Observing transactions in the first week of 2026, there’s a noticeable shift in capital flow, with state-owned bank stocks attracting significant market liquidity. This surge in interest coincides with the release of robust 2025 financial results by these banks and heightened expectations following the issuance of the Resolution on State-Owned Enterprise Development.

Among the three state-owned bank stocks, CTG stands out as the most prominent performer, consistently breaking records with unprecedented trading volumes.

Closing at 40,750 VND per share on January 9th, CTG’s stock price surged nearly 14% compared to the end of 2025. Trading volume reached nearly 39 million shares, marking the highest level since VietinBank’s listing on the Ho Chi Minh City Stock Exchange (HOSE).

With double-digit price increases in the first week of the year, state-owned bank stocks have delivered a prosperous start for domestic investors, who were net buyers. Foreign investors also actively purchased VCB (727 billion VND), BID (326 billion VND), and CTG (160 billion VND) during this period.

This buying momentum may stem from portfolio rebalancing efforts coupled with optimistic earnings expectations. All three listed state-owned banks have released preliminary 2025 financial results.

According to disclosed data, VietinBank recorded the strongest profit growth among the trio. At the 2025 Business Results Review and 2026 Task Deployment Conference, VietinBank announced a 37% year-on-year increase in pre-tax profit, reaching over 41 trillion VND—a record high for the bank. In 2025, VietinBank’s total assets grew by approximately 18%, surpassing 100 billion USD, while non-performing loans remained below 1%.

With larger assets, BIDV’s total assets reached approximately 3,250 trillion VND (over 120 billion USD). However, its profit, though still a record at over 36 trillion VND, lagged behind VietinBank’s.

Without disclosing specific figures, Vietcombank’s leadership confirmed the bank met its profit targets for 2025. The bank had set a consolidated pre-tax profit growth goal of 3.5%, with standalone profit projected at 42,734 billion VND—a more modest increase compared to VietinBank’s performance.

Total Asset Scale of Vietnam’s Big4 Banks Compared to the Region. Source: YSVN.

Beyond strong financial performance, the stocks of these three state-owned banks are drawing investment due to anticipated positive impacts from the implementation of Resolution 79.

In a research report by Yuanta Securities Vietnam (YSVN), analysts highlighted that the primary challenge for state-owned banks lies in balancing profit retention for capital increases (to comply with Basel II/III) and the pressure to pay cash dividends to the state budget. Resolution 79 addresses this by allowing the use of proceeds from state divestment and equitization for capital increases.

YSVN forecasts that Vietcombank could be the first to enter Asia’s Top 100 banks. For BIDV and VietinBank, despite their substantial asset size, their Capital Adequacy Ratios (CAR) are thinner than Vietcombank’s, positioning them to benefit significantly from the new policy enabling profit retention instead of dividend payouts.

YSVN experts note that previous cash dividend requirements strained the operating capital of BIDV and VietinBank. Resolution 79 is seen as a critical solution, enabling these banks to expand credit operations substantially in the coming period.

Banks Attract Record-Breaking Deposits

In 2025, numerous banks reported significant growth in deposits from individuals and businesses, bolstering their capital inflows and creating a robust foundation to accelerate credit expansion. This surge in deposits enables banks to meet the increasing demand for capital, supporting the recovery and growth of economic production and business activities.

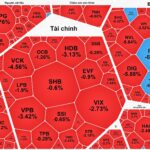

January 9th Stock Market Recap: VN-Index Surges Over 12 Points, Real Estate Stocks Face Sell-Off

The VN-Index’s upward momentum in the recent session was almost entirely reliant on the performance of state-backed blue-chip stocks, which played a pivotal role in driving the market’s gains.