Transimex Joint Stock Company (Stock Code: TMS, HoSE) has announced a public offering of bonds under the Certificate of Registration No. 558/GCN-UBCK, issued by the Chairman of the State Securities Commission (SSC) on December 30, 2025.

The company is offering 4 million convertible bonds, coded TMS426001, which are unsecured and unaccompanied by warrants.

Each bond has a face value of VND 100,000, aiming to raise a maximum of VND 400 billion. The bonds have a 2-year term, a fixed interest rate of 7% per annum, and interest payments are made annually on the anniversary of the issuance date and at maturity.

Illustrative image

The bonds are offered to existing shareholders through a rights issue at a ratio of 42.33:1, meaning shareholders holding 42.33 rights can purchase 1 bond at VND 100,000 per bond. Each shareholder is entitled to 1 right per share held.

The minimum subscription quantity is 1 bond, and the subscription period runs from February 10, 2026, to March 5, 2026.

Bondholders can convert 50% of their bonds one year after issuance and the remaining bonds at maturity.

Transimex plans to use the proceeds to supplement its financial activities, settle outstanding debts, and restructure its capital.

In other news, Transimex recently announced the issuance of nearly 3.4 million shares as dividends to shareholders.

The rights issue ratio is 100:2, allowing shareholders holding 100 shares to receive 2 new shares. The record date for this allocation is January 27, 2026.

The total issuance value, based on the par value, is approximately VND 33.9 billion, funded from the undistributed after-tax profit reported in the audited 2024 Consolidated Financial Statements.

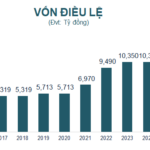

If successful, Transimex’s chartered capital will increase from nearly VND 1,693.5 billion to over VND 1,727.3 billion.

Deputy CEO of Trungnam Group: Outstanding Financial Issues to Be Resolved by First Half of 2026

On January 6, 2026, Trungnam Group (Trung Nam Corporation) hosted a meeting to share insights into their business operations and unveil their strategic plans for the year. During the event, Mr. Lê Như Phước An, Standing Deputy General Director of Trungnam Group, highlighted the company’s promising financial indicators and provided updates on the ongoing tidal prevention project in Ho Chi Minh City.