According to a newly released report, in December 2025, the foreign fund Pyn Elite Fund recorded an investment performance of 2.86%, breaking its previous three-month streak of negative returns.

PYN Elite Fund noted that the VN-Index rose by 5.5% in the final month of the year, closing 2025 at a record high of 1,784 points. However, market dynamics revealed significant polarization, with the index’s gains almost entirely driven by stocks within the Vingroup ecosystem. Behind the impressive index growth, liquidity began to signal caution.

The fund also highlighted that credit growth across the system reached nearly 18% as of December 24, 2025, outpacing deposit growth of approximately 14%. The widening gap between credit and deposits exerted notable pressure on interest rates in the final weeks of the year.

For the full year 2025, PYN Elite Fund achieved a return of 17.38%. It remains one of the largest foreign funds in Vietnam’s stock market, with a portfolio value of nearly €925 million (VND 28,300 billion) as of December 31.

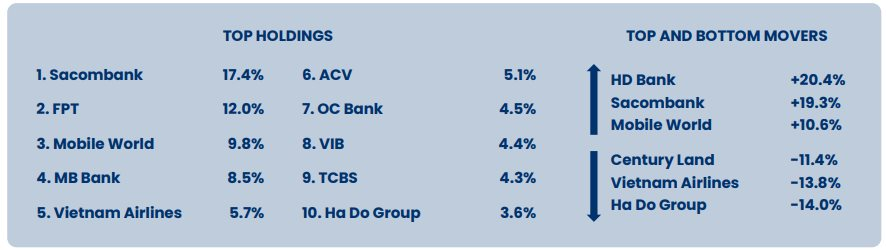

As of December 31, 2025, the fund’s top 10 holdings included 4 banking stocks (STB, MBB, OCB, VIB), 1 technology company (FPT), 1 retailer (MWG), 2 aviation firms (HVN, ACV), 1 securities company (TCX), and 1 real estate company (HDG).

In December, banking stocks HDB and STB surged 20% and 19%, respectively, significantly contributing to the fund’s performance. The fund noted that Sacombank (STB) received positive leadership-related news, interpreted by investors as a sign that the bank is nearing the end of its lengthy restructuring process, potentially unlocking value in the near future.

Conversely, real estate stocks like HDG and CRE, along with HVN, declined sharply by 11% to 14%, weighing on the fund’s returns. Despite this, PYN Elite Fund remains confident in Vietnam Airlines (HVN). The carrier reported strong 2025 results, serving 25.7 million passengers, an 11% increase year-on-year. For 2026, HVN aims to transport over 29 million passengers, targeting 13% growth.

PYN Elite Fund emphasized that, alongside the aviation sector’s recovery, Vietnam Airlines continues to expand its international network, launching 14 new routes in 2025. Notably, its direct flight to Denmark marked the first-ever non-stop connection between Vietnam and Northern Europe. On the infrastructure front, Ho Chi Minh City’s second airport achieved technical completion. Long Thanh International Airport is slated for full commercial operations by mid-2026, expected to add capacity for 25 million passengers and 1.2 million tons of cargo annually.

On the macroeconomic front, Vietnam’s Q4 GDP grew 8.5% year-on-year, pushing full-year growth above 8%. In 2025, the industrial and construction sectors led with 9% growth, followed by services at 8.6%.

International trade remained robust, with exports totaling $475 billion, up 17%, and imports reaching $455 billion, a 19.4% increase. Notably, Vietnam inaugurated, commenced, and technically launched 234 key projects nationwide, with a combined investment of over $137 billion. These large-scale initiatives are expected to underpin the ambitious 10% GDP growth target for 2026.

Expert Analysis: Impact of Resolution 79 on the Stock Market and Beneficiary Stock Portfolios

According to Yuanta experts, Resolution 79-NQ/TW signifies a fundamental shift in the mindset of state capital management, transitioning from a “restrictive management” approach to one that “fosters development.”

Market Pulse 12/01: Financial Sector Leads the Charge, VN-Index Sustains Strong Green Momentum

At the close of trading, the VN-Index climbed 9.43 points (+0.5%) to reach 1,877.33, while the HNX-Index rose 4.78 points (+1.93%) to 251.88. Market breadth favored the bulls, with 480 advancing stocks outpacing 250 decliners. Similarly, the VN30 basket saw a dominant green trend, with 23 gainers and only 7 losers.

Vietstock Daily 13/01/2026: Sustaining the Upward Momentum

The VN-Index continued its upward trajectory, supported by trading volumes surpassing the 20-day average, reflecting investor optimism. Positive momentum is reinforced by the MACD sustaining its upward trend and widening its divergence from the Signal line. However, with the Stochastic Oscillator venturing deeper into overbought territory, investors should remain cautious of potential volatility should reversal signals emerge in upcoming sessions.