Technical Signals of VN-Index

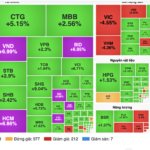

During the morning trading session on January 12, 2026, the VN-Index continued its upward trend, targeting the 1,935-1,950 point range.

Both the MACD and Stochastic Oscillator indicators have not yet signaled a sell, indicating minimal risk. Additionally, the previous peak from October 2025 has been fully breached, transforming it from a resistance to a strong support level in the future.

Technical Signals of HNX-Index

In the morning session on January 12, 2026, the HNX-Index surged significantly, poised to test the upper boundary of the Falling Wedge pattern.

Both the Stochastic Oscillator and MACD indicators are signaling a buy, with trading volume consistently above the 20-session average, substantially improving the short-term outlook.

BAF – Vietnam Agricultural Corporation BAF

In the morning session on January 12, 2026, BAF shares rose, accompanied by a Big White Candle pattern and trading volume projected to exceed the 20-session average, indicating heightened investor activity.

Currently, BAF is testing the neckline (around 37,800-38,800) of a Rounding Bottom pattern, while the gap between the 50-day SMA and 200-day SMA is narrowing.

If a Golden Cross occurs between these moving averages and the price successfully surpasses the neckline, the long-term upward momentum will be further reinforced.

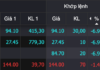

SSI – SSI Securities Corporation SSI

On January 12, 2026, SSI shares rallied strongly, forming a Big White Candle pattern with trading volume surpassing the 20-session average, reflecting investor optimism.

Currently, SSI is retesting the 23.6% Fibonacci Projection level (around 32,000-33,500), while the MACD indicator is forming lower highs and lows above the zero line.

If these positive technical signals persist in upcoming sessions, the short-term recovery prospects will gain further support.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:10 PM, January 12, 2026

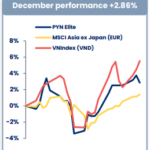

PYN Elite Fund Anticipates Sacombank’s Imminent “Value Unlock”

The Finnish investment fund PYN Elite has released its December 2025 report, revealing a nearly 3% portfolio growth, primarily driven by the strong performance of two banking stocks: HDBank (HDB) and Sacombank (STB). This achievement comes amidst a highly polarized Vietnamese stock market, despite the VN-Index closing the year at a record high.

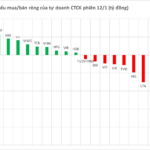

Experts Explain Why Bank and Securities Stocks Plummeted on the Morning of December 12th

The stock market kicked off the new trading week with a robust surge, fueled by the positive performance of banking and securities stocks.