Kicking off the new year 2026, NCB brings good fortune to its customers with the enticing “Phú Quý Savings – An Khang Fortune” program, setting the stage for a year filled with travel adventures across the beautiful landscapes of Vietnam and welcoming prosperity and luck.

From now until February 28, 2026, customers depositing savings at NCB will have the chance to “hunt” for Sun PhuQuoc Airways flight vouchers worth 2 million VND each. For every 200 million VND deposited with a term of 6 months or more, customers will receive one raffle code to participate in the weekly draws. The draws are conducted using electronic software to randomly select winning customers. This program applies to all Term Deposit products, regardless of whether the deposit is made over the counter or online via the NCB iziMobile app.

NCB offers significant savings incentives for customers in the new year 2026

Each customer can receive up to 3 Sun PhuQuoc Airways flight vouchers, which can be used to book flights directly on the NCB iziMobile digital banking app, offering a convenient and cost-effective way to experience “aviation-style vacations.”

Additionally, NCB is gifting gold purchase vouchers of up to 50 million VND to 15 customers with the highest increase in deposit balances from November 30, 2025, to February 28, 2026, as a token of luck and prosperity for the new year. This gesture also serves as a thank you to customers for their trust and loyalty, demonstrating NCB’s long-term commitment to supporting customers in achieving their financial goals.

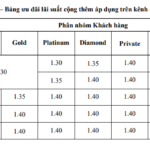

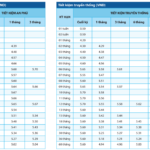

Beyond new year promotions, NCB is actively promoting digital transformation and cashless transactions by offering exclusive interest rates for customers depositing savings online through the NCB iziMobile app. By opening a new online savings account on the NCB iziMobile app during these early days of the year, customers can enjoy an attractive additional interest rate, enhancing savings efficiency while experiencing the convenience, speed, and security of digital transactions.

To take advantage of these preferential interest rates, customers need only perform a few simple steps on NCB iziMobile: log in to the app, select Savings – Open New Savings, enter the required information, choose the promotional code, and complete the transaction in just 2 minutes. The entire process is conducted online, ensuring it is quick, secure, and convenient. For those who prefer traditional savings methods, customers can also visit NCB’s transaction counters to deposit savings at the most attractive market interest rates.

Customers can also visit NCB’s transaction counters to deposit savings at the most attractive market interest rates

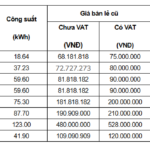

In addition to interest rate incentives, NCB also regularly launches various promotional programs on NCB iziMobile, widely appreciated by users, such as: 20% cashback up to 50,000 VND for bill payments and phone top-ups on the 10th of every month; 20% cashback, up to 100,000 VND per month for automatic bill payments of 50,000 VND or more; 100% waiver of service and electricity fees for customers making international money transfers…

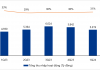

With a customer-centric approach, NCB has continuously developed financial solutions and digital platforms, helping individual and business customers manage and utilize their cash flow more effectively in the digital age. Moving into 2026, the bank plans to further refine flexible solutions tailored to modern transaction needs and habits, accompanying customers on their journey of spending, saving, and business development.

For more detailed information or service support, customers can visit the NCB website at https://www.ncb-bank.vn, contact NCB’s transaction offices/branches nationwide, or call the Hotline (028) 38 216 216 – 1800 6166.

Banks Sprint to Boost Capital in Year-End Race

Leading Vietnamese banks, including VietinBank, HDBank, and Saigonbank, have announced the successful completion of their capital increases in the final days of 2025.

Unlock the Skies: Accelerating Open Airspace Initiatives

The aviation industry is poised for a significant surge during the year-end peak season, aiming for a robust 13% growth by 2026.