Reversed Trend Propagation: TCX and SSI Lead the Charge

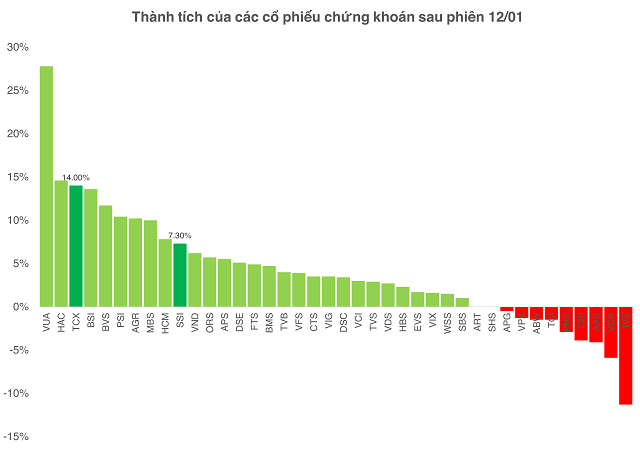

According to post-session statistics on January 12th, nearly 85% of securities stocks recorded a short-term upward trend, reflecting a significant technical improvement compared to late 2025.

Over a longer timeframe, the proportion of stocks maintaining a long-term upward trend has also risen to nearly 46% across all three exchanges, indicating that the recovery is no longer localized.

With these technical trend shifts, 31 out of 40 securities stocks (equivalent to 77.5%) have recorded growth since the beginning of 2026, a marked improvement from the previous week when only over 50% of stocks were profitable.

Currently, TCX is the strongest performer on HOSE, with a gain of over 14% since the start of the year. With a market capitalization of approximately 4.8 billion USD, TCX is becoming a significant influencer on the index, especially when combined with the familiar pillar role of SSI (+7.3%).

The resurgence of the securities group occurs as the VN-Index breaks historical records, with market liquidity significantly improving.

The first trading session of the week (January 12th) recorded the highest liquidity in three months, indicating that capital is returning to highly influential stocks, particularly financial blue chips, as the March 2026 FTSE Russell index review approaches.

The “Curse” of the First Listing Year and Valuation Challenges

Despite the reversal signals, investors in securities stocks still face challenges.

Historical data shows that approximately 75% of securities stocks decline in their first year of listing, reflecting the sector’s high volatility and susceptibility to profit-taking pressure post-IPO.

In this context, TCX is a rare case beginning to escape this “curse.” However, it’s important to note that the stock has not yet completed its first 250 trading sessions, and its long-term resilience remains to be proven.

More notably, VPX and VCK are still trading over 10% below their IPO highs, presenting a significant test for investors who participated in the IPO, especially given the initially high expectations.

Broader still, many established securities stocks are also undergoing deep corrections.

Since their 2025 peaks, SSI remains 18% discounted, HCM has fallen 21%, VCI has dropped 26%, and VND has lost over 31% of its value.

While the VN-Index has broken new highs, the securities group has yet to reclaim its 2025 peaks.

One investor noted, “Many stocks that reached all-time highs in 2025 have not yet surpassed these levels, meaning the securities sector has not yet formed a full-fledged new uptrend. Current developments likely represent a ‘preparatory phase,’ as price levels stabilize ahead of a new vibrant cycle.”

According to KBSV, with expectations of positive market growth in both index levels and liquidity in 2026, coupled with the supportive impact of potential upgrades, securities stocks are currently attractively valued.

KBSV suggests that investors prioritize companies with advantages in serving institutional clients, strong financial foundations, and reasonable valuations. Newly listed stocks, however, may require more time for their fundamentals to be fully reflected in pricing.

From a long-term perspective, Mr. Nguyễn Thế Minh believes that the recent IPO phase of securities companies, accompanied by high valuations, reflects significant market expectations. Post-IPO, as the market enters a filtering phase, valuations are becoming more realistic, highlighting the differentiation among companies.

“In the coming period, the investment banking (IB) segment is expected to be the most significant differentiator in the industry. Following the post-corporate bond lull of 2021–2022, IB activity may revive due to IPOs and divestment deals. This will provide a foundation for securities companies to cross-sell brokerage services, margin lending, and even proprietary trading,” Mr. Minh commented.

– 13:28 13/01/2026

PYN Elite Fund Anticipates Sacombank’s Imminent “Value Unlock”

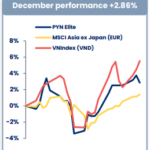

The Finnish investment fund PYN Elite has released its December 2025 report, revealing a nearly 3% portfolio growth, primarily driven by the strong performance of two banking stocks: HDBank (HDB) and Sacombank (STB). This achievement comes amidst a highly polarized Vietnamese stock market, despite the VN-Index closing the year at a record high.

Bank Stock Plummets as Brokerage Firms Unload Hundreds of Billions in Opening Week Session

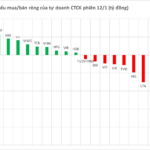

Proprietary trading desks at Vietnamese securities firms net sold VND 280 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.