This development marks the first confirmation of recent market expectations regarding the equity offerings of major state-owned enterprises, following the encouragement from the Politburo’s resolution on state economic development and new regulations on public company standards.

A prime example is VIMC, where the state holds a dominant 99.47% stake, falling short of the requirement for at least 10% of shares to be held by a minimum of 100 retail investors. As a result, the Vietnam Maritime Corporation does not yet meet the criteria for a public company.

Based on the closing price of VND 55,500 per share on January 13th, VIMC’s market capitalization exceeds VND 66 trillion.

VIMC Headquarters at Ocean Park Building, Hanoi

|

In a letter dated January 8th, VIMC announced plans to increase its charter capital and reduce state ownership to 65%, aiming to enhance competitiveness and invest in key projects.

The Corporation will engage a consulting firm to prepare for a public offering, strategic investor placement, capital increase through equity issuance, and listing on the HOSE exchange.

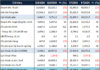

On the UPCoM market, MVN shares have seen impressive gains in early 2026, aligning with the upward trend of major state-owned stocks. As of January 13th, MVN has surged by 21.2% year-to-date.

– 3:30 PM, January 13, 2026

Expert Insights: Unveiling Two Oversold Stock Groups Poised for a Powerful Rebound

“With sustained momentum and barring unforeseen events, the VN-Index is poised to target the 1,950–2,000 range in the first half of 2026, potentially reaching its peak at around 2,100 points within the year,” the expert forecasts.

State-Owned Giants: 26 Listed Companies with 65-99% Government Ownership – Anticipating a Privatization Wave?

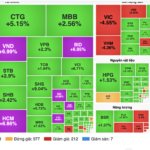

In sync with the market’s surge of over 45 points, state-owned enterprise stocks collectively rallied. From the ceiling-hitting gains of GAS and BVH to the breakout performances of KSV and GVR, the influx of capital underscores heightened expectations surrounding the 2026 divestment and restructuring narrative.