Recently, Ms. Mai Huyền Trang submitted a report detailing her acquisition of a significant stake in Thuong Dinh Shoe Joint Stock Company (Stock Code: GTD, UPCoM market).

According to the report, Ms. Mai Huyền Trang successfully purchased nearly 6.4 million GTD shares, increasing her ownership from 0% to 68.66% of the company’s capital. The transaction that led to this change in ownership and her status as a major shareholder was executed on January 8, 2026.

Notably, it is highly likely that Ms. Trang acquired the aforementioned GTD shares during the auction held by the Hanoi People’s Committee on December 16, 2025.

Specifically, the Hanoi Stock Exchange (HNX) announced that the total number of shares auctioned was nearly 6.4 million, representing 68.67% of Thuong Dinh Shoe’s charter capital, with a starting price of VND 20,500 per share.

Illustrative image

Fifteen individual investors participated in the auction, with valid bids totaling nearly 39.3 million shares. The highest bid reached VND 216,000 per share, while the lowest was VND 25,000 per share.

At the conclusion of the auction on December 16, 2025, two investors successfully won the bid for the share lot. The highest successful bid was VND 216,000 per share, the lowest was VND 134,000 per share, and the average successful bid was VND 215,999 per share.

Based on these results, it is estimated that the Hanoi People’s Committee earned over VND 1,379 billion from this divestment transaction at Thuong Dinh Shoe.

Thuong Dinh Shoe, originally established in 1957 as Workshop X30 under the Military Supply Department of the General Logistics Department, specialized in producing hard hats and rubber sandals for military use.

The company transitioned into a Joint Stock Company on July 19, 2016. Subsequently, on December 16, 2016, 9.3 million of its shares began trading on the UPCoM market under the stock code GTD.

The company’s headquarters are located at 277 Nguyen Trai Street, Thanh Xuan Ward, Thanh Xuan District, Hanoi (now 277 Nguyen Trai Street, Thanh Xuan District, Hanoi).

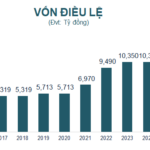

As of December 31, 2024, Thuong Dinh Shoe’s charter capital stands at VND 93 billion. The state holds nearly VND 63.9 billion (68.7% ownership), Thai Binh Trade and Investment Joint Stock Company contributes VND 9.3 billion (10%), and other shareholders contribute over VND 19.8 billion (21.3%).

According to the latest business registration update on June 26, 2025, Mr. Nguyen Van Khiem (born in 1972) serves as both the Chairman and Legal Representative of Thuong Dinh Shoe.

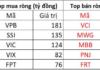

Redistribution of UPCoM Market Share

VPS retains its lead in the UPCoM market share for 2025, though significantly reduced compared to 2024, indicating a more distributed market among competitors. TCBS climbs to second place, while VPBankS makes a notable ascent into the top ranks. Conversely, SHS and BSC exit the top 10.

Two Iconic Brands and Auctions Doubling Stock Peaks

Thượng Đình Footwear Corporation (UPCoM: GTD) and Colusa – Miliket Food Corporation (UPCoM: CMN) have both achieved remarkable success in their recent stock auctions, with average winning bid prices surpassing 200,000 VND per share. These impressive results significantly outpace the current market prices on UPCoM, even as both stocks consistently hit upper limits and reach historic highs.