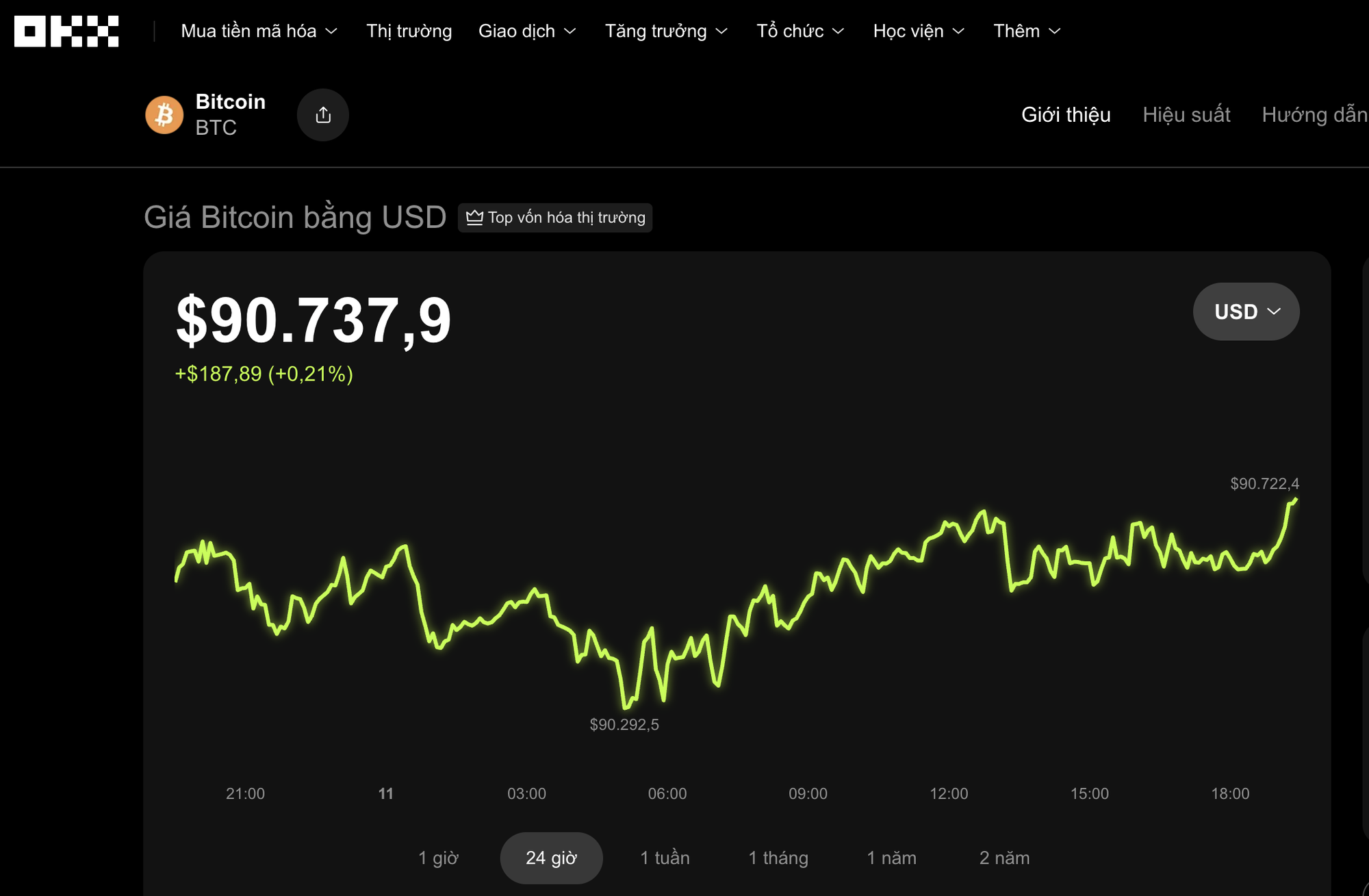

On the evening of January 11th, the cryptocurrency market witnessed mixed movements as investors remained cautious amid new signals from major players. Data from OKX revealed a slight 0.2% increase in Bitcoin over the past 24 hours, reaching approximately $90,737.

Other major cryptocurrencies also experienced narrow fluctuations: Ethereum rose by nearly 0.5% to $3,100, BNB gained over 1% to $911, and Solana inched up 0.1% to $136. Conversely, XRP dipped slightly by 0.1%, hovering around $2.

Notably, amidst sideways price movements, Bitcoin “whales”—large-scale investors holding significant amounts of cryptocurrency—significantly reduced their long positions.

TradingView data showed that these whales’ long positions peaked at around 73,000 Bitcoin in late December before sharply declining.

In the market, whales are often seen as trendsetters capable of strongly influencing price movements. Their rapid reduction in long positions has thus captured investors’ attention.

Historically, whenever whales reduce their purchases after a short-term rally, Bitcoin tends to enter a period of heightened volatility before establishing a new upward trend.

Bitcoin is trading at $90,737. Source: OKX

On social media platform X, analyst MartyParty noted that Bitfinex whales are aggressively closing their long positions.

He believes this signal has frequently preceded significant Bitcoin volatility. The most recent occurrence was in early 2025, when Bitcoin stalled around $74,000.

According to MartyParty, the whales’ retreat at that time helped alleviate speculative pressure, paving the way for a new upward trend. After a brief correction, Bitcoin surged approximately 50% in just over a month, reaching $112,000.

With Bitcoin currently oscillating around $91,500, some analysts suggest that if history repeats itself, the market could witness another rally soon.

From a longer-term perspective, CryptoQuant reported that over the past year, whales have reduced their Bitcoin holdings by more than 200,000 Bitcoin. Conversely, retail investors are increasing their ownership.

CryptoQuant interprets this as a sign of market maturation, with broader capital distribution leading to more stable long-term trends despite persistent short-term volatility.

Today’s Crypto Market, January 8th: Why Over 50% of Vietnamese Investors Are Losing Money

Many digital currency investors suffer losses due to entering the market at peak prices, driven by fear of missing out and herd mentality.

Vietstock Daily 06/01/2026: Intense Tug-of-War in the Market

The VN-Index continues to fiercely oscillate around its October 2025 peak (equivalent to the 1,740-1,795 point range). With the Stochastic Oscillator signaling a buy opportunity and the MACD sustaining its upward momentum, short-term risks appear manageable. However, investors should remain cautious of potential volatility as the index navigates a robust resistance zone.

Prime Minister Urges Ministry of Finance to Pilot Crypto Asset Market Licensing for Businesses by November 15

At the Financial Sector Year-End Conference on the afternoon of January 6th, Prime Minister Pham Minh Chinh not only emphasized the need to “turn the tide” in public investment disbursement but also provided specific directives to the Ministry of Finance. He urged the ministry to pilot a Sandbox mechanism for digital assets within the first half of January 2026.