data-driven, risk-based ex-post checks, clear accountability for leaders, and sufficiently deterrent sanctions.

Resolution 79 Will Take Effect When 5 Key Measures Are Legalized

To ensure the resolution does not remain a policy statement, five key measures must be legalized:

First, a comprehensive inventory and accounting of all state resources according to market principles. This includes land, natural resources, infrastructure, capital, and funds. Standardized valuation and disclosure mechanisms are essential for public oversight.

Second, a thorough separation of public service tasks from business activities. Public service tasks must be contracted or tendered transparently, with defined standards and output controls.

Third, standardized governance of state-owned enterprises according to international practices. KPIs must be quantifiable, information must be disclosed, performance evaluations must be comparative, and responsibilities must be linked to capital representatives and leaders.

Fourth, designing a risk-based ex-post control mechanism. Overlapping inspections must end, but the effectiveness of sanctions and asset recovery must increase.

Fifth, expanding channels for public oversight. Data must be publicly available. Transparency in public debt, investment, and assets must increase. The media, citizens, and experts must be part of the “immune system” against waste.

In conclusion, Resolution 79 is a clear commitment. Public assets must be managed as the people’s assets. They must be used for the right purposes, generate reasonable returns, and be transparently controlled. Those who cause losses must be held fully accountable.

ASSOC. PROF., DR. NGÔ TRÍ LONG

– 12:13 12/01/2026

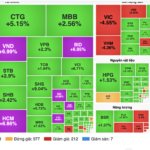

Experts Explain Why Bank and Securities Stocks Plummeted on the Morning of December 12th

The stock market kicked off the new trading week with a robust surge, fueled by the positive performance of banking and securities stocks.

Foreign Block “Pours Money In” with Strong Buying in First Week of 2026, Investing Over 500 Billion in a Bank Stock

Foreign investors initially sold off at the beginning of the week but returned to net buying by the end of the week.